Priceline 2014 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2014 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

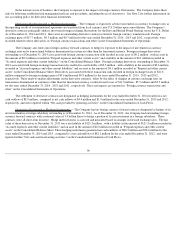

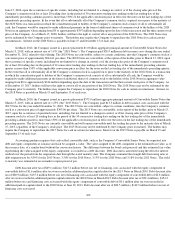

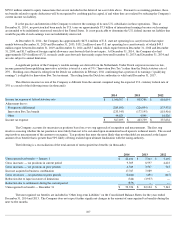

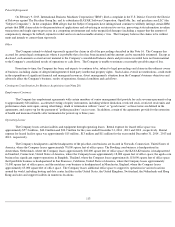

The income tax expense (benefit) for the year ended December 31, 2012 is as follows (in thousands):

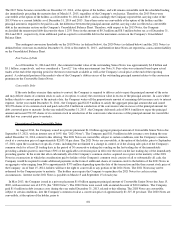

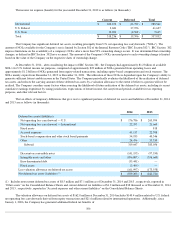

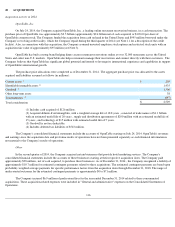

The Company has significant deferred tax assets, resulting principally from U.S. net operating loss carryforwards ("NOLs"). The

amount of NOLs available for the Company's use is limited by Section 382 of the Internal Revenue Code ("IRC Section 382 "). IRC Section

382

imposes limitations on the availability of a company's NOLs after a more than 50% ownership change occurs. It was determined that ownership

changes, as defined in IRC Section 382 have occurred. The amount of the Company's NOLs incurred prior to each ownership change is limited

based on the value of the Company on the respective dates of ownership change.

At December 31, 2014 , after considering the impact of IRC Section 382 , the Company had approximately $1.2 billion of available

NOL's for U.S. federal income tax purposes, comprised of approximately

$22 million of NOLs generated from operating losses and

approximately $1.2 billion of NOLs generated from equity-related transactions, including equity-based compensation and stock warrants. The

NOLs mainly expire from December 31, 2019 to December 31, 2021. The utilization of these NOLs is dependent upon the Company's ability to

generate sufficient future taxable income in the United States. The Company periodically evaluates the likelihood of the realization of deferred

tax assets, and reduces the carrying amount of these deferred tax assets by a valuation allowance to the extent it believes a portion will not be

realized. The Company considers many factors when assessing the likelihood of future realization of the deferred tax assets, including its recent

cumulative earnings experience by taxing jurisdiction, expectations of future income, the carryforward periods available for tax reporting

purposes, and other relevant factors.

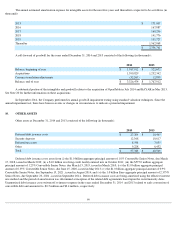

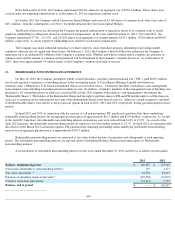

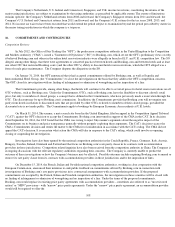

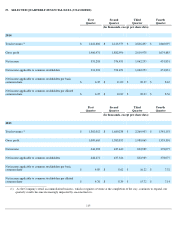

The tax effects of temporary differences that give rise to significant portions of deferred tax assets and liabilities at December 31, 2014

and 2013 are as follows (in thousands):

(1) Includes non-current deferred tax assets of $8.5 million and $7.1 million as of December 31, 2014 and 2013 , respectively, reported in

"Other assets" on the Consolidated Balance Sheets and current deferred tax liabilities of $1.2 million and $38 thousand as of December 31, 2014

and 2013 , respectively, reported in "Accrued expenses and other current liabilities" on the Consolidated Balance Sheets.

The valuation allowance on deferred tax assets of $162.0 million at December 31, 2014 includes $140.4 million related to U.S. federal

net operating loss carryforwards derived from equity transactions and $21.6 million related to international operations. Additionally, since

January 1, 2006, the Company has generated additional federal tax benefits of

106

Current

Deferred

Total

International

$

302,352

$

(13,792

)

$

288,560

U.S. Federal

3,681

37,956

41,637

U.S. State

12,203

(4,568

)

7,635

Total

$

318,236

$

19,596

$

337,832

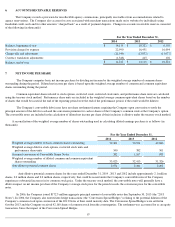

2014

2013

Deferred tax assets/(liabilities):

Net operating loss carryforward — U.S.

$

176,786

$

263,994

Net operating loss carryforward — International

22,353

21,660

Fixed assets

—

818

Accrued expenses

41,117

22,708

Stock-based compensation and other stock based payments

54,935

40,346

Other

24,456

33,530

Subtotal

319,647

383,056

Discount on convertible notes

(141,193

)

(97,550

)

Intangible assets and other

(856,807

)

(356,669

)

Euro denominated debt

(35,441

)

—

Fixed assets

(3,409

)

—

Less valuation allowance on deferred tax assets

(161,997

)

(173,558

)

Net deferred tax assets (liabilities)

(1)

$

(879,200

)

$

(244,721

)