Priceline 2014 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2014 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

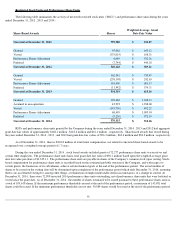

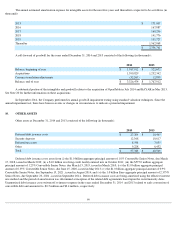

The aggregate intrinsic value of exercised employee stock options assumed in acquisitions during the years ended December 31, 2014

and 2013 was $39.9 million and $236.9 million , respectively.

For the year ended December 31, 2014 , employee stock options assumed in acquisitions had a total acquisition date fair value of $45.5

million based on a weighted average acquisition date fair value of $734.76 per share. During the year ended December 31, 2014 and 2013 ,

assumed unvested employee stock options vested for 41,524 and 65,293 shares with a fair value of $24.2 million and $30.9 million ,

respectively.

For the year ended December 31, 2014 and 2013 , the Company recorded stock-based compensation expense of $24.7 million and

$30.9

million , respectively related to unvested assumed employee stock options. As of December 31, 2014 , there was $36.2 million of total future

compensation costs related to unvested assumed employee stock options to be recognized over a weighted-average period of 1.6 years .

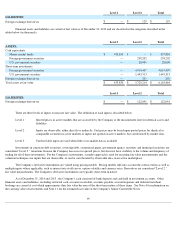

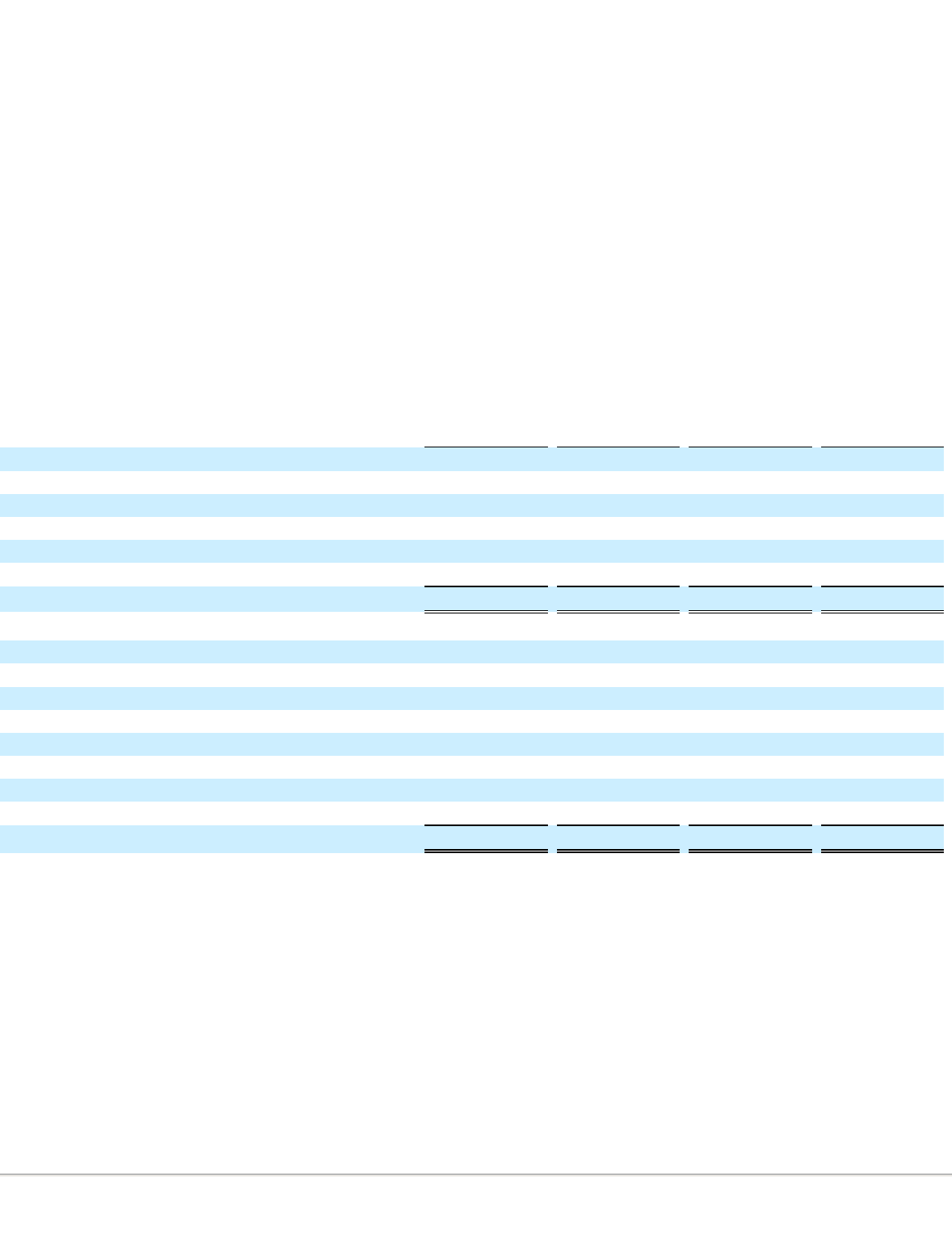

The following table summarizes, by major security type, the Company's investments as of December 31, 2014 (in thousands):

As of December 31, 2014 , foreign government securities included investments in debt securities issued by the governments of the

United Kingdom and the Netherlands.

In August 2014, the Company used its non-U.S. cash to invest in a five -

year Senior Convertible Note issued by Ctrip.com International

Ltd. ("Ctrip"). The note was issued at par in an aggregate principal amount of $500 million . Additionally, during the year ended December 31,

2014 , the Company invested $421.9 million of its non-U.S. cash in Ctrip American Depositary Shares ("ADSs"). The convertible debt and

equity securities of Ctrip have been marked to market in accordance with the accounting guidance for available-for-sale securities and at

December 31, 2014 show a $74.0 million and $86.6 million

unrealized loss, respectively, as a result of decreases in Ctrip's publicly traded shares

since the convertible debt and equity purchases were made. In connection with the purchase of the convertible note, Ctrip granted the Company

the right to appoint an observer to Ctrip's board of directors and permission to acquire Ctrip shares (including through the acquisition of Ctrip

ADSs in the open market) over the twelve months following the purchase date, so that combined with ADSs issuable upon conversion of the

note, the Company may hold up to 10% of Ctrip's outstanding equity.

93

4.

INVESTMENTS

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Fair Value

Available for sale securities:

Short-term investments:

Foreign government securities

$

52,524

$

—

$

(

34

)

$

52,490

U.S. government securities

364,276

24

(34

)

364,266

U.S. commercial paper

621,252

15

(652

)

620,615

U.S. government agency securities

104,829

—

(

18

)

104,811

Total short-term investments

$

1,142,881

$

39

$

(738

)

$

1,142,182

Long-term investments:

Foreign government securities

$

12,707

$

—

$

(

36

)

$

12,671

U.S. government securities

557,130

80

(762

)

556,448

U.S. corporate debt securities

2,332,030

2,299

(5,296

)

2,329,033

U.S. government agency securities

95,108

97

(111

)

95,094

U.S. municipal securities

1,114

—

(

12

)

1,102

Ctrip corporate debt securities

500,000

—

(

74,039

)

425,961

Ctrip equity securities

421,930

—

(

86,586

)

335,344

Total long-term investments

$

3,920,019

$

2,476

$

(166,842

)

$

3,755,653