Pottery Barn 2008 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2008 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

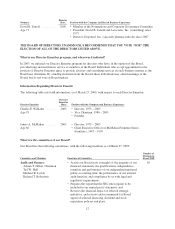

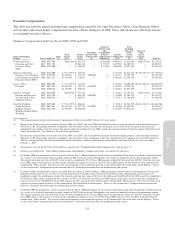

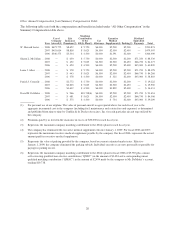

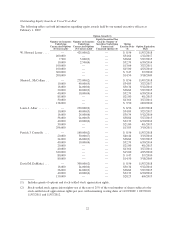

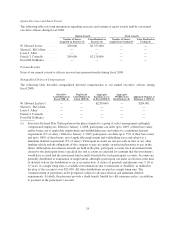

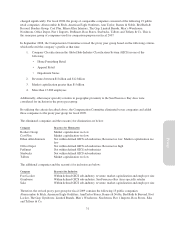

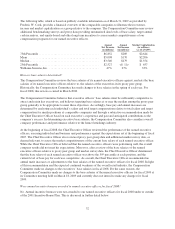

Outstanding Equity Awards at Fiscal Year-End

The following tables set forth information regarding equity awards held by our named executive officers at

February 1, 2009:

Option Awards(1)

Number of Securities

Underlying

Unexercised Options

(#) Exercisable

Number of Securities

Underlying

Unexercised Options

(#) Unexercisable

Equity Incentive Plan

Awards: Number of

Securities Underlying

Unexercised

Unearned Options (#)

Option

Exercise Price

($)

Option Expiration

Date

W. Howard Lester .... — 425,000(2) — $ 8.56 11/07/2018

400,000 — — $34.64 1/12/2017

7,500 5,000(3) — $38.84 5/27/2015

10,000 2,500(4) — $32.39 6/30/2014

100,000 — — $13.66 3/27/2011

100,000 — — $15.00 4/25/2010

300,000 — — $ 9.47 3/7/2010

200,000 — — $14.50 3/18/2009

Sharon L. McCollam . . — 275,000(2) — $ 8.56 11/07/2018

10,000 40,000(5) — $34.89 3/27/2017

16,000 24,000(6) — $30.34 9/12/2016

30,000 20,000(3) — $38.84 5/27/2015

40,000 10,000(4) — $32.39 6/30/2014

85,000 — — $21.80 4/1/2013

30,000 — — $13.66 3/27/2011

138,000 — — $ 9.50 10/9/2010

Laura J. Alber ....... — 230,000(2) — $ 8.56 11/07/2018

10,000 40,000(5) — $34.89 3/27/2017

16,000 24,000(6) — $30.34 9/12/2016

36,000 24,000(3) — $38.84 5/27/2015

40,000 10,000(4) — $32.39 6/30/2014

30,000 — — $21.80 4/1/2013

296,600 — — $13.85 3/19/2011

Patrick J. Connolly . . . — 160,000(2) — $ 8.56 11/07/2018

20,000 30,000(7) — $40.44 3/15/2016

24,000 16,000(3) — $38.84 5/27/2015

40,000 10,000(4) — $32.39 6/30/2014

20,000 — — $21.80 4/1/2013

40,000 — — $13.66 3/27/2011

320,000 — — $15.00 4/25/2010

80,000 — — $ 9.47 3/7/2010

80,000 — — $14.50 3/18/2009

David M. DeMattei . . . — 300,000(2) — $ 8.56 11/07/2018

16,000 24,000(6) — $30.34 9/12/2016

36,000 24,000(3) — $38.84 5/27/2015

40,000 10,000(4) — $32.39 6/30/2014

150,000 — — $28.25 6/4/2013

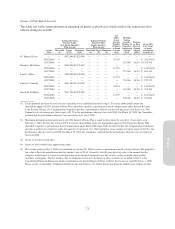

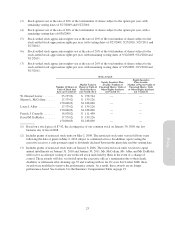

(1) Includes grants of options and stock-settled stock appreciation rights.

(2) Stock-settled stock appreciation rights vest at the rate of 25% of the total number of shares subject to the

stock-settled stock appreciation rights per year, with remaining vesting dates of 11/07/2009, 11/07/2010,

11/07/2011 and 11/07/2012.

22