Pottery Barn 2008 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2008 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

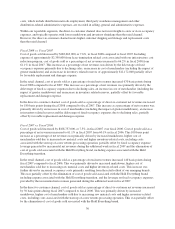

unsecured revolving credit. During fiscal 2008 and fiscal 2007, we had cumulative borrowings under the credit

facility of $195,800,000 and 189,000,000, respectively, of which the maximum amount of borrowings

outstanding at any one time were $78,000,000 and $98,000,000 during fiscal 2008 and fiscal 2007, respectively.

No amounts were outstanding under the credit facility as of February 1, 2009 or February 3, 2008. Additionally,

as of February 1, 2009, $39,559,000 in issued but undrawn standby letters of credit was outstanding under the

credit facility. We believe our cash on-hand, in addition to our available credit facilities, will provide adequate

liquidity for our business operations over the next 12-month period. Further, based on our current projections, we

believe we will be in compliance with all of our bank covenants throughout fiscal 2009.

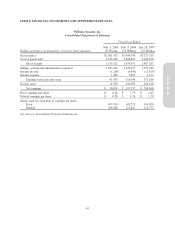

In fiscal 2008, net cash provided by operating activities was $230,163,000 compared to net cash provided by

operating activities of $245,539,000 in fiscal 2007. Cash provided by operating activities in fiscal 2008 was

primarily attributable to a decrease in merchandise inventories due to our inventory reduction initiatives

throughout fiscal 2008, an increase in deferred rent and lease incentives due to the opening of new stores and a

decrease in our prepaid catalog costs due to our catalog circulation optimization strategy. This was partially

offset by a decrease in income taxes payable due to the payment of our fiscal 2007 income taxes and a

significantly reduced income tax obligation due to reduced earnings in the back half of fiscal 2008.

In fiscal 2007, net cash provided by operating activities was $245,539,000 compared to net cash provided by

operating activities of $309,114,000 in fiscal 2006. Cash provided by operating activities in fiscal 2007 was

primarily attributable to net earnings, an increase in deferred rent and lease incentives due to new store openings

and an increase in customer deposits due to growth in unredeemed gift cards. This was partially offset by an

increase in merchandise inventories due to inventories growing at a faster rate than sales, in addition to the

purchase of new inventory to support the increase in sales in our core and emerging brands and an increase in our

leased square footage of 5.3%.

Net cash used in investing activities was $144,039,000 for fiscal 2008 compared to $197,250,000 in fiscal 2007.

Fiscal 2008 purchases of property and equipment were $191,789,000, comprised of $131,792,000 for 29 new and

23 remodeled or expanded stores, $45,847,000 for systems development projects (including e-commerce

websites) and $14,150,000 for distribution, facility infrastructure and other projects. Net cash used in investing

activities was partially offset by proceeds from the sale of a corporate aircraft of $46,787,000.

Net cash used in investing activities was $197,250,000 for fiscal 2007 compared to $189,287,000 in fiscal 2006.

Fiscal 2007 purchases of property and equipment were $212,024,000, comprised of $120,325,000 for 23 new and

26 remodeled or expanded stores, $69,286,000 for systems development projects (including e-commerce

websites) and $22,413,000 for distribution, facility infrastructure and other projects. Net cash used in investing

activities was partially offset by a $14,770,000 reimbursement from a software developer.

In fiscal 2009, we anticipate investing $90,000,000 to $100,000,000 in the purchase of property and equipment,

primarily for the construction of 8 new stores and 7 remodeled or expanded stores, systems development projects

(including e-commerce websites), and distribution, facility infrastructure and other projects.

For fiscal 2008, net cash used in financing activities was $52,160,000 compared to $208,482,000 in fiscal 2007,

comprised primarily of $50,518,000 for the payment of dividends.

For fiscal 2007, net cash used in financing activities was $208,482,000 compared to $206,027,000 in fiscal 2006,

comprised primarily of $190,378,000 for the repurchase of our common stock and $48,863,000 for the payment

of dividends, partially offset by $28,362,000 in net proceeds from the exercise of stock options.

Stock Repurchase Program

We did not repurchase any shares of our common stock during fiscal 2008 under our previously authorized

$150,000,000 share repurchase program. On December 2, 2008, our Board of Directors terminated this share

repurchase program in response to current economic conditions and our belief that in these times it is

strategically important to maintain a strong financial position and greater cash reserves.

33

Form 10-K