Pottery Barn 2008 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2008 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

OVERVIEW

Fiscal 2008 Financial Results

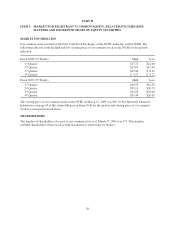

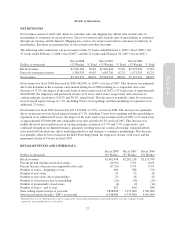

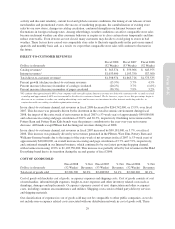

In fiscal 2008, a 52-week year, our net revenues decreased 14.8% to $3,361,472,000 from $3,944,934,000 in

fiscal 2007, a 53-week year, and our diluted earnings per share decreased by 84.1% to $0.28 in fiscal 2008 from

$1.76 in fiscal 2007. Although we are not satisfied with these results, we believe the fact that we were still able to

deliver positive earnings of $0.28 for fiscal 2008 demonstrates the flexibility of our multi-channel business

model and our ability to drive rapid change in a down-trending economy.

From a cash flow perspective, we generated $230,163,000 in cash flow from operating activities and increased

our cash balance by $29,872,000 to $148,822,000 despite significantly reduced sales and earnings during the

back half of fiscal 2008.

Retail net revenues in fiscal 2008 decreased by $318,720,000, or 14.0%, over fiscal 2007. This decrease was

primarily due to the downturn in the economic environment during fiscal 2008 resulting in a comparable store

sales decrease of 17.2%, the impact of the extra week of net revenues in fiscal 2007 (a 53-week year) of

approximately $30,000,000 and the temporary and permanent closure of 21 stores and 4 stores, respectively. This

decrease was partially offset by an increase in our store leased square footage of 7.1% (including 29 new store

openings and the remodeling or expansion of an additional 23 stores). Net revenue decreases were led by the

Pottery Barn, Williams-Sonoma and Pottery Barn Kids brands, partially offset by net revenue increases in the

West Elm brand.

In our direct-to-customer channel, net revenues in fiscal 2008 decreased by $264,742,000, or 15.9%, over fiscal

2007. This decrease was primarily driven by the downturn in the overall economic environment during fiscal

2008, the impact of the extra week of net revenues in fiscal 2007 (a 53-week year) of approximately $40,000,000

and a decrease in catalog and page circulation of 20.2% and 30.3%, respectively. Declining net revenues in the

Pottery Barn and Pottery Barn Kids brands were the primary contributors to the year-over-year net revenue

decrease. All brands except PBteen had declining net revenues during fiscal 2008.

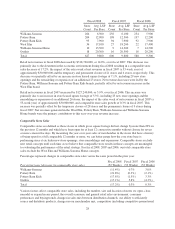

In our core brands, net revenues decreased by 16.9% over fiscal 2007 driven by net revenue decreases in the

Pottery Barn and Pottery Barn Kids brands primarily due to the downturn in the economic environment in the

back half of fiscal 2008, the impact of our catalog circulation optimization strategy and the impact of the extra

week of net revenues in fiscal 2007 (a 53-week year). Comparable store sales decreases were 21.8% and 17.8%

for the Pottery Barn and Pottery Barn Kids brands, respectively. Although net revenues decreased in the

Williams-Sonoma brand, it proved to be more resilient than our other core brands, ending the year with a

comparable store decrease of only 11.4%.

Similar to our core brands, our emerging brands (including West Elm, PBteen and Williams-Sonoma Home)

were also impacted by the downturn in the economic environment, where net revenues decreased 0.3% from

fiscal 2007 primarily due to a decrease in the Williams-Sonoma Home brand in both the retail and

direct-to-customer channels. This net revenue decrease was partially offset by increases in both the PBteen and

West Elm brands.

PBteen was our best performing brand during the year with net revenue growth of 2.7%. New product innovation

and superior execution drove this year-over-year increase. Although overall net revenues increased year-over-

year, we did begin to see net revenue decreases in the back half of the year. We do, however, continue to be

excited about the long-term growth potential of the brand as it solidifies its positioning in the Pottery Barn

portfolio of brands.

Although West Elm continued to be more resilient than our other home furnishings brands with increased net

revenues in fiscal 2008, we saw net revenue decreases in the back half of fiscal 2008 due to lower transactions

and conversion rates. Despite these declines, we continued to expand the reach of the brand by opening nine new

stores during the year, including our first West Elm stores in Puerto Rico and Canada, and are planning to open

four additional stores in fiscal 2009.

24