Pottery Barn 2008 Annual Report Download - page 64

Download and view the complete annual report

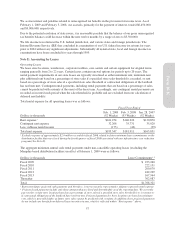

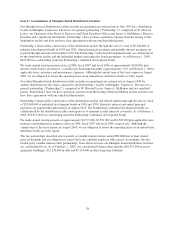

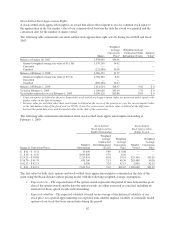

Please find page 64 of the 2008 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On January 29, 2007, we adopted the provisions of FASB Interpretation (“FIN”) No. 48, Accounting for

Uncertainty in Income Taxes – An Interpretation of FASB Statement No. 109, which clarifies the accounting for

uncertain tax positions. As a result of the implementation of FIN 48, we recognized an $11,684,000 increase in

unrecognized tax benefits, which was accounted for as a reduction to the January 29, 2007 balance of retained

earnings.

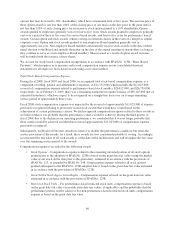

New Accounting Pronouncements

On February 4, 2008, we adopted SFAS No. 157, Fair Value Measurements, for all financial assets and

liabilities. SFAS No. 157 establishes a standard definition for fair value, provides a framework under generally

accepted accounting principles for measuring fair value and expands disclosure requirements for fair value

measurements. In December 2007, the FASB issued FSP No. 157-b, Effective Date of FASB No.157, which

delayed the effective date of SFAS No. 157 for all nonfinancial assets and liabilities (except those recognized or

disclosed at fair value in the financial statements on a recurring basis) to annual reporting periods beginning after

November 15, 2008. We do not have significant financial assets and liabilities or nonfinancial assets and

liabilities recognized or disclosed at fair value on a recurring basis and, as such, the adoption of SFAS No. 157

did not have a material impact on our consolidated financial position, results of operations or cash flows. Further,

we do not expect the adoption of FSP No. 157-b to have a material impact on our consolidated financial position,

results of operations or cash flows. Additional disclosures will be provided in our Form 10-Q for our first fiscal

quarter ending May 3, 2009.

On February 4, 2008, we adopted the provisions of SFAS No. 159, The Fair Value Option for Financial Assets

and Financial Liabilities – Including an Amendment of FASB Statement No. 115. SFAS No. 159 permits entities

to choose to measure eligible items at fair value at specified election dates and report unrealized gains and losses

on items for which the fair value option has been elected in earnings at each subsequent reporting date. The

adoption of SFAS No. 159 did not have a material impact on our consolidated financial position, results of

operations or cash flows.

In December 2007, the FASB issued SFAS No. 141 (Revised 2007), Business Combinations (“SFAS 141(R)”).

SFAS 141(R) will change the accounting for business combinations. Under SFAS 141(R), an acquiring entity

will be required to recognize all the assets acquired and liabilities assumed in a transaction at the acquisition date

fair value with limited exceptions. SFAS 141(R) will change the accounting treatment for certain specific

acquisition-related items, including expensing acquisition-related costs as incurred, valuing non-controlling

interests (minority interests) at fair value at the acquisition date, and expensing restructuring costs associated

with an acquired business. SFAS 141(R) applies prospectively, with limited exceptions, to business combinations

for which the acquisition date is on or after the first fiscal period beginning on or after December 15, 2008. Early

adoption is not permitted. Generally, the effect of SFAS 141(R) will depend on future acquisitions and, as such,

we do not currently expect the adoption of this Statement to have a material impact on our consolidated financial

position, results of operations or cash flows.

52