Pep Boys 2012 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2012 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 2, 2013, January 28, 2012 and January 29, 2011

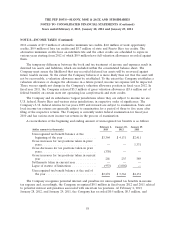

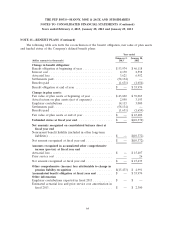

NOTE 8—INCOME TAXES (Continued)

$0.2 million, respectively, for the payment of interest and penalties which are excluded from the

unrecognized tax benefit noted above.

Unrecognized tax benefits include $0.9 million, $1.3 million, and $1.4 million, at February 2, 2013,

January 28, 2012 and January 29, 2011, respectively, of tax benefits that, if recognized, would affect the

Company’s annual effective tax rate. The Company believes it is reasonably possible that the amount

will increase or decrease within the next twelve months; however, it is not currently possible to estimate

the impact of the change.

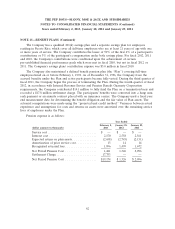

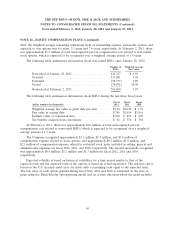

NOTE 9—STOCKHOLDERS’ EQUITY

On December 12, 2012, the Company’s Board of Directors authorized a program to repurchase up

to $50.0 million of the Company’s common stock to be made from time to time in the open market or

in privately negotiated transactions, with no expiration date. During the fourth quarter of fiscal 2012,

the Company repurchased 35,000 shares of Common Stock for $342,000. All of these repurchased

shares were placed into the Company’s treasury.

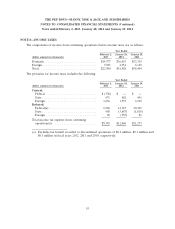

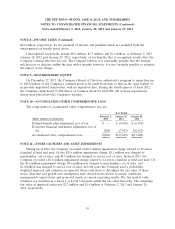

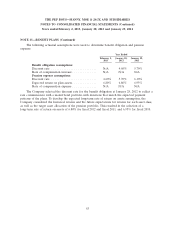

NOTE 10—ACCUMULATED OTHER COMPREHENSIVE LOSS

The components of accumulated other comprehensive loss are:

Year Ended

February 2, January 28, January 29,

(dollar amounts in thousands) 2013 2012 2011

Defined benefit plan adjustment, net of tax ..... $ — $ (9,696) $ (6,576)

Derivative financial instrument adjustment, net of

tax ................................ (980) (7,953) (10,452)

Accumulated other comprehensive loss ........ $(980) $(17,649) $(17,028)

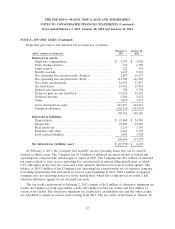

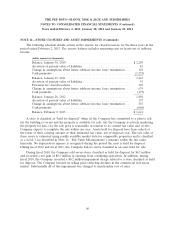

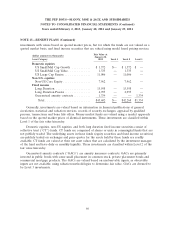

NOTE 11—STORE CLOSURES AND ASSET IMPAIRMENTS

During fiscal 2012, the Company recorded a $10.6 million impairment charge related to 49 stores

classified as held and used. Of the $10.6 million impairment charge, $5.1 million was charged to

merchandise cost of sales, and $5.5 million was charged to service cost of sales. In fiscal 2011, the

Company recorded a $1.6 million impairment charge related to 12 stores classified as held and used. Of

the $1.6 million impairment charge, $0.6 million was charged to merchandise cost of sales, and

$1.0 million was charged to service cost of sales. In both years the Company used a probability-

weighted approach and estimates of expected future cash flows to determine the fair value of these

stores. Discount and growth rate assumptions were derived from current economic conditions,

management’s expectations and projected trends of current operating results. The fair market value

estimates are classified as a Level 2 or Level 3 measure within the fair value hierarchy. The remaining

fair value of impaired assets was $2.3 million and $1.4 million at February 2, 2013 and January 28,

2012, respectively.

59