Pottery Barn 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

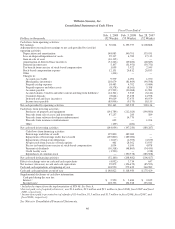

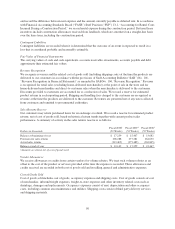

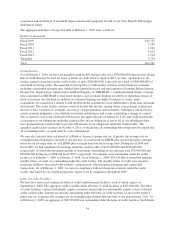

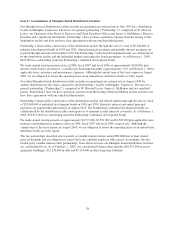

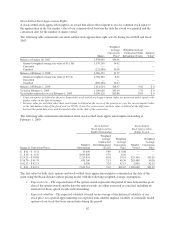

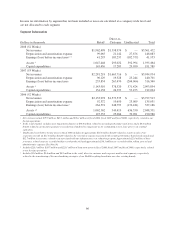

A reconciliation of income taxes at the federal statutory corporate rate to the effective rate is as follows:

Fiscal Year Ended

Feb. 1, 2009

(52 Weeks)

Feb. 3, 2008

(53 Weeks)

Jan. 28, 2007

(52 Weeks)

Federal income taxes at the statutory rate 35.0% 35.0% 35.0%

State income tax rate (8.2%) 3.5% 4.0%

Other 1.6% (0.4%) (0.9%)

Total 28.4%138.1% 38.1%

1The decrease in the fiscal 2008 effective income tax rate was primarily driven by certain favorable income tax resolutions during fiscal

2008.

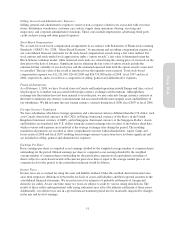

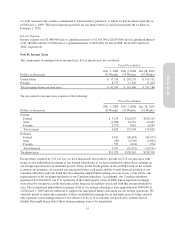

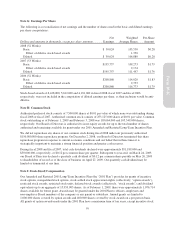

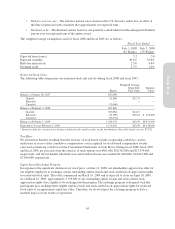

Significant components of our deferred tax accounts are as follows:

Dollars in thousands

Feb. 1, 2009

(52 Weeks)

Feb. 3, 2008

(53 Weeks)

Current:

Compensation $ 12,436 $ 11,392

Inventory 19,538 22,117

Accrued liabilities 11,868 17,585

Customer deposits 58,197 61,215

Deferred catalog costs (14,589) (21,184)

Other 2,899 718

Total current 90,349 91,843

Non-current:

Depreciation 13,392 14,616

Deferred rent 15,672 12,390

Stock-based compensation 20,828 17,757

Deferred lease incentives (27,548) (23,046)

Executive deferral plan 4,527 6,214

State taxes 8,260 15,985

Other 1,424 1,081

Total non-current 36,555 44,997

Total deferred tax assets, net $126,904 $136,840

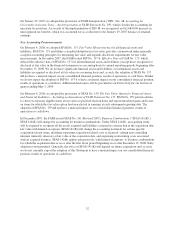

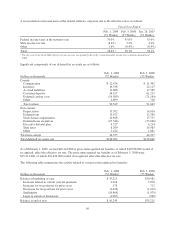

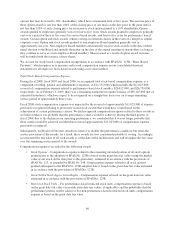

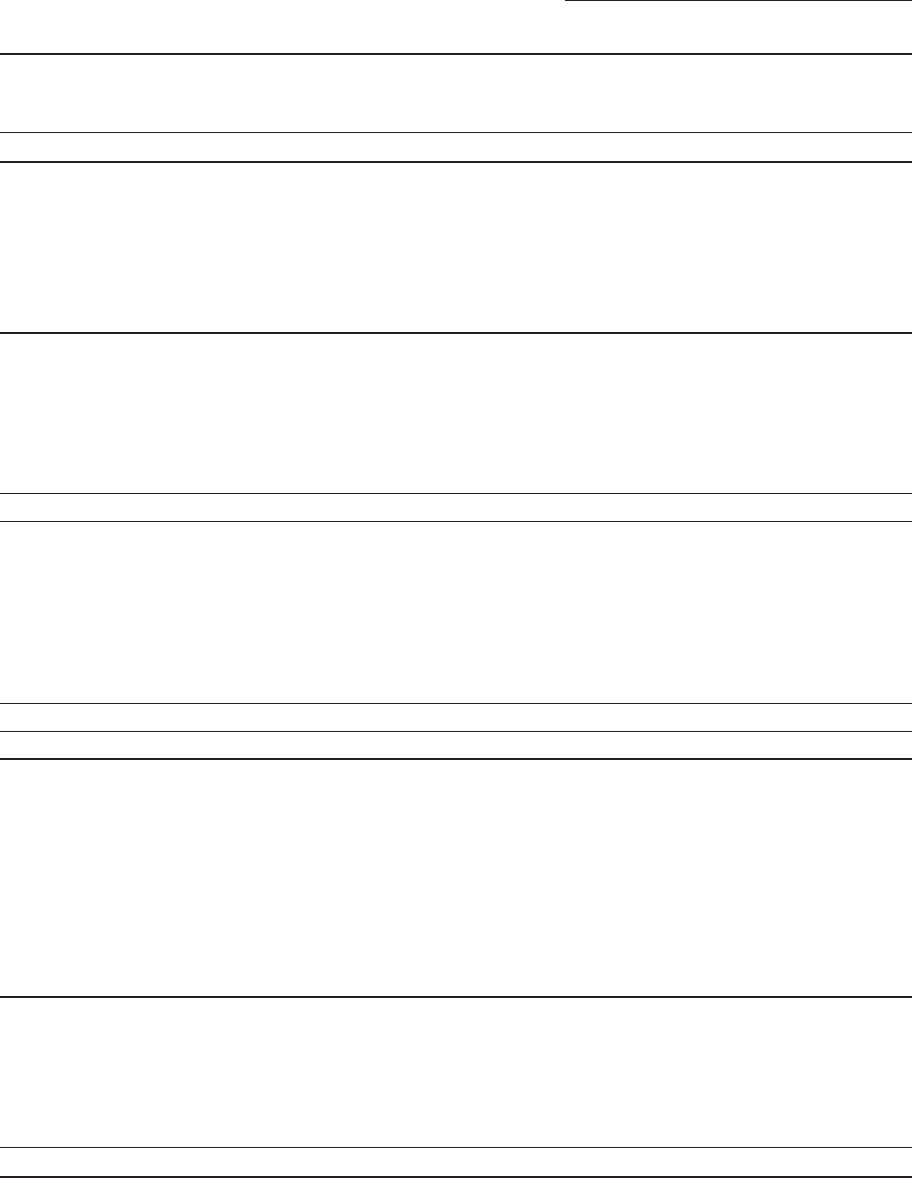

As of February 1, 2009, we had $16,243,000 of gross unrecognized tax benefits, of which $10,558,000 would, if

recognized, affect the effective tax rate. The gross unrecognized tax benefits as of February 3, 2008 were

$35,211,000, of which $22,634,000 would, if recognized, affect the effective tax rate.

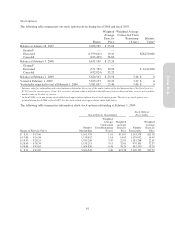

The following table summarizes the activity related to our gross unrecognized tax benefits:

Dollars in thousands

Feb. 1, 2009

(52 Weeks)

Feb. 3, 2008

(53 Weeks)

Balance at beginning of year $ 35,211 $30,981

Increases related to current year tax positions 2,018 7,076

Increases for tax positions for prior years 178 712

Decreases for tax positions for prior years (1,628) (1,010)

Settlements (18,469) (1,979)

Lapse in statute of limitations (1,067) (569)

Balance at end of year $ 16,243 $35,211

56