Pottery Barn 2008 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2008 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In the Williams-Sonoma Home brand, we believe the customer has been particularly impacted by the macro-

economic environment and that these trends are likely to continue for the foreseeable future. Given the brands

performance to-date and the fixed cost pressure from underperforming retail stores, we are working with our

landlords on potential store closings and we will continue to assess the brand’s overall market potential in this

economic environment as we progress throughout the year.

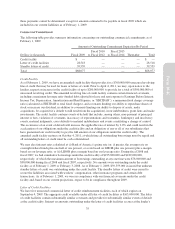

Fiscal 2008 Operational Results

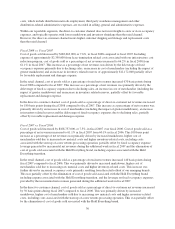

During fiscal 2008, though we faced a difficult economic environment, we were able to make significant

progress against several key initiatives, including successfully amending our unsecured credit facilities and

ending the year with significant cushions in the financial covenants on these facilities; reducing our year-end

inventory levels by $120,762,000, or 17.4%; initiating and implementing a $75,000,000 infrastructure cost

reduction program; and optimizing profitability through aggressive expense management and highly controlled

promotional activity.

In our supply chain, we continued to make significant progress on our key initiatives, including restructuring our

Asian furniture sourcing network to establish in-country expertise and improved vendor performance; expanding

our U.S. upholstered furniture operations to provide shorter lead times, better quality, and lower cost; and

in-sourcing six of our largest local furniture delivery hubs to improve customer service and reduce returns,

replacements, and damages expense. We also reduced distribution capacity due to substantial improvements in

inventory management.

In information technology, we continued the rollout of our direct-to-customer order management system. This is

a phased implementation that is improving efficiency and functionality in an area that we believe still has

significant cost and inventory planning opportunities. In the customer insights area, we implemented new

functionality that is allowing us to significantly improve the relevancy of our marketing contacts and optimize

our catalog response rates.

In e-commerce, we completed the migration of all of our websites to our next generation platform, with the

exception of West Elm, which will be transitioned in fiscal 2009. We also began testing new functionality in the

areas of click-to-call, product reviews, and search. Infrastructure was also a key area of investment this year,

including the replacement of our company-wide point-of-sale hardware and the rollout of electronic signature

and pin debit functionality in our stores.

In direct-marketing, we reduced catalog advertising costs by an estimated $45,000,000 based on the success of

our catalog circulation optimization strategy. At the same time, we continued to aggressively explore additional

traffic drivers through paid and natural search, target-driven direct response and affiliate programs. While we are

still in the early phases of these rollouts, all of these initiatives have driven increased transactions and

incremental sales to the brands.

Fiscal 2009

As we enter fiscal 2009, though we do expect a continued net revenue decline of 12% to 17%, due to the

continuing effects of the economic downturn, we are focused on the aspects of the business that we can control,

including the following three key initiatives:

• optimizing our brand positioning and marketing strategies in a “reset” economy;

• improving profitability; and

• strengthening our balance sheet.

To optimize our brand positioning, we plan to continue evolving our merchandise assortment and placing a

greater emphasis on opening price points and the value proposition. We also plan to continue making superior

customer service our top priority.

To optimize our marketing strategies, we plan to continue our catalog circulation optimization strategy and to

shift advertising dollars from catalog to e-commerce, our most profitable channel. We also plan to continue to

identify new opportunities to build brand awareness and customer engagement through search, e-mail modeling,

affiliate programs, and enhanced functionality.

25

Form 10-K