Pottery Barn 2008 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2008 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

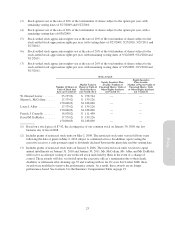

How are the parameters for annual incentive bonuses determined?

Annual incentives are set based on a variety of factors tailored to assist the company in driving performance as

well as retention.

The company promotes strong performance by rewarding executive officers, including the named executive

officers, for achieving specific performance objectives with an annual cash bonus paid through the company’s

2001 Incentive Bonus Plan (the “Bonus Plan”) or, in some cases, through discretionary bonuses granted outside

of the Bonus Plan. The company pays bonuses under the Bonus Plan only when the company meets or exceeds a

specific objective established by the Compensation Committee.

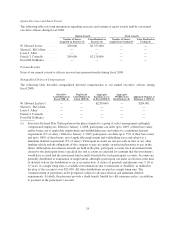

The shareholder-approved Bonus Plan is intended to qualify annual incentives as deductible performance-based

compensation under Internal Revenue Code Section 162(m), which otherwise restricts our ability to deduct

certain executive compensation in excess of $1,000,000 per executive per year. In accordance with Internal

Revenue Code rules, the Bonus Plan payout criteria are specified by the Compensation Committee in the first

quarter of each fiscal year. For fiscal 2008, the Bonus Plan limited the maximum payout to each executive to

three times the executive’s base salary as of February 4, 2008, the first day of fiscal 2008. The Compensation

Committee has historically set target incentive levels (“target bonuses”) for each executive well below this level.

Under the Bonus Plan, the Compensation Committee generally sets a primary, critical performance goal. If this

goal is not met, no bonuses are payable under the Bonus Plan. If this performance goal is met, maximum bonuses

become available under the Bonus Plan for each named executive officer and, to the extent paid, are fully

deductible to the company. For fiscal 2008, the Compensation Committee established the primary performance

goal for the Bonus Plan as annual earnings of $1.25 per share. Although maximum bonuses would be available if

this goal was met, the Compensation Committee did not expect to pay maximum bonuses or even target bonuses

if only this goal was met. The Compensation Committee is permitted, and fully expected, to apply negative

discretion in determining the actual amount, if any, to be paid to any named executive officer.

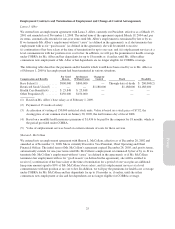

Why did the Compensation Committee choose earnings per share as the primary performance goal under the

Bonus Plan?

The Compensation Committee chose earnings per share as the primary performance goal for fiscal 2008 because

it believes that earnings per share is the most significant measure of performance and most closely aligned to

long-term shareholder value. The achievability of the goal was deemed substantially uncertain for purposes of

Internal Revenue Code Section 162(m) because it was based on profitability. When the primary earnings per

share objective for fiscal 2008 was first established, it was thought to be reasonably attainable based upon the

company’s historic and expected levels of profitability. However, the company was not able to predict the depth

of the weakening macro-economic environment we are now experiencing and its impact on the retail industry. As

a result, the earnings per share goal for fiscal 2008 was not achieved.

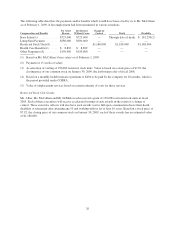

How does the Compensation Committee apply negative discretion?

To assist in guiding its use of negative discretion, the Compensation Committee establishes secondary

performance goals which, if achieved at target levels, are expected to result in payment of target bonuses. For

fiscal 2008, these secondary goals included an additional, higher earnings per share goal. The Compensation

Committee expected to pay bonuses at target levels only if the secondary, higher earnings per share goal was

fully met. The Compensation Committee may deviate from the guidelines, but may never increase bonuses under

the Bonus Plan above the maximum payout amounts that become available as a result of the achievement of the

primary performance goal.

For a fiscal year during which the primary performance goal is achieved, the Compensation Committee then

decides how (or if) to apply its negative discretion to reduce bonuses from the maximum available under the

Bonus Plan. In doing so, the Compensation Committee evaluates performance against the additional secondary

goals, company performance against the business plan approved by the Board in the first fiscal quarter and

individual performance.

33

Proxy