Pottery Barn 2008 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2008 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

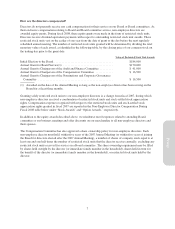

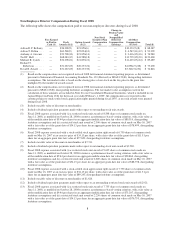

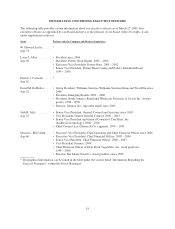

Non-Employee Director Compensation During Fiscal 2008

The following table shows the compensation paid to our non-employee directors during fiscal 2008:

Fees Earned

or Paid in

Cash ($)

Stock

Awards ($)(1)

Option Awards

($)(2)

Non-Stock

Incentive Plan

Compensation

($)

Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings

All Other

Compensation

($)(3)(4) Total ($)

Adrian D.P. Bellamy — $56,208(5) $21,856(6) — — $10,323(7)(8) $ 88,387

Adrian T. Dillon .... — $63,568(9) $25,094(10) — — $ 4,547(11)(12) $ 93,209

Anthony A. Greener . — $52,708(13) $21,856(14) — — $ 2,416(15)(16) $ 76,980

Ted W. Hall ....... — $68,083(17) $41,588(18) — — $12,729(19)(20) $122,400

Michael R. Lynch . . — $56,208(21) $21,856(22) — — $11,425(23)(24) $ 89,489

Richard T.

Robertson ....... — $51,267(25) $20,237(26) — — $4,096(27)(28) $ 75,600

David B. Zenoff .... — $51,267(29) $20,237(30) — — $5,342(31)(32) $ 76,846

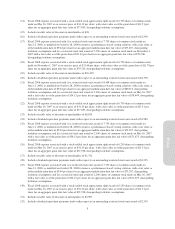

(1) Based on the compensation cost recognized in fiscal 2008 for financial statement reporting purposes as determined

pursuant to Statement of Financial Accounting Standards No. 123 (Revised) or SFAS 123(R), disregarding forfeiture

assumptions. The fair market value is based on the closing price of our stock on the day prior to the grant date

multiplied by the number of awards issued.

(2) Based on the compensation cost recognized in fiscal 2008 for financial statement reporting purposes as determined

pursuant to SFAS 123(R), disregarding forfeiture assumptions. The fair market value assumptions used in the

calculation of these amounts are included in Note I to our Consolidated Financial Statements, which is included in our

Annual Report on Form 10-K for the fiscal year ended February 1, 2009. All compensation cost reported in this

column pertains to stock-settled stock appreciation rights granted during fiscal 2007, as no such awards were granted

during fiscal 2008.

(3) Includes taxable value of discount on merchandise.

(4) Includes dividend equivalent payments made with respect to outstanding stock unit awards.

(5) Fiscal 2008 expense associated with (i) a restricted stock unit award of 8,508 shares of common stock made on

June 11, 2008, as modified on October 28, 2008 to remove a performance-based vesting criterion, with a fair value as

of the modification date of $9.44 per share for an aggregate modification date fair value of $80,316, disregarding

forfeiture assumptions and (ii) a restricted stock unit award of 2,300 shares of common stock made on May 16, 2007

with a fair value as of the grant date of $34.13 per share for an aggregate grant date fair value of $78,499, disregarding

forfeiture assumptions.

(6) Fiscal 2008 expense associated with a stock-settled stock appreciation right award of 6,750 shares of common stock

made on May 16, 2007 at an exercise price of $34.13 per share, with a fair value as of the grant date of $11.51 per

share for an aggregate grant date fair value of $77,693, disregarding forfeiture assumptions.

(7) Includes taxable value of discount on merchandise of $7,741.

(8) Includes dividend equivalent payments made with respect to outstanding stock unit award of $2,582.

(9) Fiscal 2008 expense associated with (i) a restricted stock unit award of 9,625 shares of common stock made on

June 11, 2008, as modified on October 28, 2008 to remove a performance-based vesting criterion, with a fair value as

of the modification date of $9.44 per share for an aggregate modification date fair value of $90,860, disregarding

forfeiture assumptions and (ii) a restricted stock unit award of 2,600 shares of common stock made on May 16, 2007

with a fair value as of the grant date of $34.13 per share for an aggregate grant date fair value of $88,738, disregarding

forfeiture assumptions.

(10) Fiscal 2008 expense associated with a stock-settled stock appreciation right award of 7,750 shares of common stock

made on May 16, 2007 at an exercise price of $34.13 per share, with a fair value as of the grant date of $11.51 per

share for an aggregate grant date fair value of $89,203, disregarding forfeiture assumptions.

(11) Includes taxable value of discount on merchandise of $1,626.

(12) Includes dividend equivalent payments made with respect to an outstanding restricted stock unit award of $2,921.

(13) Fiscal 2008 expense associated with (i) a restricted stock unit award of 7,755 shares of common stock made on

June 11, 2008, as modified on October 28, 2008 to remove a performance-based vesting criterion, with a fair value as

of the modification date of $9.44 per share for an aggregate modification date fair value of $73,207, disregarding

forfeiture assumptions and (ii) a restricted stock unit award of 2,250 shares of common stock made on May 16, 2007

with a fair value as of the grant date of $34.13 per share for an aggregate grant date fair value of $76,793, disregarding

forfeiture assumptions.

8