Priceline 2014 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2014 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

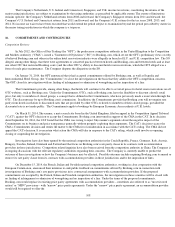

same or better rates on Booking.com as it offered to a consumer directly, but it would no longer be required to offer the same or better rates on

Booking.com as it offered to other on-line travel companies. If the commitments are accepted by the French, Italian and Swedish competition

authorities after they have been market tested, Booking.com will implement the commitments within six months of their being accepted. The

Company is currently unable to predict the outcome of the market test of the proposed commitments offered in France, Italy and Sweden or the

impact the proposed commitments in France, Italy and Sweden will have on the on-going investigations in other European countries or how its

business may be affected by the proposed commitments if accepted. The Company notes that the German competition authority has required

Hotel Reservation Service to remove its rate parity clause from its contracts with hotels, and Hotel Reservation Service's initial appeal was

denied. To the extent that regulatory authorities require changes to the Company's business practices or to those currently common to the

industry, the Company's business, competitive position and results of operations could be materially and adversely affected. Negative publicity

regarding any such investigations could adversely affect the Company's brands and therefore its market share and results of operations.

Lawsuits Alleging Antitrust Violations

On August 20, 2012, one complaint was filed on behalf of a putative class of persons who purchased hotel room reservations from

certain hotels (the "Hotel Defendants") through certain OTC defendants, including the Company. The initial complaint, Turik v. Expedia, Inc. ,

Case No. 12-cv-4365, filed in the U.S. District Court for the Northern District of California, alleged that the Hotel Defendants and the OTC

defendants violated U.S. federal and state laws by entering into a conspiracy to enforce a minimum resale price maintenance scheme pursuant to

which putative class members paid inflated prices for hotel room reservations that they purchased through the OTC defendants. Thirty-one

other

complaints containing similar allegations were filed in a number of federal jurisdictions across the country. Plaintiffs in these actions sought

treble damages and injunctive relief.

The Judicial Panel on Multidistrict Litigation ("JPML") consolidated all of the pending cases under 28 U.S.C. §1407 before Judge

Boyle in the U.S. District Court for the Northern District of Texas. On May 1, 2013, an amended consolidated complaint was filed.

On February 18, 2014, Judge Boyle dismissed the amended consolidated complaint without prejudice. On October 27, 2014 the court

denied plaintiffs' motion for leave to file a proposed Second Consolidated Amended Complaint, and on October 28, 2014 the court issued a final

judgment dismissing the case with prejudice. The time to appeal the court's October 27, 2014 decision has expired and the matter is closed.

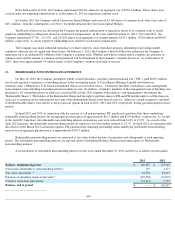

Litigation Related to Travel Transaction Taxes

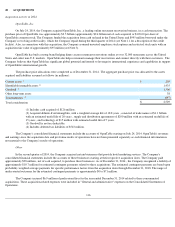

The Company and certain third-party online travel companies ("OTCs") are currently involved in approximately forty lawsuits,

including certified and putative class actions, brought by or against U.S. states, cities and counties over issues involving the payment of travel

transaction taxes (e.g., hotel occupancy taxes, excise taxes, sales taxes, etc.). The Company's subsidiaries priceline.com LLC, Lowestfare.com

LLC and Travelweb LLC are named in some but not all of these cases. Generally, the complaints allege, among other things, that the OTCs

violated each jurisdiction's respective relevant travel transaction tax ordinance with respect to the charge and remittance of amounts to cover

taxes under each law. The complaints typically seek compensatory damages, disgorgement, penalties available by law, attorneys' fees and other

relief. In addition, approximately seventy-nine municipalities or counties, and at least eleven states, have initiated audit proceedings (including

proceedings initiated by more than forty municipalities in California, which have been inactive for several years), issued proposed tax

assessments or started inquiries relating to the payment of travel transaction taxes. Additional state and local jurisdictions are likely to assert that

the Company is subject to travel transaction taxes and could seek to collect such taxes, retroactively and/or prospectively.

With respect to the principal claims in these matters, the Company believes that the laws at issue do not apply to the services it

provides, namely the facilitation of travel reservations, and, therefore, that it does not owe the taxes that are claimed to be owed. Rather, the

Company believes that the laws at issue generally impose travel transaction taxes on entities that own, operate or control hotels (or similar

businesses) or furnish or provide hotel rooms or similar accommodations or other travel services. In addition, in many of these matters, the

taxing jurisdictions have asserted claims for "conversion" - essentially, that the Company has collected a tax and wrongfully "pocketed" those

tax dollars - a claim that the Company believes is without basis and has vigorously contested. The taxing jurisdictions that are currently

involved in litigation and other proceedings with the Company, and that may be involved in future proceedings, have asserted contrary positions

and will likely continue to do so. From time to time, the Company has found it expedient to settle, and may in the future agree to settle, claims

pending in these matters without conceding that the claims at issue are meritorious or that the claimed taxes are in fact due to be paid.

109