Priceline 2014 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2014 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

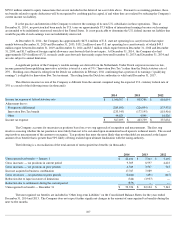

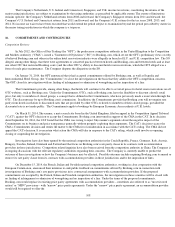

20 . ACQUISITIONS

Acquisition activity in 2014

OpenTable, Inc.

On July 24, 2014, the Company acquired OpenTable, Inc., a leading online restaurant reservation business, in a cash transaction. The

purchase price of OpenTable was approximately $2.5 billion (approximately $2.4 billion net of cash acquired) or $103.00 per share of

OpenTable common stock. The Company funded the acquisition from cash on hand in the United States and $995 million borrowed under the

Company's revolving credit facility, which the Company repaid during the third quarter of 2014 (see Note 11 for a description of the credit

facility). Also, in connection with this acquisition, the Company assumed unvested employee stock options and restricted stock units with an

acquisition fair value of approximately $95 million (see Note 3).

OpenTable has built a strong brand helping diners secure restaurant reservations online at over 32,000 restaurants across the United

States and select non-U.S. markets. OpenTable also helps restaurants manage their reservations and connect directly with their customers. The

Company believes that OpenTable has significant global potential and intends to leverage its international experience and capabilities in support

of OpenTable's international growth.

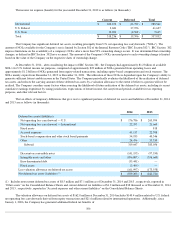

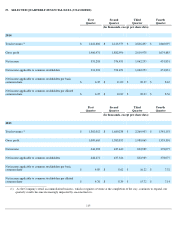

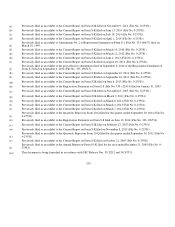

The purchase price allocations were completed as of December 31, 2014 . The aggregate purchase price was allocated to the assets

acquired and liabilities assumed as follows (in millions):

(1) Includes cash acquired of $126 million .

(2) Acquired definite-lived intangibles, with a weighted average life of 18.8 years , consisted of trade names of $1.1 billion

with an estimated useful life of 20 years , supply and distribution agreements of $290 million with an estimated useful life of

15 years , and technology of $15 million with estimated useful life of 5 years .

(3) Goodwill is not tax deductible.

(4) Includes deferred tax liabilities of $543 million .

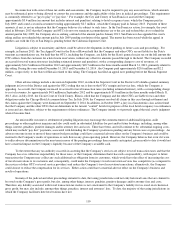

The Company's consolidated financial statements include the accounts of OpenTable starting on July 24, 2014. OpenTable's revenues

and earnings since the acquisition date and pro forma results of operations have not been presented separately as such financial information is

not material to the Company's results of operations.

Other

In the second quarter of 2014, the Company acquired certain businesses that provide hotel marketing services. The Company's

consolidated financial statements include the accounts of these businesses starting at their respective acquisition dates. The Company paid

approximately $98 million , net of cash acquired, to purchase these businesses. As of December 31, 2014

, the Company recognized a liability of

approximately $10.7 million for estimated contingent payments related to these acquisitions. The estimated contingent payments are based upon

probability weighted average payments for specific performance factors from the acquisition dates through December 31, 2018. The range of

undiscounted outcomes for the estimated contingent payments is approximately $0 to $71 million .

The Company incurred $6.9 million of professional fees for the year ended December 31, 2014 related to these consummated

acquisitions. These acquisition-related expenses were included in "General and administrative" expenses on the Consolidated Statements of

Operations.

116

Current assets

(1)

$

203

Identifiable intangible assets

(2)

1,435

Goodwill

(3)

1,500

Other long-term assets

38

Total liabilities

(4)

(647

)

Total consideration

$

2,529