Priceline 2014 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2014 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

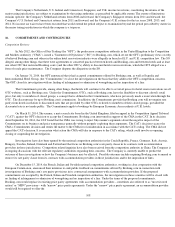

asserted that these taxes are due and payable. With respect to taxing jurisdictions that have not initiated proceedings to date, it is possible that

they will do so in the future or that they will seek to amend their tax statutes and seek to collect taxes from the Company only on a prospective

basis.

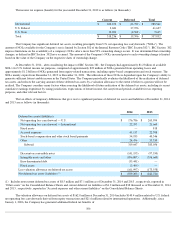

Accrual for Travel Transaction Taxes

As a result of this litigation and other attempts by jurisdictions to levy similar taxes, the Company has established an accrual (including

estimated interest and penalties) for the potential resolution of issues related to travel transaction taxes in the amount of approximately $52

million at December 31, 2014 compared to approximately $55 million at December 31, 2013 . The Company's legal expenses for these matters

are expensed as incurred and are not reflected in the amount accrued. The actual cost may be less or greater, potentially significantly, than the

liabilities recorded. An estimate for a reasonably possible loss or range of loss in excess of the amount accrued cannot be reasonably made.

The Company intends to vigorously defend against the claims in all of the proceedings described below.

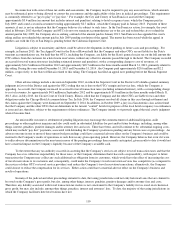

Statewide Class Actions and Putative Class Actions

Such actions include:

Actions Filed on Behalf of Individual Cities, Counties and States

Such actions include:

111

• City of Los Angeles, California v. Hotels.com, Inc., et al. (California Superior Court, Los Angeles County; filed in December

2004); (California Court of Appeal; appeal filed in March 2014);

• City of San Antonio, Texas v. Hotels.com, L.P., et al. (U.S. District Court for the Western District of Texas; filed in May

2006);

• Pine Bluff Advertising and Promotion Commission, Jefferson County, Arkansas, et al. v. Hotels.com, LP, et al. (Circuit Court

of Jefferson County, Arkansas; filed in September 2009); (Arkansas Supreme Court; appeal filed in March 2013);

• County of Lawrence, Pennsylvania v. Hotels.com, L.P., et al. (Court of Common Pleas of Lawrence County, Pennsylvania;

filed Nov. 2009); (Commonwealth Court of Pennsylvania; appeal filed in November 2010);

• City of Columbia, South Carolina, et al. v. Hotelguides.com, Inc. et al. (Court of Common Pleas, Ninth Judicial Circuit,

County of Charleston; filed in July 2013); and

• City of Charleston, et al. v. Hotelguides.com, Inc. et al. (Court of Common Pleas for Charleston County, South Carolina; filed

January 2014).

• City of San Diego, California v. Hotels.com L.P., et al. (California Superior Court, San Diego County; filed in September

2006) (Superior Court of California, Los Angeles County) (California Court of Appeal; appeal filed in August 2012);

(California Supreme Court; petition for review granted in July 2014);

• City of Atlanta, Georgia v. Hotels.com L.P., et al. (Superior Court of Fulton County, Georgia; filed in March 2006); (Court of

Appeals of the State of Georgia; appeal filed in January 2007); (Georgia Supreme Court; further appeal filed in December

2007; petition for writs of mandamus and prohibition filed in December 2012; further appeal filed in November 2013 but

transferred to Georgia Court of Appeals in July 2014);

• Leon County, et al. v. Expedia, Inc., et al. (Second Judicial Circuit Court for Leon County, Florida; filed November 2009);

(Florida First District Court of Appeal; appeal filed in May 2012); (Florida Supreme Court; jurisdiction accepted in September

2013);

• Leon County v. Expedia, Inc. et al.

(Second Judicial Circuit Court for Leon County, Florida; filed in December 2009); (Florida

First District Court of Appeal; appeal filed in October 2012); (Florida Supreme Court; notice to invoke jurisdiction filed in

October 2013);

• Montana Department of Revenue v. Priceline.com, Inc., et al. (First Judicial District Court of Lewis and Clark County,

Montana; filed in November 2010); (Montana Supreme Court; appeal filed in May 2014);

• District of Columbia v. Expedia, Inc., et al. (Superior Court of District of Columbia; filed in March 2011); (District of

Columbia Court of Appeals; appeal filed in March 2014);

• Volusia County, et al. v. Expedia, Inc., et al.

(Circuit Court for Volusia County, Florida; filed in April 2011);

• Town of Breckenridge, Colorado v. Colorado Travel Company, LLC, et al.

(District Court for Summit County, Colorado; filed

in July 2011);

• County of Nassau v. Expedia, Inc., et al. (Supreme Court of Nassau County, New York; filed in September 2011); (Appellate

Division, Second Department; appeal filed in April 2013);