Priceline 2014 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2014 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

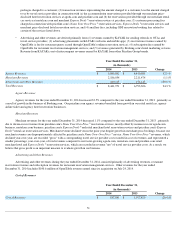

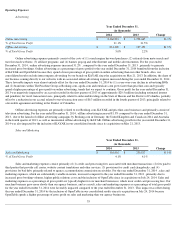

which was spent internationally through Internet search engines (primarily Google), meta-search and travel research services and affiliate

marketing. We also invested $231 million in offline advertising. We intend to continue a strategy of aggressively promoting brand awareness,

primarily through online means although we also intend to increase our offline advertising efforts, including by expanding offline campaigns

into additional markets. For example, building on its first offline advertising campaign, which it launched in the United States in 2013,

Booking.com has begun offline advertising campaigns in other markets, including Australia, Canada, the United Kingdom and Germany. We

have observed increased offline advertising by OTAs, meta-search services and travel service providers, particularly in North America and

Europe, which may make our offline advertising efforts more expensive and less effective.

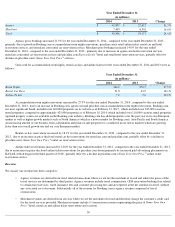

Online advertising efficiency, expressed as online advertising as a percentage of gross profit, is impacted by a number of factors that are

subject to variability and that are, in some cases, outside of our control, including ADRs, costs per click, cancellation rates, foreign exchange

rates, our ability to convert paid traffic to booking customers and the extent to which consumers come directly to our websites or mobile apps for

bookings. For example, competition for desired rankings in search results and/or a decline in ad clicks by consumers, could increase our costs-

per-click and reduce our online advertising efficiency. From 2011 to 2013 our online advertising grew faster than our gross profit due to (1)

year

-over-year declines in online advertising returns on investment ("ROIs") and (2) brand mix within The Priceline Group as our international

brands grew faster than our U.S. brands and spent a higher percentage of gross profit on online advertising. In 2014, these long-term trends were

more than offset by the inclusion of KAYAK and OpenTable because they spend a lower percentage of gross profit on online advertising than

our other brands. Also, our consolidated results exclude intercompany advertising by our brands on KAYAK since our acquisition of KAYAK in

May 2013. If Google changes how it presents travel search results or the manner in which it conducts the auction for placement among search

results in a manner that is competitively disadvantageous to us, whether to support its own travel related services or otherwise, our ability to

efficiently generate traffic to our websites could be harmed. See Part I Item 1A Risk Factors - " We rely on online advertising channels to

enhance our brand awareness and to generate a significant amount of traffic to our websites. " and " Our business could be negatively affected

by changes in Internet search engine algorithms and dynamics or traffic-generating arrangements. "

The competition authorities of many governments have begun investigations into competitive practices within the online travel industry,

and we may be involved or affected by such investigations and their results. For example, Booking.com has been the subject of a competition

investigation by U.K. competition authorities since July 2012. Other national competition authorities, including those in the Czech Republic,

France, Germany, Italy, Austria, Hungary, Sweden and Switzerland, have more recently opened investigations that focus on Booking.com's rate

parity clause in its contracts with accommodation providers in those jurisdictions. We are currently unable to predict the outcome of all of these

investigations or how our business may be affected. Possible outcomes include requiring Booking.com to remove its rate parity clause from its

contracts with accommodation providers in those jurisdictions. In the U.K. investigation, Booking.com and the other subjects of the investigation

had reached a settlement with the competition authorities; however, that settlement has been vacated on appeal. On December 15, 2014, the

French, Italian and Swedish national competition authorities, working in close cooperation with the European Commission, announced their

intention to seek public feedback on commitments offered by Booking.com in connection with investigations of Booking.com's rate parity

provisions in its contractual arrangements with accommodation providers. See Footnote 16 to our Consolidated Financial Statements and Part I

Item 1A Risk Factors - " As the size of our business grows, we may become increasingly subject to the scrutiny of anti-trust and competition

regulators. " We note that the German competition authority has required Hotel Reservation Service, a leading OTA in Germany, to remove its

rate parity clause from its contracts with hotels, and Hotel Reservation Service's initial appeal was denied. To the extent that regulatory

authorities require changes to our business practices or to those currently common to the industry, our business, competitive position and results

of operations could be materially and adversely affected. Negative publicity regarding any such investigations could adversely affect our brand

and therefore our market share and results of operations.

Hotels typically make available only a limited number of hotel rooms for opaque services like ours, especially during periods of high

occupancy. As a result, recent high hotel occupancy levels in the United States have had an adverse impact on our access to hotel rooms for our

opaque hotel reservation services, which has negatively affected our opaque hotel reservation gross profits.

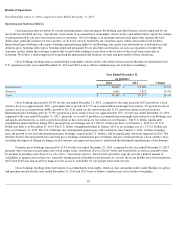

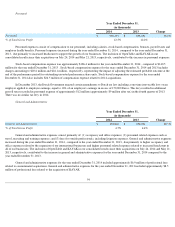

Seasonality

A meaningful amount of gross bookings are generated early in the year, as customers plan and reserve their spring and summer

vacations in Europe and North America. From a cost perspective, we expense the substantial majority of our advertising activities as the expense

is incurred, which is typically in the quarter in which reservations are booked. However, we generally do not recognize associated revenue until

future quarters when the travel occurs. As a result, we typically experience our highest levels of profitability in the second and third quarters of

the year, which is when we experience the highest levels of accommodation checkouts for the year for our European and North American

businesses.

44