Pottery Barn 2008 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2008 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

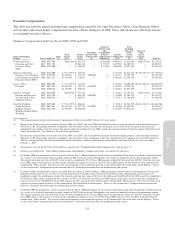

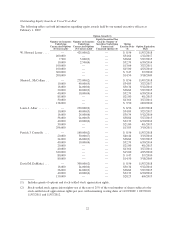

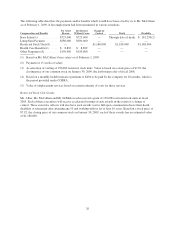

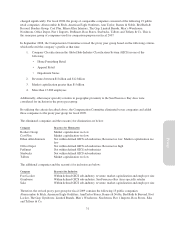

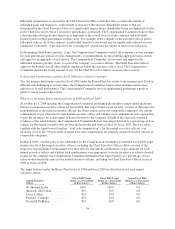

Option Exercises and Stock Vested

The following table sets forth information regarding exercises and vesting of equity awards held by our named

executive officers during fiscal 2008:

Option Awards Stock Awards

Number of Shares

Acquired on Exercise (#)

Value Realized on

Exercise ($)

Number of Shares

Acquired on Vesting (#)

Value Realized on

Vesting ($)

W. Howard Lester ......... 200,000 $2,557,000 — —

Sharon L. McCollam ....... — — — —

Laura J. Alber ............ — — — —

Patrick J. Connolly ......... 200,000 $2,124,000 — —

David M. DeMattei ........ — — — —

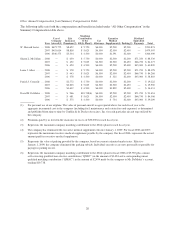

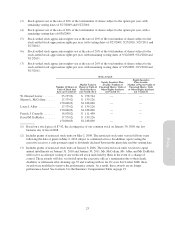

Pension Benefits

None of our named executive officers received any pension benefits during fiscal 2008.

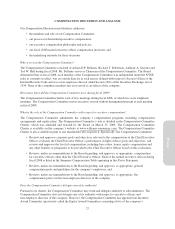

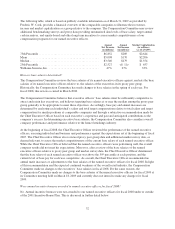

Nonqualified Deferred Compensation

The following table describes nonqualified deferred compensation to our named executive officers during

fiscal 2008:

Executive

Contributions in

Fiscal 2008 ($)

Registrant

Contributions in

Fiscal 2008 ($)

Aggregate

Earnings (Loss)

in Fiscal 2008 ($)

Aggregate

Withdrawals/

Distributions ($)

Aggregate Balance at

February 1, 2009 ($)

W. Howard Lester(1) . . — — $(238,669) — $284,901

Sharon L. McCollam . . . — — — — —

Laura J. Alber ........ — — — — —

Patrick J. Connolly .... — — — — —

David M. DeMattei .... — — — — —

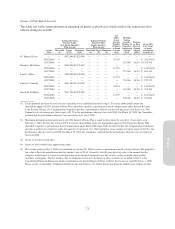

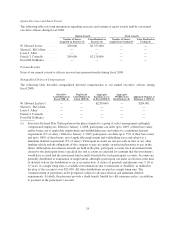

(1) Executive Deferral Plan. Participation in the plan is limited to a group of select management and highly

compensated employees. Effective January 1, 2008, participants can defer up to 100% of their base salary

and/or bonus, net of applicable employment and withholding taxes and subject to a minimum deferral

requirement (5% of salary). Effective January 1, 2009, participants can defer up to 75% of their base salary

and up to 100% of their bonus, net of applicable employment and withholding taxes and subject to a

minimum deferral requirement (5% of salary). Participant accounts are not put aside in trust or any other

funding vehicle and the obligations of the company to pay are simply an unsecured promise to pay in the

future. Although no investments actually are held in the plan, participant accounts track investment funds

chosen by the participant from a specified list, and accounts are adjusted for earnings that the investments

would have accrued had the investment fund actually been held by such participant accounts. Accounts are

generally distributed at termination of employment, although a participant can make an election at the time

of deferral to have the distribution occur at an earlier date. A choice of quarterly installments over 5, 10 or

15 years, or a single lump sum, is available for terminations due to retirement or disability, as defined in

the plan, if the account is over $25,000. All other distributions are paid as a single lump sum. The

commencement of payments can be postponed, subject to advance election and minimum deferral

requirements. At death, the plan may provide a death benefit funded by a life insurance policy, in addition

to payment of the participant’s account.

24