Pottery Barn 2008 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2008 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

these payments cannot be determined, except for amounts estimated to be payable in fiscal 2009 which are

included in our current liabilities as of February 1, 2009.

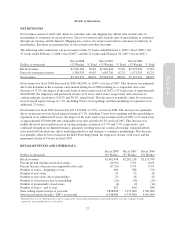

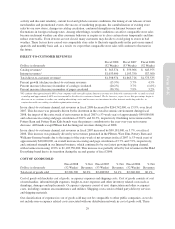

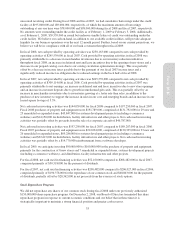

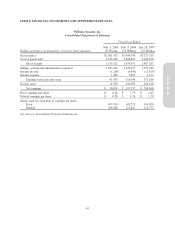

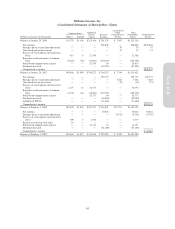

Commercial Commitments

The following table provides summary information concerning our outstanding commercial commitments as of

February 1, 2009:

Amount of Outstanding Commitment Expiration By Period

Dollars in thousands Fiscal 2009

Fiscal 2010

to Fiscal 2012

Fiscal 2013

to Fiscal 2014 Thereafter Total

Credit facility $ — — — — $ —

Letter of credit facilities 28,518 — — — 28,518

Standby letters of credit 39,559 — — — 39,559

Total $68,077 — — — $68,077

Credit Facility

As of February 1, 2009, we have an amended credit facility that provides for a $300,000,000 unsecured revolving

line of credit that may be used for loans or letters of credit. Prior to April 4, 2011, we may, upon notice to the

lenders, request an increase in the credit facility of up to $200,000,000, to provide for a total of $500,000,000 of

unsecured revolving credit. The amended revolving line of credit facility contains certain financial covenants,

including a maximum leverage ratio (funded debt adjusted for lease and rent expense to Earnings Before Interest,

Income Tax, Depreciation, Amortization and Rent Expense, or “EBITDAR”), a minimum fixed charge coverage

ratio (calculated as EBITDAR to total fixed charges), and covenants limiting our ability to repurchase shares of

stock or increase our dividend, in addition to covenants limiting our ability to dispose of assets, make

acquisitions, be acquired (if a default would result from the acquisition), incur indebtedness, grant liens and make

investments. The credit facility contains events of default that include, among others, non-payment of principal,

interest or fees, violation of covenants, inaccuracy of representations and warranties, bankruptcy and insolvency

events, material judgments, cross defaults to material indebtedness and events constituting a change of control.

The occurrence of an event of default will increase the applicable rate of interest by 2.0% and could result in the

acceleration of our obligations under the credit facility and an obligation of any or all of our subsidiaries that

have guaranteed our credit facility to pay the full amount of our obligations under the credit facility. The

amended credit facility matures on October 4, 2011, at which time all outstanding borrowings must be repaid and

all outstanding letters of credit must be cash collateralized.

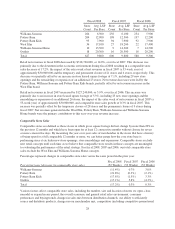

We may elect interest rates calculated at (i) Bank of America’s prime rate (or, if greater, the average rate on

overnight federal funds plus one-half of one percent, or a rate based on LIBOR plus one percent) plus a margin

based on our leverage ratio, or (ii) LIBOR plus a margin based on our leverage ratio. During fiscal 2008 and

fiscal 2007, we had cumulative borrowings under the credit facility of $195,800,000 and $189,000,000,

respectively, of which the maximum amount of borrowings outstanding at any one time were $78,000,000 and

$98,000,000 during fiscal 2008 and fiscal 2007, respectively. No amounts were outstanding under the credit

facility as of February 1, 2009 or February 3, 2008. As of February 1, 2009, $39,559,000 in issued but undrawn

standby letters of credit was outstanding under the credit facility. The standby letters of credit were issued to

secure the liabilities associated with workers’ compensation, other insurance programs and certain debt

transactions. As of February 1, 2009, we were in compliance with our financial covenants under the credit

facility and, based on our current projections, expect to be in compliance throughout 2009.

Letter of Credit Facilities

We have five unsecured commercial letter of credit reimbursement facilities, each of which expires on

September 4, 2009. The aggregate credit available under all letter of credit facilities is $165,000,000. The letter

of credit facilities contain substantially similar covenants and provide for substantially similar events of default

as the credit facility. Interest on amounts outstanding under the letter of credit facilities accrues at the lender’s

35

Form 10-K