Priceline 2014 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2014 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Revolving Credit Facility

In October 2011, the Company entered into a $1.0 billion five -year unsecured revolving credit facility with a group of lenders.

Borrowings under the revolving credit facility will bear interest, at the Company's option, at a rate per annum equal to either (i) the adjusted

LIBOR for the interest period in effect for such borrowing plus an applicable margin ranging from 1.00% to 1.50% ; or (ii) the greatest of

(a) JPMorgan Chase Bank, National Association's prime lending rate, (b) the federal funds rate plus 0.50% , and (c) an adjusted LIBOR for an

interest period of one month plus 1.00% , plus an applicable margin ranging from 0.00% to 0.50% . Undrawn balances available under the

revolving credit facility are subject to commitment fees at the applicable rate ranging from 0.10% to 0.25% .

The revolving credit facility provides for the issuance of up to $100.0 million of letters of credit as well as borrowings of up to $50

million on same-day notice, referred to as swingline loans. Borrowings under the revolving credit facility may be made in U.S. Dollars, Euros,

British Pounds Sterling and any other foreign currency agreed to by the lenders. The proceeds of loans made under the facility will be used for

working capital and general corporate purposes.

The Company funded the acquisition of OpenTable in July 2014 from cash on hand in the United States and $995 million borrowed

under the Company's revolving credit facility, which the Company repaid during the third quarter of 2014. As of December 31, 2014 and 2013 ,

there were no borrowings under the facility, and approximately $4.0 million and $2.2 million , respectively, of letters of credit issued under the

facility.

Outstanding Debt

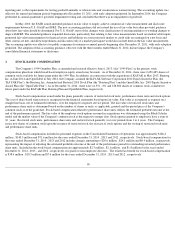

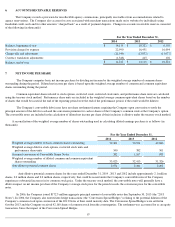

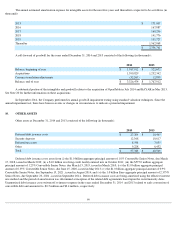

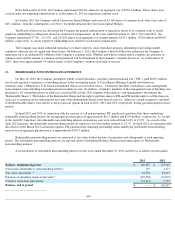

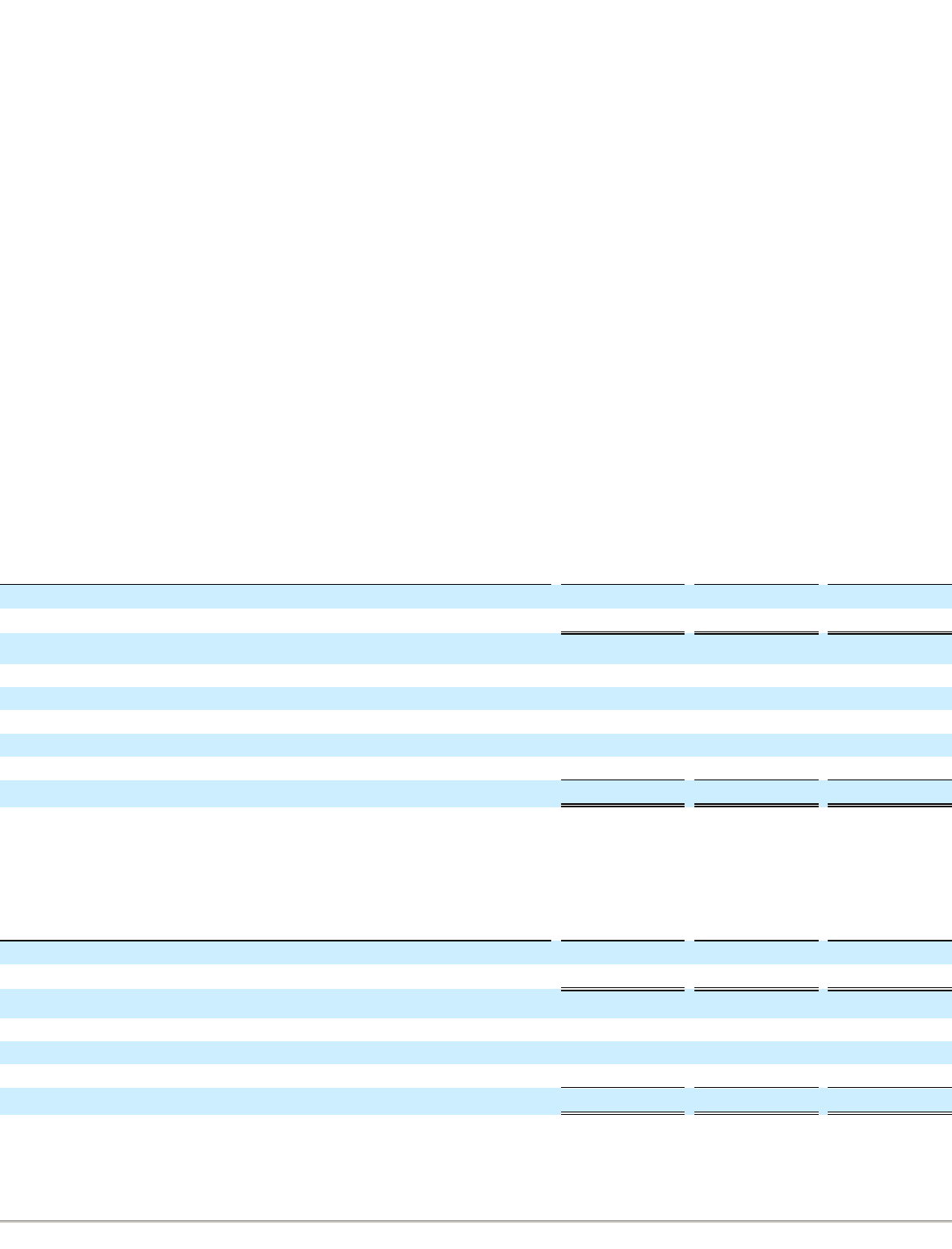

Outstanding debt as of December 31, 2014 consisted of the following (in thousands):

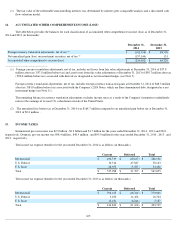

Outstanding debt as of December 31, 2013 consisted of the following (in thousands):

Based upon the closing price of the Company's common stock for the prescribed measurement periods during the three months ended

December 31, 2013 , the contingent conversion threshold on the 2015 Notes (as defined below) was exceeded.

100

11.

DEBT

December 31, 2014

Outstanding

Principal

Amount

Unamortized

Debt

Discount

Carrying

Value

Short-term debt:

1.25% Convertible Senior Notes due March 2015

$

37,524

$

(329

)

$

37,195

Long-term debt:

1.0% Convertible Senior Notes due March 2018

$

1,000,000

$

(74,834

)

$

925,166

0.35% Convertible Senior Notes due June 2020

1,000,000

(138,114

)

861,886

0.9% Convertible Senior Notes due September 2021

1,000,000

(136,299

)

863,701

2.375% (€1 Billion) Senior Notes due September 2024

1,210,068

(11,065

)

1,199,003

Total long-term debt

$

4,210,068

$

(360,312

)

$

3,849,756

December 31, 2013

Outstanding

Principal

Amount

Unamortized

Debt

Discount

Carrying

Value

Short-term debt:

1.25% Convertible Senior Notes due March 2015

$

160,464

$

(8,533

)

$

151,931

Long-term debt:

1.0% Convertible Senior Notes due March 2018

$

1,000,000

$

(96,797

)

$

903,203

0.35% Convertible Senior Notes due June 2020

1,000,000

(161,156

)

838,844

Total long-term debt

$

2,000,000

$

(257,953

)

$

1,742,047