Pottery Barn 2008 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2008 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note J: Williams-Sonoma, Inc. 401(k) Plan and Other Employee Benefits

We have a defined contribution retirement plan, the “Williams-Sonoma, Inc. 401(k) Plan” (the “Plan”), which is

intended to be qualified under Internal Revenue Code Sections 401(a), 401(k), 401(m) and 4975(e)(7). Prior to

January 1, 2009, the Plan permitted eligible employees to make salary deferral contributions up to 15% of their

eligible compensation each pay period (5% for certain higher paid individuals). As of January 1, 2009, the Plan

now permits eligible employees to make salary deferral contributions up to 75% of their eligible compensation

each pay period (5% for certain higher paid individuals). Employees designate the funds in which their

contributions are invested. Each participant may choose to have his or her salary deferral contributions and

earnings thereon invested in one or more investment funds, including our company stock fund.

Prior to January 1, 2009, our matching contribution was equal to 50% of each participant’s salary deferral

contribution each pay period, taking into account only those contributions that do not exceed 6% of the

participant’s eligible pay for the pay period (5% for certain higher paid individuals). As of January 1, 2009, each

participant’s matching contribution will be earned on a semi-annual basis with respect to eligible salary deferrals

for those employees that are employed with the company on June 30th or December 31st of the year in which the

deferrals are made. Further, as of January 1, 2009, eligible associates must complete one year of eligibility

service prior to receiving company matching contributions. For the first five years of the participant’s

employment, all matching contributions vest at the rate of 20% per year of service, measuring service from the

participant’s hire date. Thereafter, all matching contributions vest immediately.

The Plan consists of two parts: a profit sharing plan portion and, effective April 21, 2006, a stock bonus plan/

employee stock ownership plan (the “ESOP”). The ESOP portion is the portion that is invested in the company

internal revenue stock fund at any time. The profit sharing and ESOP components of the Plan are considered a

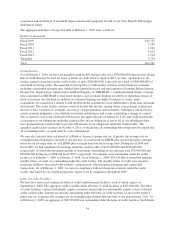

single plan under Code section 414(l). Our contributions to the plan were $5,168,000, $5,336,000 and $3,467,000

in fiscal 2008, fiscal 2007 and fiscal 2006, respectively.

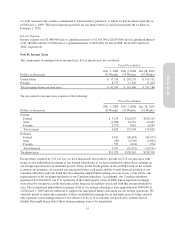

We have a nonqualified executive deferred compensation plan that provides supplemental retirement income

benefits for a select group of management and other certain highly compensated employees. This plan permits

eligible employees to make salary and bonus deferrals that are 100% vested. We have an unsecured obligation to

pay in the future the value of the deferred compensation adjusted to reflect the performance, whether positive or

negative, of selected investment measurement options, chosen by each participant, during the deferral period. As

of February 1, 2009 and February 3, 2008, $11,789,000 and $16,105,000, respectively, was included in other

long-term obligations. Additionally, we have purchased life insurance policies on certain participants to

potentially offset these unsecured obligations. The cash surrender value of these policies was $9,413,000 and

$12,758,000 as of February 1, 2009 and February 3, 2008, respectively, and was included in other assets.

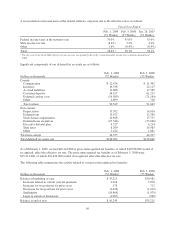

Note K: Financial Guarantees

We are party to a variety of contractual agreements under which we may be obligated to indemnify the other

party for certain matters. These contracts primarily relate to our commercial contracts, operating leases,

trademarks, intellectual property, financial agreements and various other agreements. Under these contracts, we

may provide certain routine indemnifications relating to representations and warranties or personal injury

matters. The terms of these indemnifications range in duration and may not be explicitly defined. Historically, we

have not made significant payments for these indemnifications. We believe that if we were to incur a loss in any

of these matters, the loss would not have a material effect on our financial condition or results of operations.

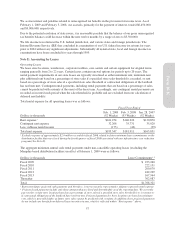

Note L: Commitments and Contingencies

We are involved in lawsuits, claims and proceedings incident to the ordinary course of our business. These

disputes, which are not currently material, are increasing in number as our business expands and our company

grows larger. Litigation is inherently unpredictable. Any claims against us, whether meritorious or not, could be

time consuming, result in costly litigation, require significant amounts of management time and result in the

diversion of significant operational resources. The results of these lawsuits, claims and proceedings cannot be

predicted with certainty. However, we believe that the ultimate resolution of these current matters will not have a

material adverse effect on our consolidated financial statements taken as a whole.

64