Pottery Barn 2008 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2008 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

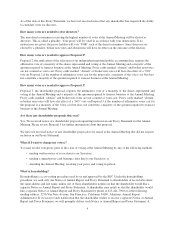

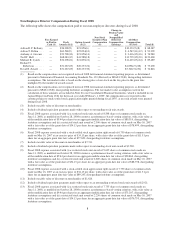

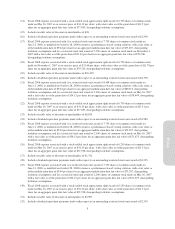

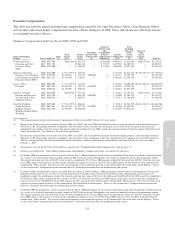

(14) Fiscal 2008 expense associated with a stock-settled stock appreciation right award of 6,750 shares of common stock

made on May 16, 2007 at an exercise price of $34.13 per share, with a fair value as of the grant date of $11.51 per

share for an aggregate grant date fair value of $77,693, disregarding forfeiture assumptions.

(15) Includes taxable value of discount on merchandise of $26.

(16) Includes dividend equivalent payments made with respect to an outstanding restricted stock unit award of $2,390.

(17) Fiscal 2008 expense associated with (i) a restricted stock unit award of 7,755 shares of common stock made on

June 11, 2008, as modified on October 28, 2008 to remove a performance-based vesting criterion, with a fair value as

of the modification date of $9.44 per share for an aggregate modification date fair value of $73,207, disregarding

forfeiture assumptions and (ii) a restricted stock unit award of 2,250 shares of common stock made on November 1,

2007 with a fair value as of the grant date of $31.44 per share for an aggregate grant date fair value of $70,740,

disregarding forfeiture assumptions.

(18) Fiscal 2008 expense associated with a stock-settled stock appreciation right award of 6,750 shares of common stock

made on November 1, 2007 at an exercise price of $31.44 per share, with a fair value as of the grant date of $11.78 per

share for an aggregate grant date fair value of $79,515, disregarding forfeiture assumptions.

(19) Includes taxable value of discount on merchandise of $10,339.

(20) Includes dividend equivalent payments made with respect to an outstanding restricted stock unit award of $2,390.

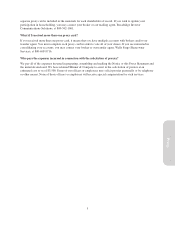

(21) Fiscal 2008 expense associated with (i) a restricted stock unit award of 8,508 shares of common stock made on

June 11, 2008, as modified on October 28, 2008 to remove a performance-based vesting criterion, with a fair value as

of the modification date of $9.44 per share for an aggregate modification date fair value of $80,316, disregarding

forfeiture assumptions and (ii) a restricted stock unit award of 2,300 shares of common stock made on May 16, 2007

with a fair value as of the grant date of $34.13 per share for an aggregate grant date fair value of $78,499, disregarding

forfeiture assumptions.

(22) Fiscal 2008 expense associated with a stock-settled stock appreciation right award of 6,750 shares of common stock

made on May 16, 2007 at an exercise price of $34.13 per share, with a fair value as of the grant date of $11.51 per

share for an aggregate grant date fair value of $77,693, disregarding forfeiture assumptions.

(23) Includes taxable value of discount on merchandise of $8,843.

(24) Includes dividend equivalent payments made with respect to an outstanding restricted stock unit award of $2,582.

(25) Fiscal 2008 expense associated with (i) a restricted stock unit award of 7,755 shares of common stock made on

June 11, 2008, as modified on October 28, 2008 to remove a performance-based vesting criterion, with a fair value as

of the modification date of $9.44 per share for an aggregate modification date fair value of $73,207, disregarding

forfeiture assumptions and (ii) a restricted stock unit award of 2,100 shares of common stock made on May 16, 2007

with a fair value as of the grant date of $34.13 per share for an aggregate grant date fair value of $71,673, disregarding

forfeiture assumptions.

(26) Fiscal 2008 expense associated with a stock-settled stock appreciation right award of 6,250 shares of common stock

made on May 16, 2007 at an exercise price of $34.13 per share, with a fair value as of the grant date of $11.51 per

share for an aggregate grant date fair value of $71,938, disregarding forfeiture assumptions.

(27) Includes taxable value of discount on merchandise of $1,741.

(28) Includes dividend equivalent payments made with respect to an outstanding restricted stock unit award of $2,355.

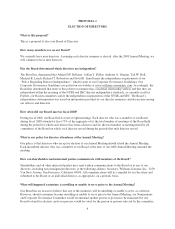

(29) Fiscal 2008 expense associated with (i) a restricted stock unit award of 7,755 shares of common stock made on

June 11, 2008, as modified on October 28, 2008 to remove a performance-based vesting criterion, with a fair value as

of the modification date of $9.44 per share for an aggregate modification date fair value of $73,207, disregarding

forfeiture assumptions and (ii) a restricted stock unit award of 2,100 shares of common stock made on May 16, 2007

with a fair value as of the grant date of $34.13 per share for an aggregate grant date fair value of $71,673, disregarding

forfeiture assumptions.

(30) Fiscal 2008 expense associated with a stock-settled stock appreciation right award of 6,250 shares of common stock

made on May 16, 2007 at an exercise price of $34.13 per share, with a fair value as of the grant date of $11.51 per

share for an aggregate grant date fair value of $71,938, disregarding forfeiture assumptions.

(31) Includes taxable value of discount on merchandise of $2,987.

(32) Includes dividend equivalent payments made with respect to an outstanding restricted stock unit award of $2,355.

9

Proxy