Pottery Barn 2008 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2008 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• The relative value of awards offered by comparable companies to executives in comparable positions to

fairly benchmark awards of different sizes and equity instruments; and

• Additional factors, including succession planning and retention of the company’s high potential

executives.

The Compensation Committee believes that each of these factors influences the type and number of shares

appropriate for each individual and that no one factor is determinative.

In determining the RSU and SSAR grants for named executive officers in fiscal 2008, the Compensation

Committee took into account the Chief Executive Officer’s recommendations. The Chief Executive Officer made

grant recommendations based on his review of the compensation levels of named executive officers in similar

positions in our proxy peer group, at levels to ensure that the long-term incentive amounts, when coupled with

base salaries and target annual incentives, resulted in total target direct compensation for each named executive

officer between the 50th and 75th percentiles of our proxy peer group. The Compensation Committee discussed

the Chief Executive Officer’s recommendations and approved the grants as recommended. The Compensation

Committee determined the Chief Executive Officer’s grant amount in an executive session following the

meeting.

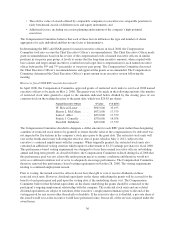

How were fiscal 2008 RSU awards determined?

In April 2008, the Compensation Committee approved grants of restricted stock units to our fiscal 2008 named

executive officers to be made on May 2, 2008. The grants were to be made in the following amounts (the number

of restricted stock units granted is equal to the amounts indicated below divided by the closing price of our

common stock on the trading day prior to the grant date, which was $26.85 per share):

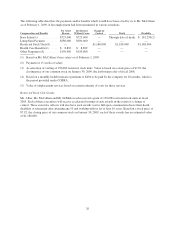

Named Executive Officer $ Value # of RSUs

W. Howard Lester ........ $945,000 35,195

Sharon L. McCollam ..... $472,000 17,579

Laura J. Alber ........... $472,000 17,579

Patrick J. Connolly ....... $378,000 14,078

David M. DeMattei ....... $472,000 17,579

The Compensation Committee decided to designate a dollar amount for each RSU grant (rather than designating

a number of restricted stock units to be granted) to ensure that the value of the compensation to be delivered was

not impacted by fluctuations in the company’s stock price prior to the grant date. The restricted stock units will

vest on the fourth anniversary following the effective date of grant, which is May 2, 2012, subject to the

executive’s continued employment with the company. When originally granted, the restricted stock units also

contained an additional vesting criterion which required achievement of $1.25 earnings per share for fiscal 2008.

This performance-based vesting requirement was designed to focus these named executive officers on building

annual and long-term growth. As described below, the Compensation Committee realized during fiscal 2008 that

this performance goal was not achievable under present macro-economic conditions and therefore would not

serve as a sufficient retention tool or serve to adequately encourage performance. The Compensation Committee

therefore removed this performance-based vesting requirement on October 28, 2008. The vesting requirements

relating to continued employment remain.

Prior to vesting, the named executive officers do not have the right to vote or receive dividends on these

restricted stock units. However, dividend equivalents on the shares underlying the grants will be accrued for the

benefit of each participant and paid upon the vesting date, if the underlying shares vest. The Compensation

Committee believes that dividend equivalents on the shares underlying the grants should be connected to the

participant’s ongoing employment relationship with the company. The restricted stock units and any related

dividend equivalents are subject to forfeiture if the executive’s employment terminates prior to the end of the

vesting period for any reason other than death or disability. If the executive dies or is disabled, a pro-rata share of

the award would vest as the executive would have performed some, but not all, of the services required under the

award terms.

36