Priceline 2014 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2014 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

During the year ended December 31, 2014 , we paid $122.9 million to satisfy the aggregate principal amount due and issued 300,256

shares of our common stock and paid cash of $2.2 million in satisfaction of the conversion value in excess of the principal amount for debt

converted prior to maturity related to the conversion of our 1.25% Convertible Senior Notes due March 2015.

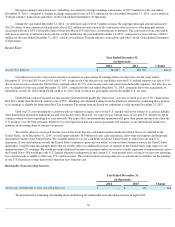

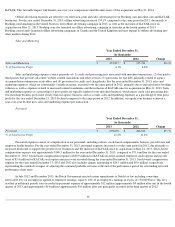

Net cash provided by operating activities for the year ended December 31, 2014 , was $2.9 billion , resulting from net income of $2.4

billion and a favorable impact of non-cash items not affecting cash flows of $518.0 million , slightly offset by net unfavorable changes in

working capital and other assets and liabilities of $25.4 million . The changes in working capital for the year ended December 31, 2014 , were

primarily related to a $203.9 million increase in accounts payable, accrued expenses and other current liabilities, offset by a $182.2 million

increase in accounts receivable and $48.9 million increase in prepaid expenses and other current assets. The increase in these working capital

balances was primarily related to increases in business volumes. Non-cash items were primarily associated with stock-based compensation

expense, depreciation and amortization, amortization of debt discount and deferred income taxes.

Net cash provided by operating activities for the year ended December 31, 2013, was $2.3 billion, resulting from net income of $1.9

billion, a favorable impact of non-cash items not affecting cash flows of $355.7 million and net favorable changes in working capital and other

assets and liabilities of $52.9 million. The changes in working capital for the year ended December 31, 2013, were primarily related to a $182.2

million increase in accounts payable, accrued expenses and other current liabilities, partially offset by a $111.6 million increase in accounts

receivable. The increase in these working capital balances was primarily related to increases in business volumes. Non-

cash items were primarily

associated with stock-based compensation expense, depreciation and amortization, amortization of debt discount, a non-cash loss on convertible

notes converted prior to maturity, and deferred income taxes.

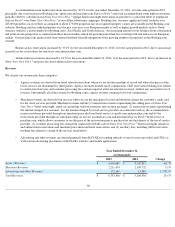

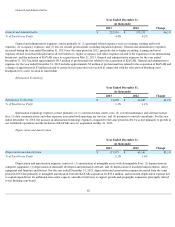

Net cash used in investing activities was $2.3 billion for the year ended December 31, 2014 . Investing activities for the year ended

December 31, 2014 were affected by payments of $2.5 billion for acquisitions, net of cash acquired and net cash payments of $80.3 million for

the settlement of foreign currency contracts slightly offset by net sales of investments of $350.3 million and a change in restricted cash of $9.3

million . Net cash used in investing activities was $2.2 billion for the year ended December 31, 2013. Investing activities for the year ended

December 31, 2013 were affected by net purchases of investments of $1.7 billion, payments of $331.9 million for acquisitions, net of cash

acquired, a change in restricted cash of $2.8 million, and net cash payments of $78.6 million for the settlement of foreign currency contracts.

Cash invested in the purchase of property and equipment was $131.5 million and $84.4 million in the years ended December 31, 2014 and 2013

,

respectively. The increase in 2014 was related to additional data center capacity and new offices to support growth and geographic expansion,

principally related to our Booking.com business.

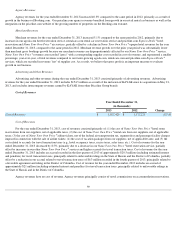

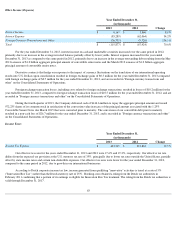

Net cash provided by financing activities was approximately $1.4 billion for the year ended December 31, 2014 . Cash provided by

financing activities for the year ended December 31, 2014 primarily consisted of total proceeds of $2.3 billion

from the issuance of Convertible

Senior Notes and Euro denominated Senior Notes, excess tax benefits from stock-based compensation of $23.4 million and the exercise of

employee stock options of $16.4 million , partially offset by treasury stock purchases of $750.4 million and payments of $125.1 million

related to the conversion of Senior Notes. Net cash used in financing activities was approximately $403.5 million for the year ended December

31, 2013. The cash used in financing activities for the year ended December 31, 2013 was primarily related to payments for treasury stock

purchases of $883.5 million, $192.5 million spent to purchase the remaining shares underlying noncontrolling interests in rentalcars.com, $414.6

million to satisfy the aggregate principal amount due upon the early conversion of senior notes, and $1.0 million of debt issuance costs, partially

offset by proceeds from the issuance of convertible senior notes with an aggregate principal amount of $1.0 billion, $91.6 million of proceeds

from the exercise of employee stock options, and $17.7 million of excess tax benefits from stock-based compensation.

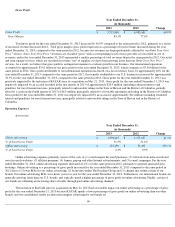

Contingencies

A number of jurisdictions have initiated lawsuits against online travel companies, including us, related to, among other things, the

payment of travel transaction taxes (e.g., hotel occupancy taxes, excise taxes, sales taxes, etc.). In addition, a number of U.S. states, counties and

municipalities have initiated audit proceedings, issued proposed tax assessments or started inquiries relating to the payment of travel transaction

taxes. To date, the majority of taxing jurisdictions in which we facilitate the making of travel reservations have not asserted that taxes are due

and payable on our travel services. With respect to jurisdictions that have not initiated proceedings to date, it is possible that they will do so in

the future or that they will seek to amend their tax statutes and seek to collect taxes from us only on a prospective basis. See Note 16 to the

Consolidated Financial Statements for a description of these pending cases and proceedings and Part I Item 1A Risk Factors - " Adverse

application of state and local tax laws could have an adverse effect on our business and results of operations. " in this Annual Report.

66