Priceline 2014 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2014 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

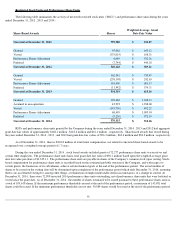

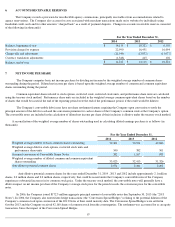

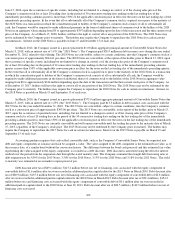

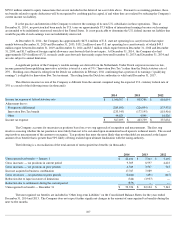

The annual estimated amortization expense for intangible assets for the next five years and thereafter is expected to be as follows (in

thousands):

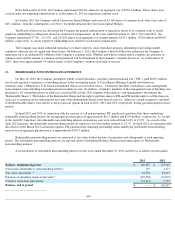

A roll-forward of goodwill for the years ended December 31, 2014 and 2013 consisted of the following (in thousands):

A substantial portion of the intangibles and goodwill relates to the acquisition of OpenTable in July 2014 and KAYAK in May 2013.

See Note 20 for further information on these acquisitions.

In September 2014, the Company performed its annual goodwill impairment testing using standard valuation techniques. Since the

annual impairment test, there have been no events or changes in circumstances to indicate a potential impairment.

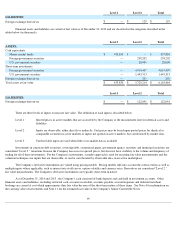

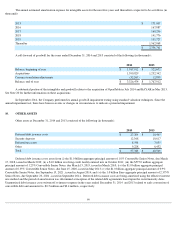

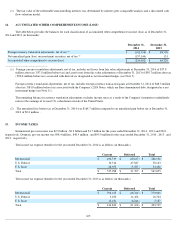

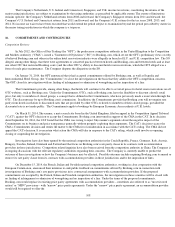

Other assets at December 31, 2014 and 2013 consisted of the following (in thousands):

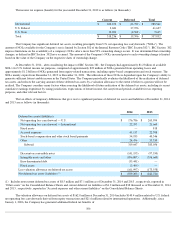

Deferred debt issuance costs arose from (i) the $1.0 billion aggregate principal amount of 1.0% Convertible Senior Notes, due March

15, 2018, issued in March 2012; (ii) a $1.0 billion revolving credit facility entered into in October 2011; (iii) the $575.0 million aggregate

principal amount of 1.25% Convertible Senior Notes, due March 15, 2015, issued in March 2010; (iv) the $1.0 billion aggregate principal

amount of 0.35% Convertible Senior Notes, due June 15, 2020, issued in May 2013; (v) the $1.0 billion aggregate principal amount of 0.9%

Convertible Senior Notes, due September 15, 2021 , issued in August 2014; and (vi) the 1.0 billion Euro aggregate principal amount of 2.375%

Senior Notes, due September 23, 2024 , issued in September 2014. Deferred debt issuance costs are being amortized using the effective interest

rate method and the period of amortization was determined at inception of the related debt agreements based upon the stated maturity dates.

Unamortized debt issuance costs written off to interest expense in the years ended December 31, 2014 and 2013 related to early conversion of

convertible debt and amounted to $0.5 million and $2.4 million , respectively.

99

2015

$

171,007

2016

167,887

2017

160,296

2018

141,776

2019

131,727

Thereafter

1,562,068

$

2,334,761

2014

2013

Balance, beginning of year

$

1,767,912

$

522,672

Acquisitions

1,590,829

1,232,342

Currency translation adjustments

(32,267

)

12,898

Balance, end of year

$

3,326,474

$

1,767,912

10.

OTHER ASSETS

2014

2013

Deferred debt issuance costs

$

27,204

$

16,465

Security deposits

12,368

10,617

Deferred tax assets

8,548

7,055

Other

9,228

6,432

Total

$

57,348

$

40,569