Pottery Barn 2008 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2008 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

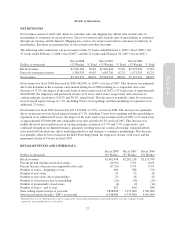

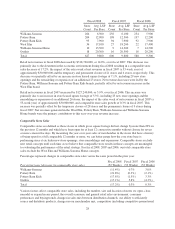

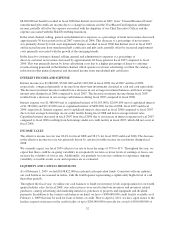

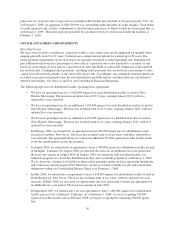

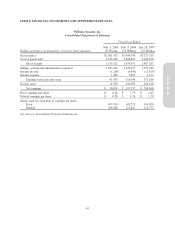

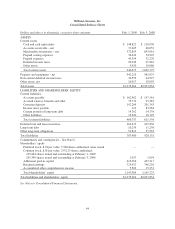

Contractual Obligations

The following table provides summary information concerning our future contractual obligations as of

February 1, 2009:

Payments Due by Period 1

Dollars in thousands Fiscal 2009

Fiscal 2010

to Fiscal 2012

Fiscal 2013

to Fiscal 2014 Thereafter Total

Mississippi industrial development bonds $ 13,150 $ — $ — $ — $ 13,150

Memphis-based distribution facilities

obligation 1,438 4,410 3,422 1,968 11,238

Capital leases 114 371 88 — 573

Interest 21,293 2,923 1,069 281 5,566

Operating leases 3,4 233,240 605,030 315,673 614,378 1,768,321

Purchase obligations 5339,302 4,875 — — 344,177

Total $588,537 $617,609 $320,252 $616,627 $2,143,025

1This table excludes $22.8 million of liabilities for unrecognized tax benefits under FIN 48, as we are not able to reasonably estimate when

cash payments for these liabilities will occur. This amount, however, has been recorded as a liability in the accompanying Consolidated

Balance Sheet as of February 1, 2009.

2Represents interest expected to be paid on our long-term debt, Mississippi industrial development bonds and our capital leases.

3See discussion on operating leases in the “Off Balance Sheet Arrangements” section and Note E to our Consolidated Financial Statements.

4Projected payments include only those amounts that are fixed and determinable as of the reporting date.

5Represents estimated commitments at year-end to purchase inventory and other goods and services in the normal course of business to meet

operational requirements.

Mississippi Industrial Development Bonds

In June 2004, in an effort to utilize tax incentives offered to us by the state of Mississippi, we entered into an

agreement whereby the Mississippi Business Finance Corporation issued $15,000,000 in long-term variable rate

industrial development bonds, the proceeds, net of debt issuance costs, of which were loaned to us to finance the

acquisition and installation of leasehold improvements and equipment located in our Olive Branch, Mississippi

distribution center. The bonds are marketed through a remarketing agent and are secured by a letter of credit

issued under our $300,000,000 line of credit facility. The bonds mature on June 1, 2024. The bond rate resets

each week based upon current market rates. The rate in effect at February 1, 2009 was 1.4%.

The bond agreement allows for each bondholder to tender their bonds to the trustee for repurchase, on demand,

with seven days advance notice. In the event the remarketing agent fails to remarket the bonds, the trustee will

draw upon the letter of credit to fund the purchase of the bonds. As of February 1, 2009, $13,150,000 remained

outstanding on these bonds and was classified as current debt. The bond proceeds were restricted for use in the

acquisition and installation of leasehold improvements and equipment located in our Olive Branch, Mississippi

distribution center.

Memphis-Based Distribution Facilities Obligation

As of February 1, 2009, total debt of $11,238,000 consisted entirely of bond-related debt pertaining to the

consolidation of our Memphis-based distribution facilities in accordance with FIN 46R, “Consolidation of

Variable Interest Entities.” See discussion of the consolidation of our Memphis-based distribution facilities at

Note F to our Consolidated Financial Statements.

Capital Leases

As of February 1, 2009, capital lease obligations of $573,000 consist primarily of leases for distribution center

equipment. As of February 3, 2008, we did not have any outstanding capital lease obligations.

Other Contractual Obligations

We have other liabilities reflected in our Consolidated Balance Sheets. The payment obligations associated with

these liabilities are not reflected in the table above due to the absence of scheduled maturities. The timing of

34