Pottery Barn 2008 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2008 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

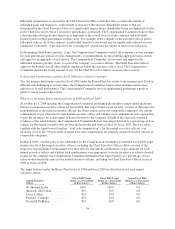

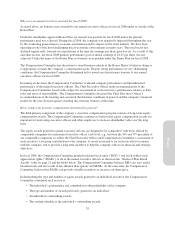

What SSARs grants were made in fiscal 2008?

On November 7, 2008, the Compensation Committee made special stock-settled stock appreciation right awards

to the named executive officers as described above. The exercise price of these awards is $8.56 per share, the

closing price of our stock on November 6, 2008 and the number of shares underlying the awards is shown below.

Named Executive Officer SSARs

W. Howard Lester .................. 425,000

Sharon L. McCollam ................ 275,000

Laura J. Alber ...................... 230,000

Patrick J. Connolly .................. 160,000

David M. DeMattei ................. 300,000

Why did the Compensation Committee make a special grant of stock-settled stock appreciation rights to the

named executive officers?

The Compensation Committee believes that it is extremely important that its compensation program provide

adequate incentives to increase shareholder value. After careful analysis, the Compensation Committee felt that

granting additional equity awards in the form of SSARs, under which value is recognized only if the value of the

underlying stock increases, would provide an appropriate incentive and also would provide additional retention

value.

The Compensation Committee believes that it is critical for the executive compensation program to provide a

constant incentive to increase shareholder value and retain executive talent. At the November 2008 meeting, the

Compensation Committee reviewed an analysis of each named executive officer’s outstanding equity awards and

the value realized by each executive from recent equity awards. The analysis showed that little to no value had

been realized from the equity awards granted during the prior five years, which aligned with the intended

pay-for-performance nature of the program. However, it also demonstrated that a significant portion of each

executive’s outstanding awards had limited to no retention value going forward and no longer provided the

intended incentive. As a result, the Compensation Committee determined that granting additional equity awards

in the form of SSARs, under which value is recognized only if the value of the underlying stock increases,

would restore an appropriate incentive focused on shareholder value creation and also would provide additional

retention value. The size of the awards was determined based on the importance of each executive’s role in

driving future performance and a subjective determination of the ongoing incentive and retention value of each

executive’s outstanding grants.

The SSARs provide added retention value through the vesting schedule applicable to the awards. For each named

executive officer other than Mr. Lester, the SSARs are scheduled to vest at a rate of 25% each year, subject to the

officer’s continued employment with the company. Mr. Lester’s SSAR grant follows the same vesting schedule,

except that it is subject to his continued service either as an employee or as a non-employee member of our

Board.

The Compensation Committee believes that if Mr. Lester ceased to be an employee of the company but

continued on as a member of the Board, his contributions in that position would continue to be critical to the

company and he would continue to be a key driver of the long-term success of the company. For this reason, the

Compensation Committee wanted to encourage Mr. Lester’s continuation in this capacity and also reward him

for increases in stockholder value generated during that time.

When are equity awards made to executive officers?

Equity awards to executive officers are only approved at scheduled Compensation Committee meetings.

Executives do not have any role in selecting the grant date of equity awards. The grant date of equity awards is

generally the date of the approval of the award, and the exercise price of stock options or SSARs is always the

closing price of the company’s common stock on the trading day prior to the grant date. In general, equity awards

37

Proxy