Pottery Barn 2008 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2008 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Note M: Related Party Transaction

On May 16, 2008, we completed two transactions relating to our corporate aircraft. First, we sold our Bombardier

Global Express airplane for approximately $46,787,000 in cash (a net after-tax cash benefit of approximately

$29,000,000) to an unrelated third party. This resulted in a gain on sale of asset of approximately $16,000,000 in

the second quarter of fiscal 2008. Second, we entered into an Aircraft Lease Agreement (the “Lease Agreement”)

with a limited liability company (the “LLC”) owned by W. Howard Lester, our Chief Executive Officer and

Chairman of the Board of Directors, for use of a Bombardier Global 5000 owned by the LLC. These transactions

were approved by our Board of Directors.

Under the terms of the Lease Agreement, in exchange for use of the aircraft, we will pay the LLC $375,000 for

each of the thirty-six months of the lease term through May 15, 2011. We are also responsible for all use-related

costs associated with the aircraft, including fixed costs such as crew salaries and benefits, insurance and hangar

costs, and all direct operating costs. Closing costs associated with the Lease Agreement were divided evenly

between us and the LLC, and each party paid its own attorney and advisor fees. The Lease Agreement is subject

to early termination by either party, with 90 days prior written notice, if Mr. Lester retires or otherwise

withdraws from active management of the company. During fiscal 2008, we paid a total of $3,185,000 to the

LLC and as of February 1, 2009, $375,000, equal to one month’s rent, was owed to the LLC, all of which was

paid subsequent to year-end.

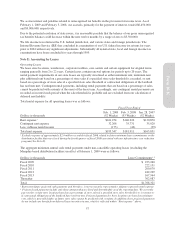

Note N: Infrastructure Cost Reduction Program

On January 21, 2009, we announced a series of actions completed during the fourth quarter of fiscal 2008 to

reduce our fiscal 2009 fixed and semi-fixed overhead costs by approximately $75,000,000. These actions

included an approximate 18% reduction in company-wide full time headcount (approximately 1,400 positions),

the closure of our Camp Hill, Pennsylvania care center and the closure of a 500,000 square foot distribution

facility in Memphis, Tennessee. In connection with this cost reduction program, we incurred approximately

$12,734,000 in severance and lease termination related expenses in the fourth quarter of fiscal 2008.

Approximately $2,390,000 of these expenses are recorded within cost of goods sold and $10,344,000 is recorded

within selling, general and administrative expenses.

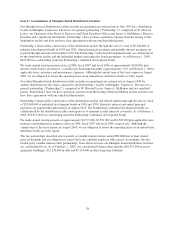

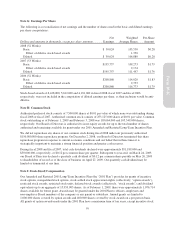

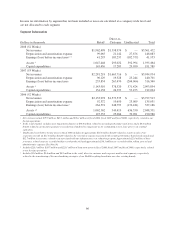

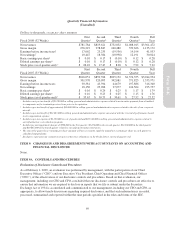

Note O: Segment Reporting

We have two reportable segments, retail and direct-to-customer. The retail segment has five merchandising

concepts which sell products for the home (Williams-Sonoma, Pottery Barn, Pottery Barn Kids, West Elm and

Williams-Sonoma Home). The five retail merchandising concepts are operating segments, which have been

aggregated into one reportable segment, retail. The direct-to-customer segment has six merchandising concepts

(Williams-Sonoma, Pottery Barn, Pottery Barn Kids, PBteen, West Elm and Williams-Sonoma Home) and sells

similar products through our seven direct mail catalogs (Williams-Sonoma, Pottery Barn, Pottery Barn Kids,

Pottery Barn Bed and Bath, PBteen, West Elm and Williams-Sonoma Home) and six e-commerce websites

(williams-sonoma.com, potterybarn.com, potterybarnkids.com, pbteen.com, westelm.com and wshome.com).

Management’s expectation is that the overall economics of each of our major concepts within each reportable

segment will be similar over time.

These reportable segments are strategic business units that offer similar home-centered products. They are

managed separately because the business units utilize two distinct distribution and marketing strategies. Our

operating segments are aggregated at the channel level for reporting purposes due to the fact that our brands are

interdependent for economies of scale and we do not maintain fully allocated income statements at the brand

level. As a result, material financial decisions related to the brands are made at the channel level. Furthermore, it

is not practicable for us to report revenue by product group.

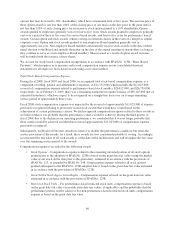

We use earnings before unallocated corporate overhead, interest and taxes to evaluate segment profitability.

Unallocated costs before income taxes include corporate employee-related costs, occupancy expenses (including

depreciation expense), third-party service costs and administrative costs, primarily in our corporate systems,

corporate facilities and other administrative departments. Unallocated assets include the net book value of

corporate facilities and related information systems, deferred income taxes, other corporate long-lived assets and

corporate cash and cash equivalents.

65

Form 10-K