Priceline 2014 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2014 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

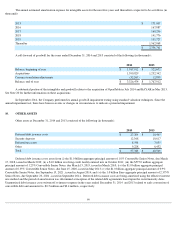

reporting unit, or the requirements for testing goodwill annually or when events and circumstances warrant testing. The accounting update was

effective for annual and interim periods beginning after December 15, 2011, with early adoption permitted. In September 2014, the Company

performed its annual quantitative goodwill impairment testing and concluded that there was no impairment of goodwill.

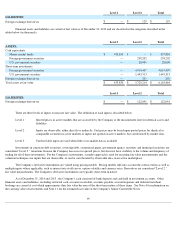

In May 2010, the FASB issued amended guidance on fair value to largely achieve common fair value measurement and disclosure

requirements between U.S. GAAP and IFRS. The new accounting guidance did not extend the use of fair value but rather provided guidance

about how fair value should be determined. For U.S. GAAP, most of the changes were clarifications of existing guidance or wording changes to

align with IFRS. The amended guidance expanded disclosure, particularly that relating to fair value measurements based on unobservable inputs,

permitted fair value measurements for financial assets and liabilities on a net position if market or credit risks are managed on a net basis and

other criteria are met, and allowed premiums and discounts only if a market participant would also include them in the fair value measurement.

This accounting update was effective for public companies for interim or annual periods beginning after December 15, 2011, with early adoption

permitted. The adoption of this accounting guidance, effective with the three months ended March 31, 2012, did not impact the Company's

consolidated financial statements or disclosure.

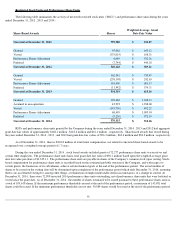

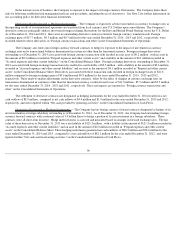

The Company's 1999 Omnibus Plan, as amended and restated effective June 6, 2013, (the "1999 Plan") is the primary stock

compensation plan from which broad-based employee equity awards may be made. As of December 31, 2014 , there were 2,650,485 shares of

common stock available for future grant under the 1999 Plan. In addition, in connection with the acquisition of KAYAK in May 2013, Buuteeq,

Inc. in June 2014 and OpenTable in July 2014, the Company assumed the KAYAK Software Corporation 2012 Equity Incentive Plan (the

"KAYAK Plan"), the Buuteeq, Inc. Amended and Restated 2010 Stock Plan (the "Buuteeq Plan") and the OpenTable, Inc. 2009 Equity Incentive

Award Plan (the "OpenTable Plan"). As of December 31, 2014 , there were 14,351 , 191 and 238,804 shares of common stock available for

future grant under the KAYAK Plan, Buuteeq Plan and OpenTable Plan, respectively.

Stock-

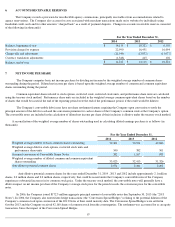

based compensation issued under the plans generally consists of restricted stock units, performance share units and stock options.

The cost of share-based transactions is recognized in the financial statements based upon fair value. Fair value is recognized as expense on a

straight line basis, net of estimated forfeitures, over the employee's requisite service period. The fair value of restricted stock units and

performance share units is determined based on the number of shares or units, as applicable, granted and the quoted price of the Company's

common stock as of the grant date. Stock-based compensation related to performance share units reflects the estimated probable outcome at the

end of the performance period. The fair value of the employee stock options assumed in acquisitions was determined using the Black-Scholes

model and the market value of the Company's common stock at the respective merger date. Stock options granted to employees have a term of

10 years. Restricted stock units, performance share units and restricted stock generally vest over periods from 1 to 4 years. The Company

issues new shares of common stock upon the issuance of restricted stock, the exercise of stock options and the vesting of restricted stock units

and performance share units.

Stock-based compensation included in personnel expenses in the Consolidated Statements of Operations was approximately $186.4

million , $140.5 million and $71.6 million for the years ended December 31, 2014 , 2013 and 2012 , respectively. Stock-

based compensation for

the years ended December 31, 2014 , 2013 and 2012 includes charges amounting to $20.6 million , $24.1 million and $0.9 million , respectively,

representing the impact of adjusting the estimated probable outcome at the end of the performance period for outstanding unvested performance

share units. Included in the stock-based compensation are approximately $2.3 million , $2.1 million , and $1.8 million for the years ended

December 31, 2014 , 2013 , and 2012 , respectively, for grants to non-employee directors. The related tax benefit for stock-based compensation

is $38.4 million , $18.5 million and $7.6 million for the years ended December 31, 2014 , 2013 and 2012 , respectively.

90

3.

STOCK-

BASED COMPENSATION