Priceline 2014 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2014 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the different methods of recording revenue and cost of revenue between our Name Your Own Price

®

travel services and our other services.

Trends

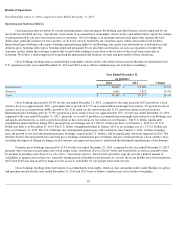

Over the last several years we have experienced strong growth in our accommodation reservation services. We believe this growth is

the result of, among other things, the broader shift of travel purchases from offline to online, the widespread adoption of mobile devices, the high

growth of travel overall in emerging markets such as Asia-Pacific and South America, and the continued innovation and execution by our teams

around the world to build accommodation supply, content and distribution and to improve the customer experience on our websites and mobile

apps. These year-over-year growth rates have generally decelerated in recent years. For example, for the year ended December 31, 2014 , our

accommodation room night reservation growth was 28% , a deceleration from 37% in 2013 , 40% in 2012 and 53% in 2011. Given the size of

our hotel reservation business, we expect that our year-over-year growth rates will continue to decelerate, though the rate of deceleration may

fluctuate.

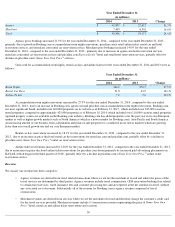

The size of the travel market outside of the United States is substantially greater than that within the United States. Historically, Internet

use and e-commerce activity of international consumers have trailed that of consumers in the United States. However, international consumers

are rapidly moving to online means for purchasing travel. Accordingly, recent international online travel growth rates have substantially

exceeded, and are expected to continue to exceed, the growth rates within the United States. We expect that over the long-term, international

online travel growth rates will follow a similar trend to that experienced in the United States. In addition, the base of hotel properties in Europe

and Asia is particularly fragmented compared to that in the United States, where the hotel market is dominated by large hotel chains. We believe

online reservation systems like ours may be more appealing to small chains and independent hotels more commonly found outside of the United

States. Our growth has primarily been generated by our international accommodation reservation service brands, Booking.com and agoda.com.

Booking.com, our most significant brand, included over 600,000 properties on its website as of February 13, 2015 , which included over

245,000

vacation rental properties (updated property counts are available on the Booking.com website). Booking.com has added properties over the past

year in its core European market as well as higher

-growth markets such as North America (which is a newer market for Booking.com), Asia-

Pacific and South America. An increasing amount of our business from both a destination and point-of-sale perspective is conducted in our

newer markets which are growing faster than our overall growth rate. We believe that the opportunity to continue to grow our business exists for

the markets in which we operate. We believe these trends and factors have enabled us to become the leading online accommodation reservation

service provider in the world as measured by room nights booked.

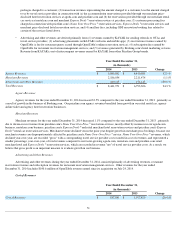

As our international business represents the substantial majority of our financial results, we expect to continue to see our operating

results and other financial metrics largely driven by international performance. For example, certain markets in which we operate that are in

earlier stages of development have lower operating margins compared to more mature markets, which could have a negative impact on our

overall margins as these markets increase in size over time. Also, we intend to continue to invest in adding accommodations available for

reservation on our websites, including hotels, bed and breakfasts, hostels and vacation rentals. Vacation rentals generally consist of, among

others, properties categorized as single-unit and multi-unit villas, apartments, "aparthotels" (which are apartments with a front desk and cleaning

service) and chalets and are generally self-catered (i.e., include a kitchen), directly bookable properties. Many of the newer accommodations we

add to our travel reservation services, especially in highly penetrated markets, may have fewer rooms, lower average daily rates ("ADRs") or

higher credit risk and may appeal to a smaller subset of consumers (e.g., hostels and bed and breakfasts), and therefore may also negatively

impact our margins. For example, because a vacation rental is either a single unit or a small collection of independent units, vacation rental

properties represent more limited booking opportunities than non-vacation rental properties, which generally have more units to rent per

property. Our non-hotel accommodations in general may be subject to increased seasonality due to local tourism seasons, weather or other

factors. As we increase our non-

hotel accommodation business, these different market characteristics could negatively impact our profit margins;

and, to the extent these properties represent an increasing percentage of the properties added to our websites, our gross bookings growth rate and

property growth rate will likely diverge over time (since each such property has fewer booking opportunities). As a result of the foregoing, as the

percentage of non-hotel accommodations increases, the number of reservations per property will likely decrease. In addition, non-hotel

accommodations, including vacation rentals, tend to be more seasonal in nature and may close during "off-season," which impacts our property

counts quarter to quarter.

Concerns persist about the outlook for the global economy in general, and the European Union in particular, with recent declines in

broad Eurozone economic indicators raising fears about the pace of economic growth and the risk of deflation. In addition, many governments

around the world, including the U.S. government and certain European governments, continue to operate at large financial deficits, resulting in

high levels of sovereign debt in such countries. Greece, Ireland, Portugal and certain other European Union countries with high levels of

sovereign debt at times have had difficulty refinancing

41