Pottery Barn 2008 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2008 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

providing market data and advice regarding general compensation trends in the retail industry and among

similarly situated companies. Frederic W. Cook did not provide any specific compensation recommendations

regarding the data provided to management or the Compensation Committee. The Compensation Committee may

request that Frederic W. Cook attend its meetings and advise the Compensation Committee either in person or

via telephone. Frederic W. Cook provided counsel to the Compensation Committee at the March 11, 2008

Compensation Committee meeting via telephone at the request of the Chairman, Adrian Bellamy.

What is the Compensation Committee’s philosophy of executive compensation?

The Compensation Committee believes that the company’s executive compensation programs should support the

company’s objective of creating value for its shareholders. Accordingly, the Compensation Committee believes

that executive officers and other key employees should have a significant interest in the company’s stock

performance, and compensation programs should link executive compensation to shareholder value. For this

reason, the Compensation Committee strives to ensure that the company’s executive officer compensation

programs are designed to enable the company to attract, retain, motivate and reward highly qualified executive

officers while maintaining strong and direct links between executive pay, individual performance, the company’s

financial performance and shareholder returns.

One of the ways the Compensation Committee has sought to accomplish these goals is by making a significant

portion of individual compensation directly dependent on the company’s achievement of financial goals, and by

providing significant rewards for exceeding those goals. The Compensation Committee believes that strong

financial performance, on a sustained basis, is an effective means of enhancing long-term shareholder return.

There is no pre-established policy or target for the allocation between cash and non-cash compensation or short-

term and long-term compensation. Rather, the appropriate level and mix of compensation is reviewed and

determined on an ongoing basis, and at least annually.

How is the Compensation Committee currently implementing this philosophy given recent conditions in the retail

industry?

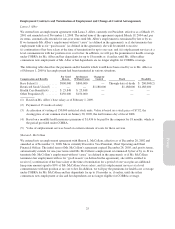

The Compensation Committee remains committed to its philosophy and for that reason, a significant portion of

the executive compensation is tied directly to our company’s performance. However, given the volatile economic

conditions and the impact on the company and the retail industry as a whole, the Compensation Committee has in

some cases removed requirements regarding financial goals attached to compensation that it believed were no

longer achievable. The Compensation Committee took these actions because it believed that financial goals that

are not achievable even with strong performance do not serve the intended purpose of motivating performance or

driving increases in long-term shareholder value. In addition, the Compensation Committee strongly believes that

compensation that cannot be earned would have an adverse effect on retention of the executives whose continued

efforts are critical to the company’s long-term success.

In determining how to implement its executive compensation philosophy during fiscal 2008, the Compensation

Committee monitored both the company’s performance against our fiscal 2008 plan and the company’s

performance relative to its compensation peer group. While meeting performance goals set by the company is

very important, the Compensation Committee believes that, particularly in an uncertain macro-economic

environment, relative performance also is a very important component in assessing pay practices for our named

executive officers. Relative performance of the company as measured against others in the home-furnishings

industry serves as a gauge for measuring the impact of current macro-economic conditions on the company’s

performance and the ability of our executives to effectively manage the company through this period. The

company’s performance relative to the home-furnishings industry has continued to be comparable, despite the

fact that the company did not perform according to its fiscal 2008 plan. In addition, the Compensation

Committee concluded that management could not have foreseen the severity of the deterioration in the retail

industry. The combination of these factors resulted in the Compensation Committee’s decision to remove from

certain equity awards the financial goals tied to the company’s absolute performance that previously were

required to be achieved for vesting.

29

Proxy