Pep Boys 2012 Annual Report Download - page 57

Download and view the complete annual report

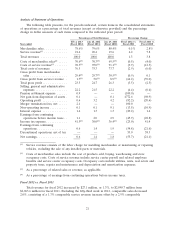

Please find page 57 of the 2012 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(4) Includes an aggregate pretax charge of $1.6 million for asset impairment, of which $0.6 million was charged to merchandise

cost of sales, $1.0 million was charged to service cost of sales.

(5) Includes a tax benefit of $3.6 million and $2.2 million in Fiscal 2011 and Fiscal 2010, respectively, due to the release of

valuation allowances on state net operating loss carryforwards and credits.

(6) Includes a pretax benefit of $5.9 million due to the reduction in reserve for excess inventory which reduced merchandise

cost of sales and an aggregate pretax charge of $1.0 million for asset impairment, of which $0.8 million was charged to

merchandise cost of sales and $0.2 million was charged to service cost of sales.

(7) Includes an aggregate pretax charge of $3.1 million for asset impairment, of which $2.2 million was charged to merchandise

cost of sales, $0.7 million was charged to service cost of sales and $0.2 million (pretax) was charged to discontinued

operations.

(8) Includes an aggregate pretax charge of $5.4 million for asset impairment, of which $2.8 million was charged to merchandise

cost of sales, $0.6 million was charged to service cost of sales and $1.9 million (pretax) was charged to discontinued

operations.

(9) Fiscal 2009 includes a gain from debt retirement of $6.2 million. Fiscal 2008 includes a gain from debt retirement of

$3.5 million, partially offset by a $1.2 million charge for deferred financing costs.

(10) Gross profit from merchandise sales includes the cost of products sold, buying, warehousing and store occupancy costs.

Gross profit from service revenue includes the cost of installed products sold, buying, warehousing, service payroll and

related employee benefits and occupancy costs. Occupancy costs include utilities, rents, real estate and property taxes,

repairs and maintenance and depreciation and amortization expenses. Our gross profit may not be comparable to those of

our competitors due to differences in industry practice regarding the classification of certain costs.

(11) Return on average stockholders’ equity is calculated by taking the net earnings (loss) for the period divided by average

stockholders’ equity for the year.

(12) Includes the purchase of master lease assets for $117.1 million.

18