Priceline 2014 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2014 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

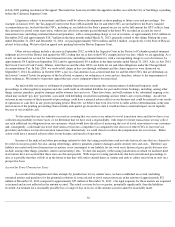

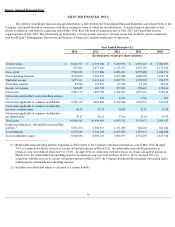

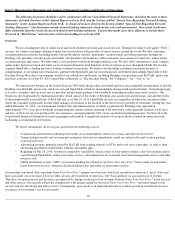

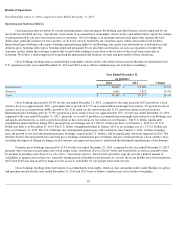

Item 6. Selected Financial Data

SELECTED FINANCIAL DATA

The selected consolidated financial data presented below is derived from the Consolidated Financial Statements and related Notes of the

Company, and should be read in connection with those statements, some of which are included herein. Selected financial data reflects data

related to rentalcars.com from its acquisition date of May 2010, KAYAK from its acquisition date of May 2013 and OpenTable from its

acquisition date of July 2014. The information set forth below is not necessarily indicative of future results and should be read in conjunction

with Part II Item 7 Management's Discussion and Analysis of Financial Condition and Results of Operations.

_____________________________

39

Year Ended December 31,

2014

2013

2012

2011

2010

(In thousands, except per share amounts)

Total revenues

$

8,441,971

$

6,793,306

$

5,260,956

$

4,355,610

$

3,084,905

Cost of revenues

857,841

1,077,420

1,177,275

1,275,730

1,175,934

Gross profit

7,584,130

5,715,886

4,083,681

3,079,880

1,908,971

Total operating expenses

4,510,818

3,303,472

2,253,888

1,680,958

1,122,174

Operating income

3,073,312

2,412,414

1,829,793

1,398,922

786,797

Total other expense

83,864

115,877

67,924

31,128

40,514

Income tax expense

567,695

403,739

337,832

308,663

218,141

Net income

2,421,753

1,892,798

1,424,037

1,059,131

528,142

Net income attributable to noncontrolling interests

(1)

—

135

4,471

2,760

601

Net income applicable to common stockholders

2,421,753

1,892,663

1,419,566

1,056,371

527,541

Net income applicable to common stockholders

per basic common share

46.30

37.17

28.48

21.27

11.00

Net income applicable to common stockholders

per diluted share

45.67

36.11

27.66

20.63

10.35

Total assets

14,940,563

10,444,460

6,569,742

3,970,671

2,905,953

Long-term obligations, redeemable noncontrolling

interests

(2)

5,031,073

2,304,917

1,731,385

788,218

621,624

Total liabilities

6,373,540

3,526,198

2,457,825

1,191,971

1,046,828

Total stockholders' equity

8,566,694

6,909,729

3,896,975

2,574,295

1,813,336

(1)

Redeemable noncontrolling interests beginning in 2010 relates to the Company's purchase of rentalcars.com in May 2010. In April

2011, in connection with the exercise of certain call and put options in March 2011, the redeemable noncontrolling interests in

rentalcars.com were reduced from 24.4% to 19.0%. In April 2012, in connection with the exercise of certain call and put options in

March 2012, the redeemable noncontrolling interests in rentalcars.com were reduced from 19.0% to 12.7%. In April 2013, in

connection with the exercise of certain call and put options in March 2013, the Company purchased the remaining outstanding shares

underlying the redeemable noncontrolling interests.

(2)

Includes convertible debt which is classified as a current liability.