Pottery Barn 2008 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2008 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

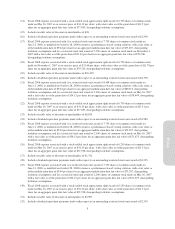

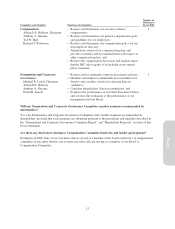

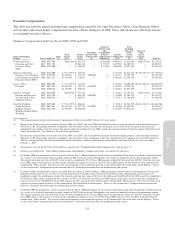

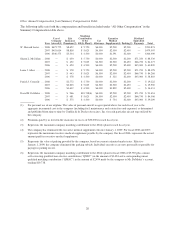

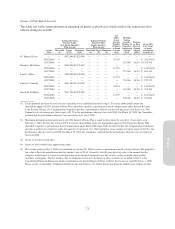

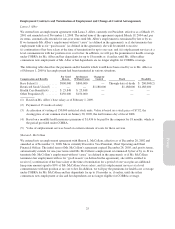

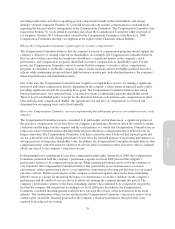

Executive Compensation

This table sets forth the annual and long-term compensation earned by our Chief Executive Officer, Chief Financial Officer

and our three other most highly compensated executive officers during fiscal 2008. These individuals are collectively known

as our named executive officers.

Summary Compensation Table for Fiscal 2008, 2007 and 2006

Name and Principal

Position Year(1) Salary ($)

Bonus

(S)

Stock

Awards

($)(2)

Option

Awards

($)(3)

Non-Equity

Incentive Plan

Compensation

($)

Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings(4)

All Other

Compensation

($)(5)

Total

Excluding

Reversed

Stock

Award

Expense

($)

Reversed

Stock

Award

Expense

($)(2) Total ($)

W. Howard Lester ........

Chairman and Chief

Executive Officer

(PEO)

2008

2007

2006

$975,000

$993,750

$975,000

—

—

—

$85,032(6)

—

—

$1,905,747

$2,981,381

$ 264,891

—

—

—

<$238,669>

$ 55,279

$ 23,094

$700,874

$479,507

$366,400

$3,427,984

$4,509,917

$1,629,385

<$60,153>(6)

—

—

$3,367,831

$4,509,917

$1,629,385

Sharon L. McCollam ...... 2008 $725,000 — $ 971,219(7) $ 726,787 — — $ 88,330 $2,511,336 <$3,631,287>(7) <$1,119,951>

Executive Vice President, 2007 $738,942 — $1,423,878 $ 873,653 $200,000 — $ 84,277 $3,320,750 — $3,320,750

Chief Operating and Chief

Financial Officer (PFO)

2006 $621,212 — $1,193,509 $ 718,853 — — $ 60,820 $2,594,394 — $2,594,394

Laura J. Alber ............ 2008 $800,000 — $ 971,219(7) $ 741,092 — — $ 88,078 $2,600,389 <$3,631,287>(7) <$1,030,898>

President 2007 $815,385 — $1,423,878 $ 765,213 $150,000 — $ 84,268 $3,238,744 — $3,238,744

2006 $700,770 — $1,193,509 $ 700,867 — — $ 58,803 $2,653,949 — $2,653,949

Patrick J. Connolly ........

Director and Executive

Vice President, Chief

Marketing Officer

2008

2007

2006

$570,000

$578,769

$566,538

—

—

—

$28,867(8)

—

—

$ 573,722

$ 602,410

$ 585,971

—

$100,000

—

—

—

—

$ 19,222

$ 19,900

$ 16,431

$1,191,811

$1,301,079

$1,168,940

<$18,915>(8)

—

—

$1,172,896

$1,301,079

$1,168,940

David M. DeMattei ....... 2008 $675,000 — $ 971,219(7) $ 804,634 — — $ 93,654 $2,544,507 <$3,631,287>(7) <$1,086,780>

Group President, 2007 $687,981 — $1,423,878 $1,127,527 $125,000 — $ 84,506 $3,448,892 — $3,448,892

Williams-Sonoma,

Williams-Sonoma Home,

West Elm

2006 $614,596 — $1,193,509 $1,056,698 — — $ 59,209 $2,924,012 — $2,924,012

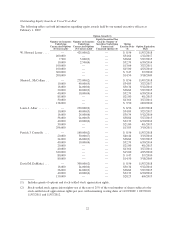

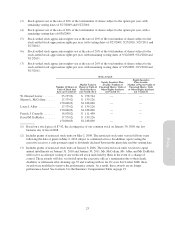

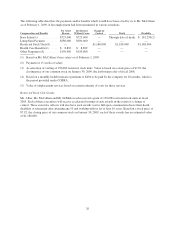

(1) The compensation reflected in the Summary Compensation Table for fiscal 2007 reflects a 53-week period.

(2) Based on the compensation cost recognized in fiscal 2008, fiscal 2007, and fiscal 2006 for financial statement reporting purposes as determined pursuant to

SFAS No. 123R, disregarding forfeiture assumptions. The fair market value is based on the closing price of our stock on the day prior to the grant date

multiplied by the number of awards issued. The amount under this column for fiscal 2008 excludes the amounts disclosed under the column titled “Reversed

Stock Award Expense.” See footnote 5 for a detailed explanation.

(3) Based on the compensation cost recognized in fiscal 2008, fiscal 2007, and fiscal 2006 for financial statement reporting purposes as determined pursuant to

SFAS No. 123R, disregarding forfeiture assumptions. The fair market value assumptions used in the calculation of these amounts for fiscal 2008 and fiscal

2007 are included in Note I to our Consolidated Financial Statements, which is included in our Annual Report on Form 10-K for the fiscal year ended

February 1, 2009.

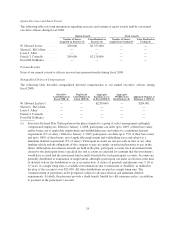

(4) Total income (loss) in the Executive Deferral Plan as shown in the “Nonqualified Deferred Compensation” table on page 24.

(5) Details are provided in the “Other Annual Compensation from Summary Compensation Table” provided on the next page.

(6) In October 2008, the performance criteria associated with the May 2, 2008 performance-based award was determined to no longer be probable of being achieved.

As a result, we reversed all previously recorded expense of $60,153 for this award. Subsequently, the award was modified to remove the performance criteria.

The original grant date fair value of $26.85 for the award was modified to $9.44. Fiscal 2008 expense recorded for this award was $85,032. Therefore, the total

fiscal 2008 expense with respect to all stock awards, including the expense reversal, was $24,879. Fiscal 2008 expense for this award has been reportedinthe

column titled “Stock Awards.” The reversed stock award expense has been reported separately, in the column titled “Reversed Stock Award Expense.” Please

see the section titled “Compensation Discussion and Analysis” for further discussion about the modification of this award.

(7) In October 2008, the performance criteria associated with the January 6, 2006 and May 2, 2008 performance-based awards were determined to no longerbe

probable of being achieved. As a result, we reversed all previously recorded expense of $3,631,287 for both awards. Subsequently, these awards were

modified to remove the performance criteria. The original grant date fair values of $42.18 for the 2006 award and $26.85 for the 2008 award were modifiedto

$9.44. Fiscal 2008 expense recorded for these awards was $971,219. Therefore, the total fiscal 2008 expense with respect to all stock awards, including the

expense reversal, was <$2,660,068>. Fiscal 2008 expense for these awards has been reported in the column titled “Stock Awards.” The reversed stock award

expense has been reported separately, in the column titled “Reversed Stock Award Expense.” Please see the section titled “Compensation Discussion and

Analysis” for further discussion about the modification of these awards.

(8) In October 2008, the performance criteria associated with the May 2, 2008 performance-based award was determined to no longer be probable of being achieved.

As a result, we reversed all previously recorded expense of $18,915 for this award. Subsequently, the award was modified to remove the performance criteria.

The original grant date fair value of $26.85 for the award was modified to $9.44. Fiscal 2008 expense recorded for this award was $28,867. Therefore, the total

fiscal 2008 expense with respect to all stock awards, including the expense reversal, was $9,952. Fiscal 2008 expense for this award has been reported in the

column titled “Stock Awards.” The reversed stock award expense has been reported separately, in the column titled “Reversed Stock Award Expense.” Please

see the section titled “Compensation Discussion and Analysis” for further discussion about the modification of this award.

19

Proxy