Pottery Barn 2008 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2008 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

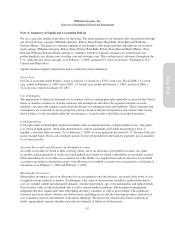

and record the difference between rent expense and the amount currently payable as deferred rent. In accordance

with Financial Accounting Standards Board (“FASB”) Staff Position (“FSP”) 13-1, “Accounting for Rental Costs

Incurred During a Construction Period,” we record rental expense during the construction period. Deferred lease

incentives include construction allowances received from landlords, which are amortized on a straight-line basis

over the lease term, including the construction period.

Contingent Liabilities

Contingent liabilities are recorded when it is determined that the outcome of an event is expected to result in a

loss that is considered probable and reasonably estimable.

Fair Value of Financial Instruments

The carrying values of cash and cash equivalents, accounts receivable, investments, accounts payable and debt

approximate their estimated fair values.

Revenue Recognition

We recognize revenues and the related cost of goods sold (including shipping costs) at the time the products are

delivered to our customers in accordance with the provisions of Staff Accounting Bulletin (“SAB”) No. 101,

“Revenue Recognition in Financial Statements” as amended by SAB No. 104, “Revenue Recognition.” Revenue

is recognized for retail sales (excluding home-delivered merchandise) at the point of sale in the store and for

home-delivered merchandise and direct-to-customer sales when the merchandise is delivered to the customers.

Discounts provided to customers are accounted for as a reduction of sales. We record a reserve for estimated

product returns in each reporting period. Shipping and handling fees charged to the customer are recognized as

revenue at the time the products are delivered to the customer. Revenues are presented net of any taxes collected

from customers and remitted to governmental authorities.

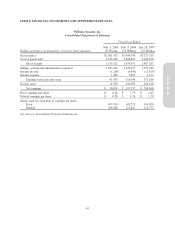

Sales Returns Reserve

Our customers may return purchased items for an exchange or refund. We record a reserve for estimated product

returns, net of cost of goods sold, based on historical return trends together with current product sales

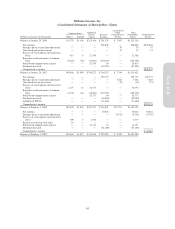

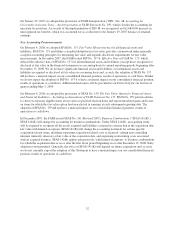

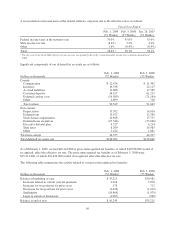

performance. A summary of activity in the sales returns reserve is as follows:

Dollars in thousands

Fiscal 20081

(52 Weeks)

Fiscal 20071

(53 Weeks)

Fiscal 20061

(52 Weeks)

Balance at beginning of year $ 17,259 $ 15,467 $ 13,682

Provision for sales returns 206,288 277,281 264,630

Actual sales returns (213,405) (275,489) (262,845)

Balance at end of year $ 10,142 $ 17,259 $ 15,467

1Amounts are shown net of cost of goods sold.

Vendor Allowances

We receive allowances or credits from certain vendors for volume rebates. We treat such volume rebates as an

offset to the cost of the product or services provided at the time the expense is recorded. These allowances and

credits received are recorded in both cost of goods sold and in selling, general and administrative expenses.

Cost of Goods Sold

Cost of goods sold includes cost of goods, occupancy expenses and shipping costs. Cost of goods consists of cost

of merchandise, inbound freight expenses, freight-to-store expenses and other inventory related costs such as

shrinkage, damages and replacements. Occupancy expenses consist of rent, depreciation and other occupancy

costs, including common area maintenance and utilities. Shipping costs consist of third party delivery services

and shipping materials.

50