Priceline 2014 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2014 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

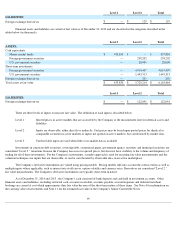

In the normal course of business, the Company is exposed to the impact of foreign currency fluctuations. The Company limits these

risks by following established risk management policies and procedures, including the use of derivatives. See Note 2 for further information on

our accounting policy for derivative financial instruments.

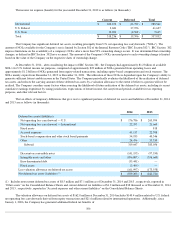

Derivatives Not Designated as Hedging Instruments — The Company is exposed to adverse movements in currency exchange rates as

the operating results of its international operations are translated from local currency into U.S. Dollars upon consolidation. The Company's

derivative contracts principally address short-term foreign exchange fluctuations for the Euro and British Pound Sterling versus the U.S. Dollar.

As of December 31, 2014 and 2013 , there were no outstanding derivative contracts related to foreign currency translation risk. Foreign

exchange gains of $13.7 million , $0.3 million and $0.7 million for the years ended December 31, 2014 , 2013 and 2012 , respectively, were

recorded related to these derivatives in "Foreign currency transactions and other" in the Consolidated Statements of Operations.

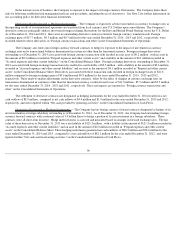

The Company also enters into foreign currency forward contracts to hedge its exposure to the impact of movements in currency

exchange rates on its transactional balances denominated in currencies other than the functional currency. Foreign exchange derivatives

outstanding as of December 31, 2014 associated with foreign currency transaction risks resulted in a net asset of $0.2 million , with an asset in

the amount of $0.3 million recorded in "Prepaid expenses and other current assets" and a liability in the amount of $0.1 million recorded in

"Accrued expenses and other current liabilities" on the Consolidated Balance Sheet. Foreign exchange derivatives outstanding at December 31,

2013 associated with foreign exchange transaction risks resulted in a net liability of $0.5 million , with a liability in the amount of $0.6 million

recorded in "Accrued expenses and other current liabilities" and an asset in the amount of $0.1 million recorded in "Prepaid and other current

assets" on the Consolidated Balance Sheet. Derivatives associated with these transaction risks resulted in foreign exchange losses of $21.8

million compared to foreign exchange gains of $3.6 million and $0.8 million for the years ended December 31, 2014 , 2013 and 2012 ,

respectively. These mark-to-market adjustments on the derivative contracts, offset by the effect of changes in currency exchange rates on

transactions denominated in currencies other than the functional currency, resulted in net losses of $11.8 million , $5.5 million and $5.5 million

for the years ended December 31, 2014 , 2013 and 2012 , respectively. These net impacts are reported in “Foreign currency transactions and

other” on the Consolidated Statements of Operations.

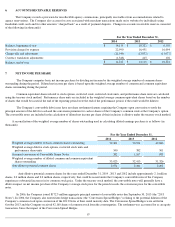

The settlement of derivative contracts not designated as hedging instruments for the year ended December 31, 2014 resulted in a net

cash outflow of $8.9 million , compared to net cash inflows of $4.4 million and $1.9 million for the years ended December 31, 2013 and 2012 ,

respectively, and were reported within "Net cash provided by operating activities" on the Consolidated Statements of Cash Flows.

Derivatives Designated as Hedging Instruments — The Company had no foreign currency forward contracts designated as hedges of its

net investment in a foreign subsidiary outstanding as of December 31, 2014 . As of December 31, 2013 , the Company had outstanding foreign

currency forward contracts with a notional value of 3.0 billion Euros to hedge a portion of its net investment in a foreign subsidiary. These

contracts were all short-term in nature. Hedge ineffectiveness is assessed and measured based on changes in forward exchange rates. The fair

value of these derivatives at December 31, 2013 was a net liability of $121.3 million , with a liability in the amount of $121.5 million

recorded in

"Accrued expenses and other current liabilities" and an asset in the amount of $0.2 million recorded in "Prepaid expenses and other current

assets" on the Consolidated Balance Sheet. These hedging instruments generated net cash outflows of $80.3 million and $78.6 million for the

years ended

December 31, 2014 and 2013 , compared to a net cash inflows of $82.1 million for the year ended December 31, 2012 , and were

reported within "Net cash used in investing activities" on the Consolidated Statements of Cash Flows.

96