Priceline 2014 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2014 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

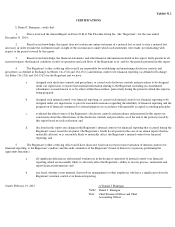

Any Agreement may provide for an Award to be subject to any clawback policy of the Company that may be in

effect from time to time or is required under any applicable law or rules and regulations of the national securities

exchange or national securities association on which shares of Stock may be traded.

Any notice, demand, request or other communication hereunder to any party shall be deemed to be sufficient if

contained in a written instrument delivered in person or duly sent by first class registered, certified or overnight mail,

postage prepaid, or telecopied with a confirmation copy by regular, certified or overnight mail, addressed or telecopied,

as the case may be, (a) if to the recipient of an Award, at his or her residence address last filed with the Company and (b)

if to the Company, at its principal place of business, addressed to the attention of its Treasurer, or to such other address

or telecopier number, as the case may be, as the addressee may have designated by notice to the addressor. All such

notices, requests, demands and other communications shall be deemed to have been received: (i) in the case of personal

delivery, on the date of such delivery; (ii) in the case of mailing, when received by the addressee; and (iii) in the case of

facsimile transmission, when confirmed by facsimile machine report.

Nothing contained in the Plan shall require the issuance or delivery of certificates for any period during which

the Company has elected to maintain or caused to be maintained the evidence of ownership of its shares of Stock, either

generally or in the case of Stock acquired pursuant to Awards, by book entry, and all references herein to such actions or

to certificates shall be interpreted accordingly in light of the systems maintained for that purpose. Furthermore, any

reference herein to actions to be taken or notices (including of grants of Awards) to be provided in writing or pursuant to

specific procedures may be satisfied by means of and pursuant to any electronic or automated voice response systems the

Company may elect to establish for such purposes, either by itself or through the services of a third party, for the period

such systems are in effect.

It is intended that all Awards shall be granted and maintained on a basis which ensures they are exempt from, or

otherwise compliant with, the requirements of Section 409A of the Code and the Plan shall be governed, interpreted and

enforced consistent with such intent. Neither the Committee nor the Company, nor any of its Affiliates or its or their

officers, employees, agents, or representatives, shall have any liability or responsibility for any adverse federal, state or

local tax consequences and penalty taxes which may result in the grant or settlement of any Award on a basis contrary to

the provisions of Section 409A of the Code or comparable provisions of any applicable state or local income tax laws.

The Plan and all Agreements and actions taken thereunder otherwise shall be governed, interpreted and enforced in

accordance with the laws of the State of Delaware, without regard to the conflict of laws principles thereof.

-27-

17.

Clawback Policy

18.

Notices and Other Communications

19.

Administrative Provisions

20.

Governing Law