Pottery Barn 2008 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2008 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

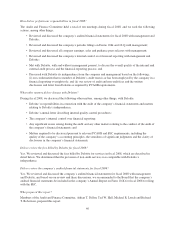

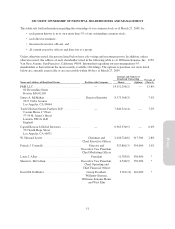

Name and Address of Beneficial Owner Position with Company

Amount and Nature of

Beneficial Ownership Percent of

Class(1)Shares Options

Adrian D.P. Bellamy ............................ Director 62,612 141,750 *

Adrian T. Dillon ................................ Director 7,600 36,750 *

Anthony A. Greener ............................. Director 2,250 6,750 *

Ted W. Hall ................................... Director 2,250 6,750 *

Michael R. Lynch ............................... Director 2,300 130,750 *

Richard T. Robertson ............................ Director 6,500(11) 123,250 *

David B. Zenoff ................................ Director 11,000 32,250 *

All current executive officers and directors as a group

(13 persons) ................................. — 3,068,801(12) 3,077,150 5.8%

* Less than 1%.

(1) Assumes exercise of stock options currently exercisable or exercisable within 60 days of March 27, 2009 by

the named individual into shares of our common stock. Based on 105,684,660 shares outstanding as of

March 27, 2009.

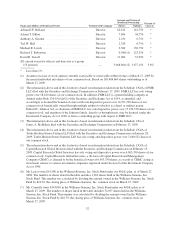

(2) The information above and in this footnote is based on information taken from the Schedule 13G/A of FMR

LLC filed with the Securities and Exchange Commission on February 17, 2009. FMR LLC has sole voting

power over 58,420 shares of our common stock. In addition, FMR LLC is a parent holding company as

defined under Rule 13d-1(b)(ii)(G) of the Securities and Exchange Act of 1934, as amended, and

accordingly is deemed the beneficial owner with sole dispositive power over 14,551,290 shares of our

common stock beneficially owned through multiple entities to which it is a direct or indirect parent.

Edward C. Johnson 3rd, as chairman of FMR LLC, has sole dispositive power over 13,254,370 shares of our

common stock, and members of the Johnson family, directly or through trusts, may be deemed, under the

Investment Company Act of 1940, to form a controlling group with respect to FMR LLC.

(3) The information above and in this footnote is based on information taken from the Schedule 13G of

James A. McMahan filed with the Securities and Exchange Commission on February 13, 2009.

(4) The information above and in this footnote is based on information taken from the Schedule 13G/A of

Taube Hodson Stonex Partners LLP filed with the Securities and Exchange Commission on January 28,

2009. Taube Hodson Stonex Partners LLP has sole voting and dispositive power over 7,640,521 shares of

our common stock.

(5) The information above and in this footnote is based on information taken from the Schedule 13G/A of

Capital Research Global Investors filed with the Securities and Exchange Commission on February 13,

2009. Capital Research Global Investors has sole voting and dispositive power over 6,963,330 shares of our

common stock. Capital Research Global Investors, a division of Capital Research and Management

Company (CRMC), is deemed to be the beneficial owner of 6,963,330 shares as a result of CRMC acting as

investment adviser to various investment companies registered under Section 8 of the Investment Company

Act of 1940.

(6) Mr. Lester owns $14,580 in the Williams-Sonoma, Inc. Stock Fund under our 401(k) plan, as of March 27,

2009. The number of shares listed in the table includes 1,362 shares held in the Williams-Sonoma, Inc.

Stock Fund. This number was calculated by dividing the amount owned in the Williams-Sonoma, Inc. Stock

Fund by $10.70, the closing price of Williams-Sonoma, Inc. common stock on March 27, 2009.

(7) Mr. Connolly owns $343,010 in the Williams-Sonoma, Inc. Stock Fund under our 401(k) plan, as of

March 27, 2009. The number of shares listed in the table includes 32,057 shares held in the Williams-

Sonoma, Inc. Stock Fund. This number was calculated by dividing the amount owned in the Williams-

Sonoma, Inc. Stock Fund by $10.70, the closing price of Williams-Sonoma, Inc. common stock on

March 27, 2009.

52