Pottery Barn 2008 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2008 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

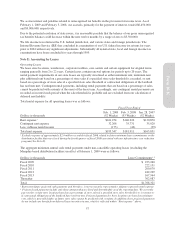

We accrue interest and penalties related to unrecognized tax benefits in the provision for income taxes. As of

February 1, 2009 and February 3, 2008, our accruals, primarily for the payment of interest, totaled $6,450,000,

and $9,006,000, respectively.

Due to the potential resolution of state issues, it is reasonably possible that the balance of our gross unrecognized

tax benefits balance could decrease within the next twelve months by a range of zero to $3,500,000.

We file income tax returns in the U.S. federal jurisdiction, and various states and foreign jurisdictions. The

Internal Revenue Service (IRS) has concluded its examination of our U.S. federal income tax returns for years

prior to 2004 without any significant adjustments. Substantially all material state, local and foreign income tax

examinations have been concluded for years through 1999.

Note E: Accounting for Leases

Operating Leases

We lease store locations, warehouses, corporate facilities, care centers and certain equipment for original terms

ranging generally from 2 to 22 years. Certain leases contain renewal options for periods up to 20 years. The

rental payment requirements in our store leases are typically structured as either minimum rent, minimum rent

plus additional rent based on a percentage of store sales if a specified store sales threshold is exceeded, or rent

based on a percentage of store sales if a specified store sales threshold or contractual obligations of the landlord

has not been met. Contingent rental payments, including rental payments that are based on a percentage of sales,

cannot be predicted with certainty at the onset of the lease term. Accordingly, any contingent rental payments are

recorded as incurred each period when the sales threshold is probable and are excluded from our calculation of

deferred rent liability.

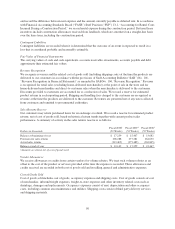

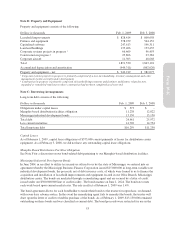

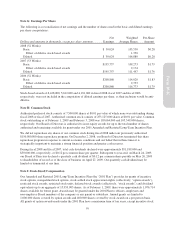

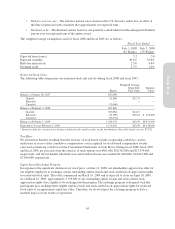

Total rental expense for all operating leases was as follows:

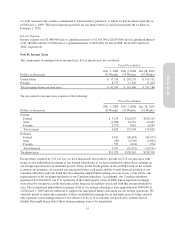

Fiscal Year Ended

Dollars in thousands

Feb. 1, 2009

(52 Weeks)

Feb. 3, 2008

(53 Weeks)

Jan. 28, 2007

(52 Weeks)

Rent expense,1 $161,254 $146,226 $130,870

Contingent rent expense 32,268 35,731 35,020

Less: sublease rental income (175) (46) (39)

Total rent expense $193,347 $181,911 $165,851

1Excludes expense of approximately $2.0 million recorded in fiscal 2008 related to future minimum lease commitments on the

distribution facility that was closed during the fourth quarter of fiscal 2008 associated with our infrastructure cost reduction

program (See Note N).

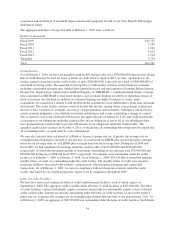

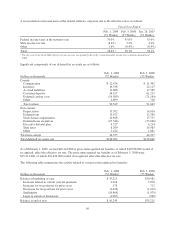

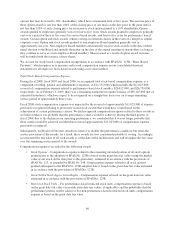

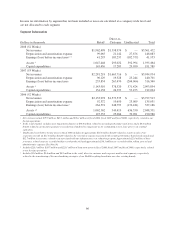

The aggregate minimum annual cash rental payments under non-cancelable operating leases (excluding the

Memphis-based distribution facilities) in effect at February 1, 2009 were as follows:

Dollars in thousands Lease Commitments1,2

Fiscal 2009 $ 233,240

Fiscal 2010 222,131

Fiscal 2011 200,670

Fiscal 2012 182,229

Fiscal 2013 167,964

Thereafter 762,087

Total $1,768,321

1Represents future projected cash payments and therefore, is not necessarily representative of future expected rental expense.

2. Projected cash payments include only those amounts that are fixed and determinable as of the reporting date. We currently

pay rent for certain store locations based on a percentage of store sales if a specified store sales threshold is or is not met or

if contractual obligations of the landlord have not been met. Projected payments for these locations are based on minimum

rent, which is generally higher as future store sales cannot be predicted with certainty. In addition, these projected payments

do not include any benefit from deferred lease incentive income, which is reflected within “Rent expense” above.

57

Form 10-K