Priceline 2014 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2014 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

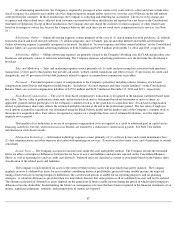

The Company does not use financial instruments for trading or speculative purposes. The Company recognizes all derivative

instruments on the balance sheet at fair value and its derivative instruments are generally short-term in duration. The derivative instruments do

not contain leverage features.

The Company is exposed to the risk that counterparties to derivative contracts may fail to meet their contractual obligations. The

Company regularly reviews its credit exposure as well as assessing the creditworthiness of its counterparties. See Note 5 for further detail on

derivatives.

Recent Accounting Pronouncements

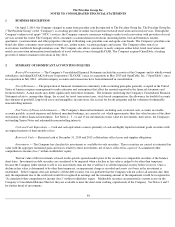

In May 2014, the Financial Accounting Standards Board ("FASB") and the International Accounting Standards Board ("IASB") issued

a new accounting standard on the recognition of revenue from contracts with customers that is designed to create greater comparability for

financial statement users across industries and jurisdictions. The core principle of the standard is that an "entity recognizes revenue to depict the

transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in

exchange for those goods or services." Additionally, the new guidance specifies the accounting for some costs to obtain or fulfill a contract with

a customer. The new standard will also require enhanced disclosures. The accounting standard is effective for public entities for annual and

interim periods beginning after December 15, 2016. Early adoption is not permitted under U.S. GAAP and retrospective application is permitted

but not required. The Company is currently evaluating the impact on its consolidated financial statements of adopting this new guidance.

In April 2014, the FASB issued an accounting update which amends the definition of a discontinued operation. The new definition

limits discontinued operations reporting to disposals of components of an entity that represent strategic shifts that have or will have a major

effect on an entity's operations and financial results. The new definition includes an acquired business that is classified as held for sale at the date

of acquisition. The accounting update requires new disclosures of both discontinued operations and a disposal of an individually significant

component of an entity. The accounting update is effective for annual and interim periods beginning on or after December 15, 2014. Early

adoption is permitted but only for disposals that have not been reported in financial statements previously issued. The Company adopted this

update in the first quarter of 2015 and this accounting update did not have an impact on the Company's consolidated financial statements.

In July 2013, the FASB issued an accounting update which provides guidance on financial statement presentation of an unrecognized

tax benefit when a net operating loss carryforward or a tax credit carryforward exists in the same taxing jurisdiction. Per this guidance, an entity

must present the unrecognized tax benefit as a reduction to a deferred tax asset, except when the carryforward is not available as of the reporting

date under the governing tax law to settle taxes or the entity does not intend to use the deferred tax asset for this purpose. This amendment does

not impact the recognition or measurement of uncertain tax positions or the disclosure reconciliation of gross unrecognized tax benefits. The

update is effective for public companies beginning after December 15, 2013. The Company adopted this update in the first quarter of 2014 and

this accounting update did not have an impact on the Company's consolidated balance sheet.

In February 2013, the FASB issued accounting guidance which requires entities to provide additional information about items

reclassified out of accumulated other comprehensive income ("AOCI") to net income. Changes in AOCI balances by component, both before tax

and after tax, must be disclosed and significant items reclassified out of AOCI by component must be reported either on the face of the income

statement or in a separate footnote to the financial statements. The accounting guidance is effective for public companies for fiscal years, and

interim periods within those years, beginning after December 15, 2012. See Note 14 for information on AOCI balances. There were no

reclassifications out of AOCI to net income for the years ended December 31, 2014 , 2013 and 2012 .

On January 1, 2012, the Company adopted the amended accounting guidance issued by the Financial Accounting Standards Board

("FASB") concerning the presentation of comprehensive income. The new guidance requires comprehensive income to be reported in either a

single statement or in two consecutive statements reporting net income and other comprehensive income. The Company selected to present two

consecutive statements. This amended guidance did not change the items that constitute net income or other comprehensive income, the timing

of when other comprehensive income is reclassified to net income, or the earnings per share computation.

In September 2011, the FASB issued an accounting update, which amended the guidance on testing goodwill for impairment. Under the

revised guidance, entities testing goodwill for impairment have the option of performing a qualitative assessment before calculating the fair

value of the reporting unit. If, based on the qualitative factors, it is more-likely-than not that the fair value of the reporting unit is less than its

carrying value, then the unchanged two-step approach previously used would be required. The new accounting guidance did not change how

goodwill is calculated, how goodwill is assigned to the

89