Priceline 2014 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2014 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

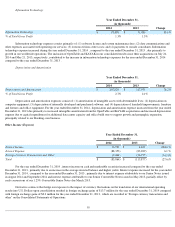

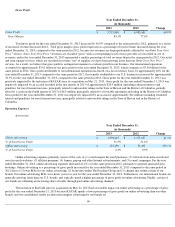

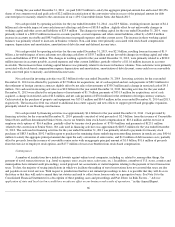

Liquidity and Capital Resources

As of December 31, 2014 , we had $8.0 billion in cash, cash equivalents, short-term investments and long-term investments.

Approximately $6.9 billion is held by our international subsidiaries and is denominated primarily in U.S. Dollars, Euros and, to a lesser extent,

British Pounds Sterling and other currencies. We currently intend to indefinitely reinvest these funds outside of the United States. If we repatriate

cash to the United States, we would utilize our net operating loss carryforwards and beyond that amount incur additional tax payments in the

United States. Cash equivalents, short-term investments, and long-

term investments are comprised of U.S. and foreign corporate bonds, U.S. and

foreign government securities, high grade commercial paper, foreign equity securities, U.S. government agency securities, U.S. municipal

securities and bank deposits.

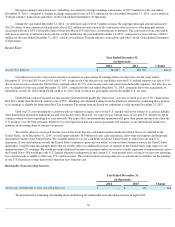

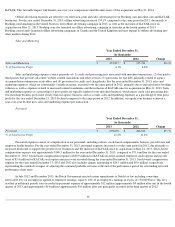

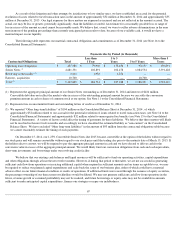

In October 2011, we entered into a $1.0 billion five-year unsecured revolving credit facility with a group of lenders. Borrowings under

the revolving credit facility will bear interest, at our option, at a rate per annum equal to either (i) the adjusted LIBOR for the interest period in

effect for such borrowing plus an applicable margin ranging from 1.00% to 1.50%; or (ii) the greatest of (a) JPMorgan Chase Bank, National

Association's prime lending rate, (b) the federal funds rate plus 0.50%, and (c) an adjusted LIBOR for an interest period of one month plus

1.00%, plus an applicable margin ranging from 0.00% to 0.50%. Undrawn balances available under the revolving credit facility are subject to

commitment fees at the applicable rate ranging from 0.10% to 0.25%. The revolving credit facility provides for the issuance of up to $100.0

million of letters of credit as well as borrowings of up to $50.0 million on same-day notice, referred to as swingline loans. Borrowings under the

revolving credit facility may be made in U.S. Dollars, Euros, British Pounds Sterling and any other foreign currency agreed to by the lenders.

The proceeds of loans made under the facility will be used for working capital and general corporate purposes. As of December 31, 2014 , there

were no borrowings under the facility, and approximately $4.0 million of letters of credit issued under the facility.

On July 24, 2014, we acquired OpenTable, Inc., a leading provider of online restaurant reservations, in a cash transaction for a purchase

price of approximately $2.5 billion (approximately $2.4 billion net of cash acquired) or $103.00 per share of OpenTable common stock. We

funded the acquisition from cash on hand in the United States and $995 million borrowed under our revolving credit facility, which was repaid

during the third quarter of 2014.

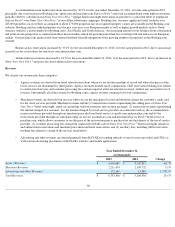

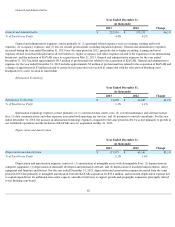

In August 2014, we issued in a private placement $1.0 billion aggregate principal amount of Convertible Senior Notes due 2021, with

an interest rate of 0.9%. Interest on the notes is payable on March 15 and September 15 of each year. We used approximately $147.3 million of

the net proceeds to concurrently repurchase outstanding shares of our common stock. We intend to use the remaining net proceeds for general

corporate purposes, which may include repurchases of our common stock from time to time, repaying outstanding debt and corporate

acquisitions. See Note 11 to the Consolidated Financial Statements for further details on these notes.

In August 2014, we used $500 million of our non-U.S. cash to invest in a five-year senior convertible note issued by Ctrip.com

International Ltd. ("Ctrip"). Additionally, during the year ended December 31, 2014 , we invested $421.9 million of our non-U.S. cash in Ctrip

American Depositary Shares. See Note 4 to the Consolidated Financial Statements for further details on these investments.

In September 2014, we issued 1.0 billion Euro aggregate principal amount of Senior Notes due 2024, with an interest rate of 2.375%.

Interest on the notes is payable annually on September 23, beginning September 23, 2015. We intend to use the net proceeds for general

corporate purposes, which may include repurchases of our common stock from time to time, repaying outstanding debt and corporate

acquisitions. See Note 11 to the Consolidated Financial Statements for further details on these notes.

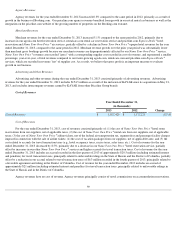

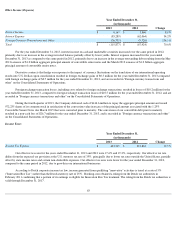

In the third and fourth quarters of 2014, we repurchased 114,645 shares of our common stock in privately negotiated, off-market

transactions and 438,897 shares of our common stock in the open market for aggregate costs of $147.3 million and $500.0 million , respectively.

As of December 31, 2014 , we had a remaining aggregate amount of $7.2 million authorized by our Board of Directors to purchase our common

stock. On February 5, 2015, our Board of Directors authorized us to repurchase up to an additional $3.0 billion of our common stock. We may

from time to time make additional repurchases of our common stock, depending on prevailing market conditions, alternate uses of capital, and

other factors.

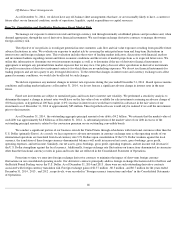

Our merchant transactions are structured such that we collect cash up front from our customers and then we pay most of our travel

service providers at a subsequent date. We therefore tend to experience significant seasonal swings in deferred merchant bookings and travel

service provider payables depending on the absolute level of our merchant transactions during the last few weeks of every quarter.

65