Priceline 2014 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2014 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

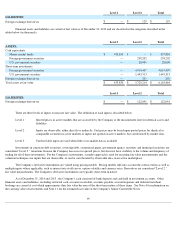

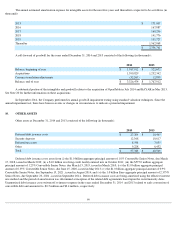

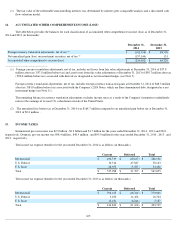

The 2015 Notes became convertible on December 15, 2014, at the option of the holders, and will remain convertible until the scheduled trading

day immediately preceding the maturity date of March 15, 2015, regardless of the Company's stock price. Therefore, the 2015 Notes were

convertible at the option of the holders as of December 31, 2014 and 2013 , and accordingly the Company reported the carrying value of the

2015 Notes as a current liability as of December 31, 2014 and 2013 . Since these notes are convertible at the option of the holders and the

principal amount is required to be paid in cash, the difference between the principal amount and the carrying value is reflected as convertible

debt in the mezzanine section on the Company's Consolidated Balance Sheet. Therefore, with respect to the 2015 Notes, the Company

reclassified the unamortized debt discount for these 1.25% Notes in the amount of $0.3 million and $8.5 million before tax as of December 31,

2014 and 2013 , respectively, from additional paid-in-capital to convertible debt in the mezzanine section on the Company's Consolidated

Balance Sheet.

The contingent conversion thresholds on the 2018 Notes (as defined below), the 2020 Notes (as defined below) and the 2021 Notes (as

defined below) were not exceeded at December 31, 2014 or December 31, 2013 , and therefore these Notes are reported as a non-

current liability

on the Consolidated Balance Sheet.

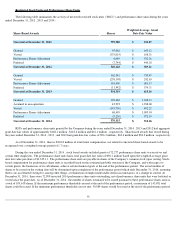

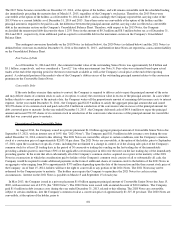

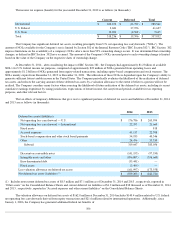

Fair Value of Debt

As of December 31, 2014 and 2013 , the estimated market value of the outstanding Senior Notes was approximately $4.8 billion and

$3.1 billion , respectively, and was considered a "Level 2 " fair value measurement (see Note 5). Fair value was estimated based upon actual

trades at the end of the reporting period or the most recent trade available as well as the Company's stock price at the end of the reporting

period. A substantial portion of the market value of the Company's debt in excess of the outstanding principal amount relates to the conversion

premium on the Convertible Senior Notes.

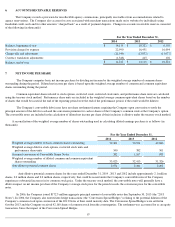

Convertible Debt

If the note holders exercise their option to convert, the Company is required to deliver cash to repay the principal amount of the notes

and may deliver shares of common stock or cash, at its option, to satisfy the conversion value in excess of the principal amount. In cases where

holders decide to convert prior to the maturity date, the Company writes off the proportionate amount of remaining debt issuance costs to interest

expense. In the year ended December 31, 2014 , the Company paid $122.9 million to satisfy the aggregate principal amount due and issued

300,256 shares of its common stock and paid cash of $2.2 million in satisfaction of the conversion value in excess of the principal amount for

debt converted prior to maturity. In the year ended December 31, 2013 , the Company delivered cash of $414.6 million to repay the principal

amount and issued 972,235 shares of its common stock in satisfaction of the conversion value in excess of the principal amount for convertible

debt that was converted prior to maturity.

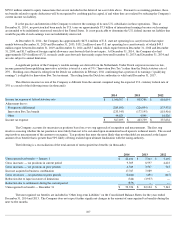

Description of Senior Convertible Notes

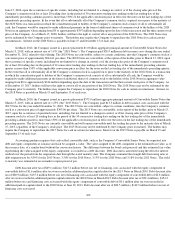

In August 2014, the Company issued in a private placement $1.0 billion aggregate principal amount of Convertible Senior Notes due

September 15, 2021, with an interest rate of 0.9% (the "2021 Notes"). The Company paid $11.0 million in debt issuance costs during the year

ended December 31, 2014, related to this offering. The 2021 Notes are convertible, subject to certain conditions, into the Company's common

stock at a conversion price of approximately $2,055.50 per share. The 2021 Notes are convertible, at the option of the holder, prior to September

15, 2021, upon the occurrence of specific events, including but not limited to a change in control, or if the closing sales price of the Company's

common stock for at least 20 trading days in the period of 30 consecutive trading days ending on the last trading day of the immediately

preceding calendar quarter is more than 150%

of the applicable conversion price in effect for the notes on the last trading day of the immediately

preceding quarter. In the event that all or substantially all of the Company's common stock is acquired on or prior to the maturity of the 2021

Notes in a transaction in which the consideration paid to holders of the Company's common stock consists of all or substantially all cash, the

Company would be required to make additional payments in the form of additional shares of common stock to the holders of the 2021 Notes in

an aggregate value ranging from $0 to approximately $375 million depending upon the date of the transaction and the then current stock price of

the Company. As of June 15, 2021, holders will have the right to convert all or any portion of the 2021 Notes. The 2021 Notes may not be

redeemed by the Company prior to maturity. The holders may require the Company to repurchase the 2021 Notes for cash in certain

circumstances. Interest on the 2021 Notes is payable on March 15 and September 15 of each year.

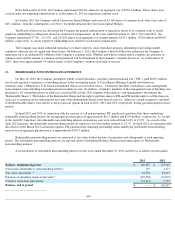

In May 2013, the Company issued in a private placement $1.0 billion aggregate principal amount of Convertible Senior Notes due June 15,

2020, with an interest rate of 0.35% (the "2020 Notes"). The 2020 Notes were issued with an initial discount of $20.0 million . The Company

paid $1.0 million in debt issuance costs during the year ended December 31, 2013, related to this offering. The 2020 Notes are convertible,

subject to certain conditions, into the Company's common stock at a conversion price of approximately $1,315.10 per share. The 2020 Notes are

convertible, at the option of the holder, prior to

101