Pottery Barn 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

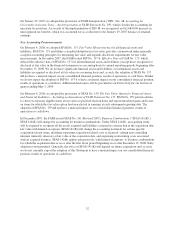

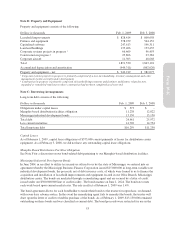

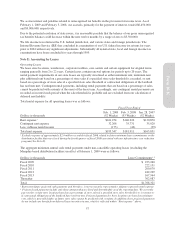

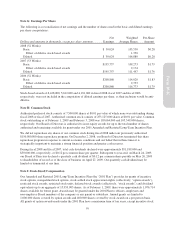

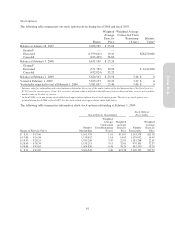

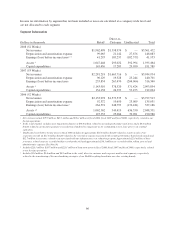

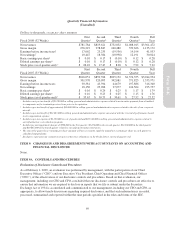

Note G: Earnings Per Share

The following is a reconciliation of net earnings and the number of shares used in the basic and diluted earnings

per share computations:

Dollars and amounts in thousands, except per share amounts

Net

Earnings

Weighted

Average Shares

Per-Share

Amount

2008 (52 Weeks)

Basic $ 30,024 105,530 $0.28

Effect of dilutive stock-based awards 1,350

Diluted $ 30,024 106,880 $0.28

2007 (53 Weeks)

Basic $195,757 109,273 $1.79

Effect of dilutive stock-based awards 2,174

Diluted $195,757 111,447 $1.76

2006 (52 Weeks)

Basic $208,868 114,020 $1.83

Effect of dilutive stock-based awards 2,753

Diluted $208,868 116,773 $1.79

Stock-based awards of 6,428,000, 5,612,000 and 4,181,000 in fiscal 2008, fiscal 2007 and fiscal 2006

respectively, were not included in the computation of diluted earnings per share, as their inclusion would be anti-

dilutive.

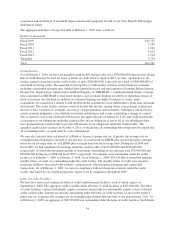

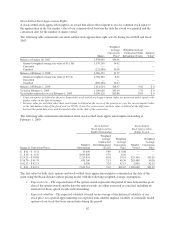

Note H: Common Stock

Authorized preferred stock consists of 7,500,000 shares at $0.01 par value of which none was outstanding during

fiscal 2008 or fiscal 2007. Authorized common stock consists of 253,125,000 shares at $0.01 par value. Common

stock outstanding as of February 1, 2009 and February 3, 2008 was 105,664,000 and 105,349,000 shares,

respectively. Our Board of Directors is authorized to issue equity awards for up to the total number of shares

authorized and remaining available for grant under our 2001 Amended and Restated Long-Term Incentive Plan.

We did not repurchase any shares of our common stock during fiscal 2008 under our previously authorized

$150,000,000 share repurchase program. On December 2, 2008, our Board of Directors terminated this share

repurchase program in response to current economic conditions and our belief that in these times it is

strategically important to maintain a strong financial position and greater cash reserves.

During fiscal 2008 and fiscal 2007, total cash dividends declared were approximately $51,189,000 and

$50,000,000, respectively, or $0.12 per common share per quarter. Subsequent to year-end, on March 24, 2009,

our Board of Directors declared a quarterly cash dividend of $0.12 per common share payable on May 26, 2009

to shareholders of record as of the close of business on April 27, 2009. Our quarterly cash dividend may be

limited or terminated at any time.

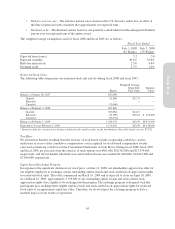

Note I: Stock-Based Compensation

Our Amended and Restated 2001 Long-Term Incentive Plan (the “2001 Plan”) provides for grants of incentive

stock options, nonqualified stock options, stock-settled stock appreciation rights (collectively, “option awards”),

restricted stock awards, restricted stock units, deferred stock awards (collectively, “stock awards”) and dividend

equivalents up to an aggregate of 15,959,903 shares. As of February 1, 2009, there were approximately 1,076,714

shares available for future grant. Awards may be granted under the 2001 Plan to officers, employees and

non-employee Board members of the company or any parent or subsidiary. Annual grants are limited to

1,000,000 shares covered by option awards and 400,000 shares covered by stock awards on a per person basis.

All grants of option awards made under the 2001 Plan have a maximum term of ten years, except incentive stock

59

Form 10-K