Priceline 2014 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2014 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

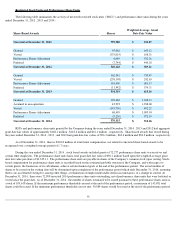

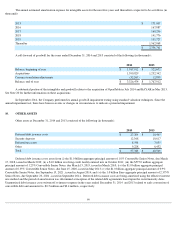

The following table summarizes, by major security type, the Company's short-term investments as of December 31, 2013 (in

thousands):

The Company has classified its investments as available-for-sale securities. These securities are carried at estimated fair value with the

aggregate unrealized gains and losses related to these investments, net of taxes, reflected as a part of "Accumulated other comprehensive income

(loss)" on the Consolidated Balance Sheets. Classification as short-term or long-term is based upon the maturity of the debt securities.

There were no significant realized gains or losses related to investments for the years ended December 31, 2014 , 2013 and 2012 .

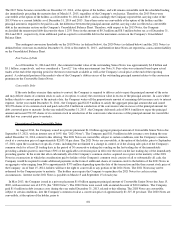

Financial assets and liabilities are carried at fair value as of December 31, 2014 and are classified in the categories described in the

tables below (in thousands):

94

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Fair Value

Available for sale securities:

Short-term investments:

Foreign government securities

$

4,019,530

$

233

$

(356

)

$

4,019,407

U.S. government securities

1,443,083

250

(20

)

1,443,313

Total

$

5,462,613

$

483

$

(376

)

$

5,462,720

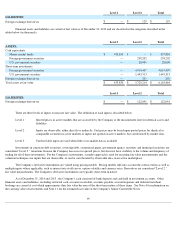

5.

FAIR VALUE MEASUREMENTS

Level 1

Level 2

Total

ASSETS:

Cash equivalents:

Money market funds

$

155,608

$

—

$

155,608

Foreign government securities

—

974,855

974,855

U.S. government securities

—

676,503

676,503

U.S. commercial paper

—

427,884

427,884

U.S. government agency securities

—

10,000

10,000

Short-term investments:

Foreign government securities

—

52,490

52,490

U.S. government securities

—

364,266

364,266

U.S. commercial paper

—

620,615

620,615

U.S. government agency securities

—

104,811

104,811

Foreign exchange derivatives

—

336

336

Long-term investments:

Foreign government securities

—

12,671

12,671

U.S. government securities

—

556,448

556,448

U.S. corporate debt securities

—

2,329,033

2,329,033

U.S. government agency securities

—

95,094

95,094

U.S. municipal securities

—

1,102

1,102

Ctrip corporate debt securities

—

425,961

425,961

Ctrip equity securities

335,344

—

335,344

Total assets at fair value

$

490,952

$

6,652,069

$

7,143,021