Priceline 2014 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2014 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

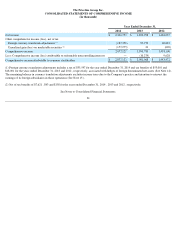

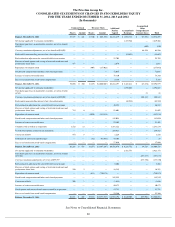

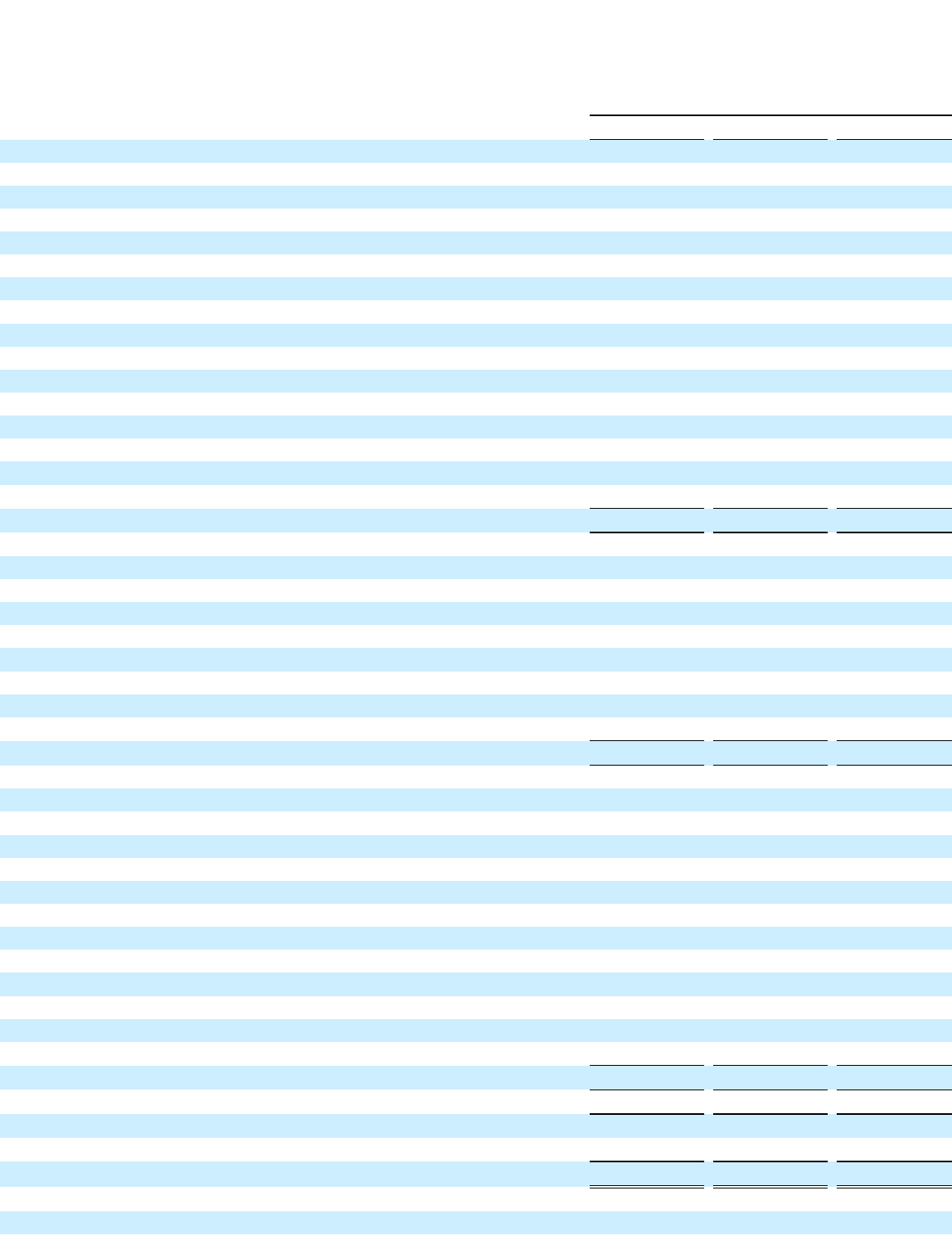

The Priceline Group Inc.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

Year Ended December 31,

2014

2013

2012

OPERATING ACTIVITIES:

Net income

$

2,421,753

$

1,892,798

$

1,424,037

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation

78,241

48,365

32,818

Amortization

129,579

69,610

32,323

Provision for uncollectible accounts, net

22,990

16,451

16,094

Deferred income tax expense (benefit)

31,707

(11,104

)

19,596

Stock-based compensation expense and other stock based payments

189,292

142,098

72,035

Amortization of debt issuance costs

5,229

7,898

5,212

Amortization of debt discount

54,731

55,718

39,820

Loss on early extinguishment of debt

6,270

26,661

—

Changes in assets and liabilities:

Accounts receivable

(182,209

)

(111,572

)

(105,277

)

Prepaid expenses and other current assets

(48,932

)

(6,909

)

(40,793

)

Accounts payable, accrued expenses and other current liabilities

203,870

182,163

256,021

Other

1,876

(10,741

)

33,864

Net cash provided by operating activities

2,914,397

2,301,436

1,785,750

INVESTING ACTIVITIES:

Purchase of investments

(10,552,214

)

(9,955,800

)

(6,352,495

)

Proceeds from sale of investments

10,902,500

8,291,283

4,799,412

Additions to property and equipment

(131,504

)

(84,445

)

(55,158

)

Acquisitions and other equity investments, net of cash acquired

(2,496,366

)

(331,918

)

(33,861

)

Proceeds from foreign currency contracts

14,354

3,266

86,159

Payments on foreign currency contracts

(94,661

)

(81,870

)

(4,014

)

Change in restricted cash

9,347

(2,783

)

(2,756

)

Net cash used in investing activities

(2,348,544

)

(2,162,267

)

(1,562,713

)

FINANCING ACTIVITIES:

Proceeds from revolving credit facility

995,000

—

—

Payments related to revolving credit facility

(995,000

)

—

—

Proceeds from the issuance of long-term debt

2,282,217

980,000

1,000,000

Payment of debt issuance costs

(17,464

)

(1,018

)

(20,916

)

Payments related to conversion of senior notes

(125,136

)

(414,569

)

(1

)

Repurchase of common stock

(750,378

)

(883,515

)

(257,021

)

Payments to purchase subsidiary shares from noncontrolling interests

—

(

192,530

)

(61,079

)

Payments of stock issuance costs

—

(

1,191

)

—

Proceeds from exercise of stock options

16,389

91,607

2,683

Proceeds from the termination of conversion spread hedges

—

19

—

Excess tax benefit from stock-based compensation

23,366

17,686

5,189

Net cash provided by (used in) financing activities

1,428,994

(403,511

)

668,855

Effect of exchange rate changes on cash and cash equivalents

(136,190

)

17,987

11,621

Net increase (decrease) in cash and cash equivalents

1,858,657

(246,355

)

903,513

Cash and cash equivalents, beginning of period

1,289,994

1,536,349

632,836

Cash and cash equivalents, end of period

$

3,148,651

$

1,289,994

$

1,536,349

SUPPLEMENTAL CASH FLOW INFORMATION:

Cash paid during the period for income taxes

$

491,530

$

391,169

$

300,539