Priceline 2014 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2014 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

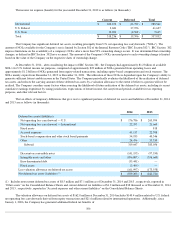

$250.0 million related to equity transactions that are not included in the deferred tax asset table above. Pursuant to accounting guidance, these

tax benefits related to equity deductions will be recognized by crediting paid in capital, if and when they are realized by reducing the Company's

current income tax liability.

It is the practice and intention of the Company to reinvest the earnings of its non-U.S. subsidiaries in those operations. Thus at

December 31, 2014 , no provision had been made for U.S. taxes on approximately $7.3 billion of international earnings because such earnings

are intended to be indefinitely reinvested outside of the United States. It is not practicable to determine the U.S. federal income tax liability that

would be payable if such earnings were not indefinitely reinvested.

At December 31, 2014 , the Company has approximately $673.4 million of U.S. state net operating loss carryforwards that expire

mainly between December 31, 2020 and December 31, 2033, $131.2 million of non-U.S. net operating loss carryforwards, of which $49.3

million expire between December 31, 2019 and December 31, 2021 and $3.7 million which expire between December 31, 2028 and December

31, 2030, and $1.7 million of foreign capital allowance carryforwards that do not expire. At December 31, 2014 , the Company also had

approximately $29.6 million of U.S. research credit carryforwards that mainly expire between December 31, 2033 and December 31, 2034 and

are also subject to annual limitation.

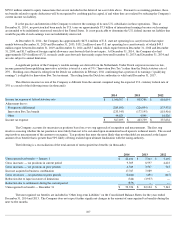

A significant portion of the Company's taxable earnings are derived from the Netherlands. Under Dutch corporate income tax law,

income generated from qualifying innovative activities is taxed at a rate of 5% ("Innovation Box Tax") rather than the Dutch statutory rate of

25% . Booking.com obtained a ruling from the Dutch tax authorities in February 2011 confirming that a portion of its earnings ("qualifying

earnings") is eligible for Innovation Box Tax treatment. The ruling from the Dutch tax authorities is valid until December 31, 2017.

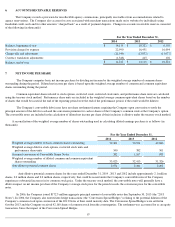

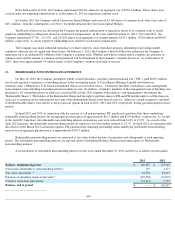

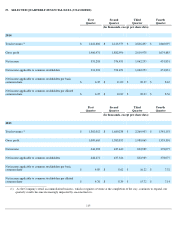

The effective income tax rate of the Company is different from the amount computed using the expected U.S. statutory federal rate of

35% as a result of the following items (in thousands):

The Company accounts for uncertain tax positions based on a two step approach of recognition and measurement. The first step

involves assessing whether the tax position is more likely than not to be sustained upon examination based upon its technical merits. The second

step involves measurement of the amount to recognize. Tax positions that meet the more likely than not threshold are measured at the largest

amount of tax benefit that is greater than 50% likely of being realized upon ultimate finalization with the taxing authority.

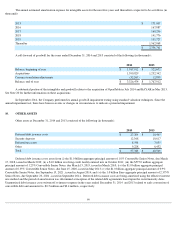

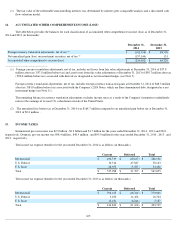

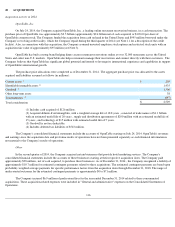

The following is a reconciliation of the total amount of unrecognized tax benefits (in thousands):

The unrecognized tax benefits are included in "Other long-term liabilities" on the Consolidated Balance Sheets for the years ended

December 31, 2014 and 2013 . The Company does not expect further significant changes in the amount of unrecognized tax benefits during the

next twelve months.

107

2014

2013

2012

Income tax expense at federal statutory rate

$

1,046,307

$

803,788

$

616,654

Adjustment due to:

Foreign rate differential

(289,692

)

(226,894

)

(175,932

)

Innovation Box Tax benefit

(233,545

)

(177,195

)

(118,916

)

Other

44,625

4,040

16,026

Income tax expense

$

567,695

$

403,739

$

337,832

2014

2013

2012

Unrecognized tax benefit — January 1

$

22,104

$

7,343

$

3,192

Gross increases — tax positions in current period

9,305

8,597

4,423

Gross increases — tax positions in prior periods

6,569

3,507

343

Increase acquired in business combination

17,767

7,089

—

Gross decreases — tax positions in prior periods

(2,164

)

(495

)

(615

)

Reduction due to lapse in statute of limitations

(346

)

(3,937

)

—

Reduction due to settlements during the current period

(879

)

—

—

Unrecognized tax benefit — December 31

$

52,356

$

22,104

$

7,343