Priceline 2014 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2014 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

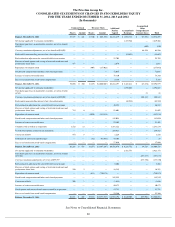

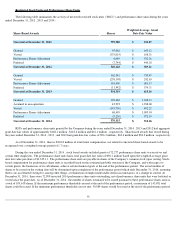

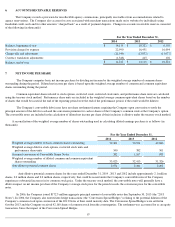

Restricted Stock Units and Performance Share Units

The following table summarizes the activity of unvested restricted stock units ("RSUs") and performance share units during the years

ended December 31, 2012 , 2013 and 2014 :

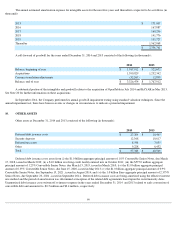

RSUs and performance share units granted by the Company during the years ended December 31, 2014 , 2013 and 2012 had aggregate

grant date fair values of approximately $168.1 million , $118.6 million and $61.1 million , respectively. Share-based awards that vested during

the years ended December 31, 2014 , 2013 , and 2012 had grant date fair values of $96.3 million , $62.6 million and $38.3 million , respectively.

As of December 31, 2014 , there is $263.8 million of total future compensation cost related to unvested share-based awards to be

recognized over a weighted-average period of 1.7 years .

During the year ended December 31, 2014 , stock based awards included grants of 72,277 performance share units to executives and

certain other employees. The performance share units had a total grant date fair value of $96.1 million based upon the weighted-average grant

date fair value per share of $1,329.11 . The performance share units are payable in shares of the Company's common stock upon vesting. Stock-

based compensation for performance share units is recorded based on the estimated probable outcome if the Company, and with respect to

certain grants, the businesses of its subsidiaries, achieve certain financial goals at the end of the performance period. The actual number of

shares to be issued on the vesting date will be determined upon completion of the performance period which ends December 31, 2016, assuming

there is no accelerated vesting for, among other things, a termination of employment under certain circumstances, or a change in control. At

December 31, 2014 , there were 72,098 unvested 2014

performance share units outstanding, net of performance share units that were forfeited or

vested since the grant date. As of December 31, 2014 , the number of shares estimated to be issued pursuant to these performance shares units is

a total of 109,618 shares. If the maximum performance thresholds are met at the end of the performance period, a maximum of 145,981 total

shares could be issued. If the minimum performance thresholds are not met, 50,884 shares would be issued at the end of the performance period.

91

Share-Based Awards

Shares Weighted Average Grant

Date Fair Value

Unvested at December 31, 2011

799,980

$

231.87

Granted

95,062

$

643.12

Vested

(353,819

)

$

108.31

Performance Shares Adjustment

6,649

$

532.26

Forfeited

(7,744

)

$

444.18

Unvested at December 31, 2012

540,128

$

389.21

Granted

162,341

$

730.47

Vested

(258,198

)

$

242.63

Performance Shares Adjustment

101,490

$

681.13

Forfeited

(11,442

)

$

579.71

Unvested at December 31, 2013

534,319

$

615.10

Granted

128,484

$

1,308.13

Assumed in an acquisition

43,993

$

1,238.68

Vested

(195,730

)

$

492.22

Performance Shares Adjustment

68,499

$

1,085.94

Forfeited

(9,250

)

$

972.19

Unvested at December 31, 2014

570,315

$

912.26