Pottery Barn 2008 Annual Report Download - page 48

Download and view the complete annual report

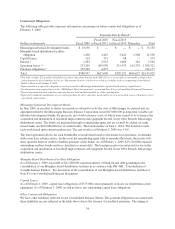

Please find page 48 of the 2008 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.prime rate (or, if greater, the average rate on overnight federal funds plus one-half of one percent) plus 2.0%. As

of February 1, 2009, an aggregate of $28,518,000 was outstanding under the letter of credit facilities. Such letters

of credit represent only a future commitment to fund inventory purchases to which we had not taken legal title as

of February 1, 2009. The latest expiration possible for any future letters of credit issued under the facilities is

February 1, 2010.

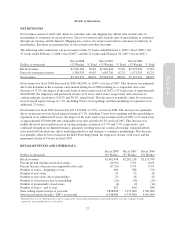

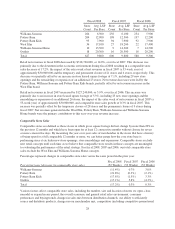

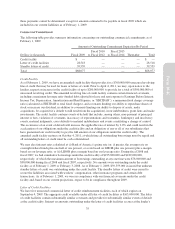

OFF BALANCE SHEET ARRANGEMENTS

Operating Leases

We lease store locations, warehouses, corporate facilities, care centers and certain equipment for original terms

ranging generally from 2 to 22 years. Certain leases contain renewal options for periods up to 20 years. The

rental payment requirements in our store leases are typically structured as either minimum rent, minimum rent

plus additional rent based on a percentage of store sales if a specified store sales threshold is exceeded, or rent

based on a percentage of store sales if a specified store sales threshold or contractual obligations of the landlord

has not been met. Contingent rental payments, including rental payments that are based on a percentage of sales,

cannot be predicted with certainty at the onset of the lease term. Accordingly, any contingent rental payments are

recorded as incurred each period when the sales threshold is probable and are excluded from our calculation of

deferred rent liability. See Notes A and E to our Consolidated Financial Statements.

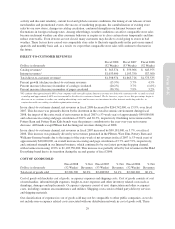

The following represent our distribution facility operating lease agreements:

• We have an operating lease for a 1,002,000 square foot retail distribution facility located in Olive

Branch, Mississippi. The lease has an initial term of 22.5 years, expiring January 2022, with two

optional five-year renewals.

• We have an operating lease for an additional 1,103,000 square foot retail distribution facility located in

Olive Branch, Mississippi. The lease has an initial term of 22.5 years, expiring January 2023, with two

optional five-year renewals.

• We have an operating lease for an additional 1,170,000 square feet of a distribution facility located in

Olive Branch, Mississippi. The lease has an initial term of six years, expiring January 2011, with two

optional two-year renewals.

• In February 2004, we entered into an agreement to lease 781,000 square feet of a distribution center

located in Cranbury, New Jersey. The lease has an initial term of seven years, with three optional five-

year renewals. The agreement allows us to lease an additional 219,000 square feet of the facility in the

event the current tenant vacates the premises.

• In August 2004, we entered into an agreement to lease a 500,000 square foot distribution facility located

in Memphis, Tennessee. In August 2008, we renewed this lease for an additional two year period and

the lease now expires in August 2010. In January 2009, in connection with our infrastructure cost

reduction program, we closed this distribution facility and vacated the property as of February 1, 2009.

We do, however, continue to be liable for future rental payments under our lease agreement through the

end of the lease term in August 2010. Therefore, we have recorded a liability for all contractual future

obligations within our Consolidated Balance Sheet as of February 1, 2009.

• In May 2006, we entered into an agreement to lease a 418,000 square foot distribution facility located in

South Brunswick, New Jersey. The lease has an initial term of two years, with two optional two-year

renewals. In May 2008, we exercised our option under the lease agreement to renew the agreement for

an additional two year period. The lease now expires in June 2010.

• In September 2007, we entered into a 10-year agreement to lease 1,180,000 square feet of distribution

facility space in City of Industry, California. As of February 3, 2008, we were occupying 950,000

square feet of this facility and, in February 2008, we began occupying the remaining 230,000 square

feet.

36