Pottery Barn 2008 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2008 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our other Memphis-based distribution facility includes an operating lease entered into in August 1990 for

another distribution facility that is adjoined to the Partnership 1 facility in Memphis, Tennessee. The lessor is a

general partnership (“Partnership 2”) comprised of W. Howard Lester, James A. McMahan and two unrelated

parties. Partnership 2 does not have operations separate from the leasing of this distribution facility and does not

have lease agreements with any unrelated third parties.

Partnership 2 financed the construction of this distribution facility and related addition through the sale of a total

of $24,000,000 of industrial development bonds in 1990 and 1994. Quarterly interest and annual principal

payments are required through maturity in August 2015. The Partnership 2 industrial development bonds are

collateralized by the distribution facility and require us to maintain certain financial covenants. As of February 1,

2009, $10,813,000 was outstanding under the Partnership 2 industrial development bonds.

We made annual rental payments of approximately $2,577,000, $2,591,000 and $2,585,000 plus applicable taxes,

insurance and maintenance expenses in fiscal 2008, fiscal 2007 and fiscal 2006, respectively. Although the

current term of the lease expires in August 2009, we are obligated to renew the operating lease on an annual basis

until these bonds are fully repaid.

The two partnerships described above qualify as variable interest entities under FIN 46R due to their related

party relationship to us and our obligation to renew the leases until the bonds are fully repaid. Accordingly, the

two related party variable interest entity partnerships from which we lease our Memphis-based distribution

facilities are consolidated by us. As of February 1, 2009, our consolidated balance sheet includes $16,372,000 in

assets (primarily buildings), $11,238,000 in debt and $5,134,000 in other long-term liabilities.

Corporate Aircraft Transactions

On May 16, 2008, we completed two transactions relating to our corporate aircraft. First, we sold our Bombardier

Global Express airplane for approximately $46,787,000 in cash (a net after-tax cash benefit of approximately

$29,000,000) to an unrelated third party. This resulted in a gain on sale of asset of approximately $16,000,000 in

the second quarter of fiscal 2008. Second, we entered into an Aircraft Lease Agreement (the “Lease Agreement”)

with a limited liability company (the “LLC”) owned by W. Howard Lester, our Chief Executive Officer and

Chairman of the Board of Directors, for use of a Bombardier Global 5000 owned by the LLC. These transactions

were approved by our Board of Directors.

Under the terms of the Lease Agreement, in exchange for use of the aircraft, we will pay the LLC $375,000 for

each of the thirty-six months of the lease term through May 15, 2011. We are also responsible for all use-related

costs associated with the aircraft, including fixed costs such as crew salaries and benefits, insurance and hangar

costs, and all direct operating costs. Closing costs associated with the Lease Agreement were divided evenly

between us and the LLC, and each party paid its own attorney and advisor fees. The Lease Agreement is subject

to early termination by either party, with 90 days prior written notice, if Mr. Lester retires or otherwise

withdraws from active management of the company. During fiscal 2008, we paid a total of $3,185,000 to the

LLC and as of February 1, 2009, $375,000, equal to one month’s rent, was owed to the LLC, all of which was

paid subsequent to year-end.

Indemnification Agreements

We have indemnification agreements with our directors and executive officers. These agreements, among other

things, require us to indemnify each director and executive officer to the fullest extent permitted by California

law, including coverage of expenses such as attorneys’ fees, judgments, fines and settlement amounts incurred by

the director or executive officer in any action or proceeding, including any action or proceeding by or in right of

us, arising out of the person’s services as a director or executive officer.

49

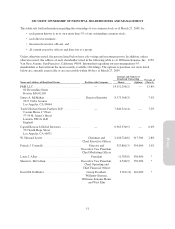

Proxy