Priceline 2014 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2014 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

As a result of this litigation and other attempts by jurisdictions to levy similar taxes, we have established an accrual for the potential

resolution of issues related to travel transaction taxes in the amount of approximately $52 million at December 31, 2014 and approximately $55

million at December 31, 2013 . Our legal expenses for these matters are expensed as incurred and are not reflected in the amount accrued. The

actual cost may be less or greater, potentially significantly, than the liabilities recorded. An estimate for a reasonably possible loss or range of

loss in excess of the amount accrued cannot be reasonably made. We believe that, even if we were to suffer adverse determinations in the near

term in more of the pending proceedings than currently anticipated given results to date, because of our available cash, it would not have a

material impact on our liquidity.

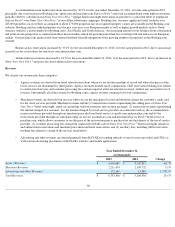

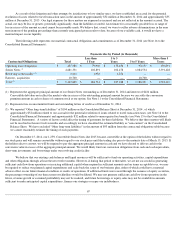

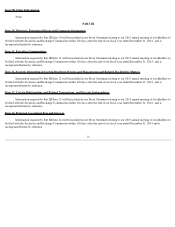

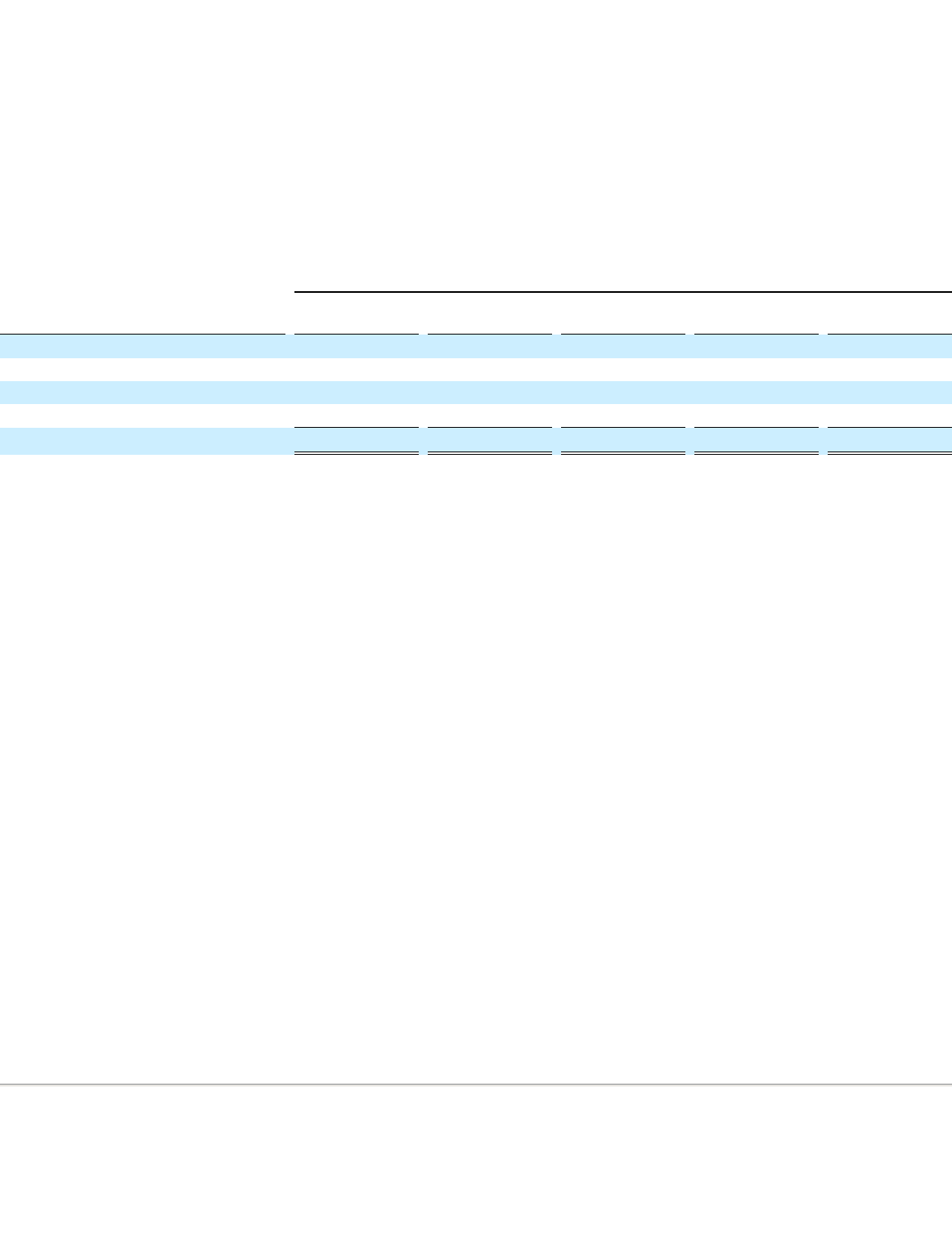

The following table represents our material contractual obligations and commitments as of December 31, 2014 (see Note 16 to the

Consolidated Financial Statements):

_____________________________

On December 15, 2014, our 1.25% Convertible Senior Notes due 2015 became convertible at the option of the holders without regard to

our stock price and will remain convertible without regard to our stock price until the trading day prior to the maturity date of March 15, 2015. If

the holders elect to convert, we will be required to pay the aggregate principal amount in cash and we have elected to deliver cash for the

conversion value in excess of the aggregate principal amount. We would likely fund our conversion obligations from cash and cash equivalents,

short-term investments and borrowings under our revolving credit facility.

We believe that our existing cash balances and liquid resources will be sufficient to fund our operating activities, capital expenditures

and other obligations through at least the next twelve months. However, if during that period or thereafter, we are not successful in generating

sufficient cash flow from operations or in raising additional capital when required in sufficient amounts and on terms acceptable to us, we may

be required to reduce our planned capital expenditures and scale back the scope of our business plan, either of which could have a material

adverse effect on our future financial condition or results of operations. If additional funds were raised through the issuance of equity securities,

the percentage ownership of our then current stockholders would be diluted. We may not generate sufficient cash flow from operations in the

future, revenue growth or sustained profitability may not be realized, and future borrowings or equity sales may not be available in amounts

sufficient to make anticipated capital expenditures, finance our strategies or repay our indebtedness.

67

Payments due by Period (in thousands)

Contractual Obligations

Total

Less than

1 Year

1 to 3

Years

3 to 5 Years

More than 5

Years

Operating lease obligations

$

437,386

$

79,902

$

133,436

$

93,157

$

130,891

Senior Notes

(1)

4,681,331

102,891

102,478

1,084,534

3,391,428

Revolving credit facility

(2)

3,212

1,938

1,274

—

—

Earnout - acquisition

10,700

—

—

10,700

—

Total

(3)

$

5,132,629

$

184,731

$

237,188

$

1,188,391

$

3,522,319

(1) Represents the aggregate principal amount of our Senior Notes outstanding as of December 31, 2014 and interest of $434 million.

Convertible debt does not reflect the market value in excess of the outstanding principal amount because we can settle the conversion

premium amount in cash or shares of common stock at our option. See Note 11 to the Consolidated Financial Statements.

(2) Represents fees on uncommitted funds and outstanding letters of credit as of December 31, 2014

.

(3) We reported "Other long-term liabilities" of $104 million on the Consolidated Balance Sheet at December 31, 2014 , of which

approximately $52 million related to our accrual for the potential resolution of issues related to travel transaction taxes (see Note 16 to the

Consolidated Financial Statements) and approximately $32 million related to unrecognized tax benefits (see Note 15 to the Consolidated

Financial Statements). A variety of factors could affect the timing of payments for these liabilities. We believe that these matters will likely

not be resolved in the next twelve months and accordingly we have classified the estimated liability as "non-current" on the Consolidated

Balance Sheet. We have excluded "Other long-term liabilities" in the amount of $93 million from the contractual obligations table because

we cannot reasonably estimate the timing of such payments.