Priceline 2014 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2014 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

their debt. Failure to reach political consensus regarding workable solutions to these issues has resulted in a high level of uncertainty regarding

the future economic outlook. This uncertainty, as well as concern over governmental austerity measures including higher taxes and reduced

government spending, could impair consumer spending and adversely affect travel demand. At times, we have experienced volatility in

transaction growth rates and weaker trends in hotel ADRs across many regions of the world, particularly in those European countries that appear

to be most affected by economic uncertainties. We believe that these business trends are likely impacted by weak economic conditions and

sovereign debt concerns. Disruptions in the economies of such countries could cause, contribute to or be indicative of deteriorating macro-

economic conditions.

Greece's newly elected government, which campaigned against austerity measures, may not be able to reach an acceptable solution to

the country's debt crisis with the European Union. This may increase the likelihood that Greece, and in turn other countries, could exit the

European Union, which could lead to added economic uncertainty and further devaluation or eventual abandonment of the Euro common

currency. These and other macro-economic uncertainties, such as sovereign default risk becoming more widespread, declining oil prices and

geopolitical tensions, have led to significant volatility in the exchange rate between the Euro, the U.S. Dollar and other currencies. The European

Central Bank, in an effort to stimulate the European economy, recently launched a quantitative easing program to purchase public debt, which in

turn has caused the Euro exchange rate to weaken compared to the U.S. Dollar.

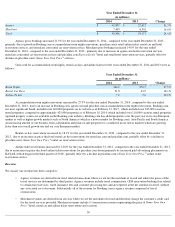

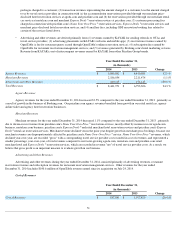

Our international business represents a substantial majority of our financial results. During the year ended December 31, 2014 , our

international business (the substantial majority of which is generated by Booking.com) represented approximately 87% of our gross bookings

(an operating and statistical metric referring to the total dollar value, generally inclusive of all taxes and fees, of all travel services purchased by

our customers), and approximately 94% of our consolidated operating income. Therefore, because we report our results in U.S. Dollars, we face

exposure to adverse movements in currency exchange rates as the financial results of our international businesses are translated from local

currency (principally the Euro and the British Pound Sterling) into U.S. Dollars. The U.S. Dollar significantly strengthened against the Euro

during 2014, moving from an exchange rate of 1.38 U.S. Dollars per Euro as of January 1, 2014 to 1.13 U.S. Dollars per Euro as of January 31,

2015. The U.S. Dollar also strengthened significantly during this time frame as compared to many other currencies. As a result, our foreign

currency denominated net assets, gross bookings, gross profit, operating expenses and net income have been negatively impacted as expressed in

U.S. Dollars.

For example, gross profit from our international operations grew year-over-year on a local currency basis by approximately 32%

for the

three months ended December 31, 2014 , but, as a result of the impact of changes in currency exchange rates, grew 24% as reported in U.S.

Dollars. The U.S. Dollar significantly strengthened against the Euro during 2014, moving from an exchange rate of 1.38 U.S. Dollars per Euro as

of January 1, 2014 to 1.21 U.S. Dollars per Euro as of December 31, 2014. The U.S. Dollar strengthened further in January 2015 to an exchange

rate of 1.13 U.S. Dollars per Euro as of January 31, 2015. The U.S. Dollar has also strengthened against many other currencies since January 1,

2014. At these exchange rates, the growth of our total and international gross bookings, expressed in U.S. Dollars, will be significantly adversely

impacted in 2015. We generally enter into derivative instruments to minimize the impact of short-term currency fluctuations on our consolidated

operating results. However, such derivative instruments are short-term in nature and not designed to hedge against currency fluctuations that

could impact our gross bookings, revenues or gross profit (see Note 5 to the Consolidated Financial Statements for additional information on our

derivative contracts).

Significant fluctuations in currency exchange rates can also impact consumer travel behavior. For example, recent dramatic

depreciation of the Russian Ruble has resulted in it becoming more expensive for Russians to travel to Europe and most other non-Ruble

destinations. Consumers traveling from a country whose currency has weakened against other currencies may book lower ADR

accommodations, choose to shorten or cancel their international travel plans or choose to travel domestically rather than internationally, any of

which could adversely affect our gross bookings, revenues and results of operations, in particular when expressed in U.S. Dollars.

The uncertainty of macro-economic factors, the volatility in foreign exchange rates and their impact on consumer behavior, which may

differ across regions, makes it more difficult to forecast industry and consumer trends and the timing and degree of their impact on our markets

and business, which in turn could adversely affect our ability to effectively manage our business and adversely affect our results of operations.

We compete with both online and traditional travel and travel related reservation and search services. The market for the travel

reservation and search services we offer is intensely competitive, a trend we expect to continue, and current and new competitors can launch new

services at a relatively low cost. We currently, or potentially may in the future, compete with a variety of companies, including:

42

• online travel reservation services such as those owned by Expedia, Orbitz (which has agreed to be acquired by Expedia), Ctrip,

Rakuten, eDreams ODIGEO and Jalan;