Priceline 2014 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2014 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

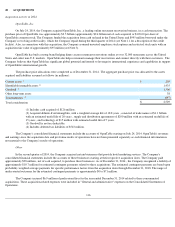

The Company's Netherlands, U.S. federal and Connecticut, Singapore, and U.K. income tax returns, constituting the returns of the

major taxing jurisdictions, are subject to examination by the taxing authorities as prescribed by applicable statute. The statute of limitations

remains open for: the Company's Netherlands returns from 2008 and forward; the Company's Singapore returns from 2011 and forward; the

Company's U.S. Federal and Connecticut returns from 2011 and forward; and the Company's U.K. returns for the tax years 2008, 2013, and

2014. No income tax waivers have been executed that would extend the period subject to examination beyond the period prescribed by statute in

the major taxing jurisdictions in which the company is a taxpayer.

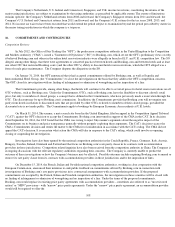

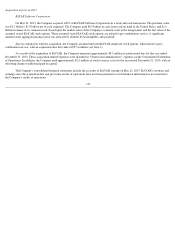

Competition Reviews

In July 2012, the Office of Fair Trading (the "OFT"), the predecessor competition authority in the United Kingdom to the Competition

and Markets Authority ("CMA"), issued a "Statement of Objections" ("SO") to Booking.com, which set out the OFT's preliminary views on why

it believed Booking.com and others in the online hotel reservation industry were allegedly in breach of E.U. and U.K. competition law. The SO

alleged, among other things, that there were agreements or concerted practices between hotels and Booking.com and between hotels and at least

one other OTC that restricted Booking.com's (and the other OTC's) ability to discount hotel room reservations, which the OFT alleged was a

form of resale price maintenance. The Company disputes the allegations in the SO.

On January 31, 2014, the OFT announced that it had accepted commitments offered by Booking.com, as well as Expedia and

Intercontinental Hotel Group, (the "Commitments") to close the investigation on the basis that they address the OFT's competition concerns.

The OFT closed its investigation with no finding of infringement or admission of wrongdoing and no imposition of a fine.

The Commitments provide, among other things, that hotels will continue to be able to set retail prices for hotel room reservations on all

OTC websites, such as Booking.com. Under the Commitments, OTCs, such as Booking.com, have the flexibility to discount a hotel's retail

price, but only to members of closed groups, a concept that is defined in the Commitments, who have previously made a reservation through the

OTC. The discount may be up to Booking.com's commission. In addition, the Commitments provide that Booking.com will not require rate

parity from hotels in relation to discounted rates that are provided by other OTCs or hotels to members of their closed groups, provided the

discounted rate is not made public. The Commitments apply to bookings by European Economic Area residents at U.K. hotels.

On March 31, 2014, Skyscanner, a meta-search site based in the United Kingdom, filed an appeal in the Competition Appeal Tribunal

("CAT") against the OFT's decision to accept the Commitments. Booking.com intervened in support of the CMA in the CAT. In its decision

dated September 26, 2014, the CAT found that the CMA was wrong to reject Skyscanner's arguments about the negative impact of the

Commitments on its business and price transparency generally without properly exploring these arguments. The CAT's decision vacates the

CMA's Commitments decision and remits the matter to the CMA for reconsideration in accordance with the CAT's ruling. The CMA did not

appeal the CAT's decision. It is uncertain what action the CMA will take in response to the CAT's ruling, which could involve re-opening,

closing or suspending the investigation.

Investigations have also been opened by the national competition authorities in the Czech Republic, France, Germany, Italy, Austria,

Hungary, Sweden, Ireland, Denmark and Switzerland that focus on Booking.com's rate parity clause in its contracts with accommodation

providers in those jurisdictions. Competition related inquiries have also been received from the competition authority in China. The Company is

in ongoing discussions with the relevant regulatory authorities regarding their concerns. The Company is currently unable to predict the

outcome of these investigations or how the Company's business may be affected. Possible outcomes include requiring Booking.com to amend or

remove its rate parity clause from its contracts with accommodation providers in those jurisdictions and/or the imposition of fines.

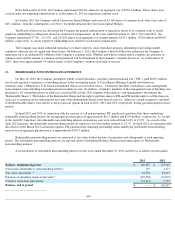

On December 15, 2014, the French, Italian and Swedish national competition authorities, working in close cooperation with the

European Commission, announced their intention to seek public feedback on commitments offered by Booking.com in connection with

investigations of Booking.com's rate parity provisions in its contractual arrangements with accommodation providers. If the proposed

commitments are accepted by the French, Italian and Swedish competition authorities, the investigations in those countries will be closed with

no finding of infringement or admission of wrongdoing and no imposition of a fine. Under the terms of the proposed commitments,

Booking.com would replace its existing price parity agreements with accommodation providers - sometimes also referred to as "most favored

nation" or "MFN" provisions - with "narrow" price parity agreements. Under the "narrow" price parity agreement, an accommodation provider

would still be required to offer the

108

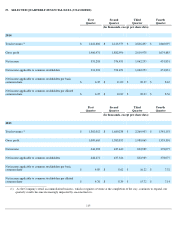

16.

COMMITMENTS AND CONTINGENCIES